Home Insurance Cancellation Letter: 5 Mistakes to Avoid

Home insurance cancellation letter—it is perhaps no more than another form, but its significance is far greater than most property owners are aware of. Whatever your reason for changing providers, selling your home, or just not being satisfied with your coverage, getting a cancellation letter in the proper manner is vital. Misrepresented, it might cause gaps in coverage, unwanted charges, or even harm to your credit. For homeowners wishing to cancel their policy, learning to write a formal and flawless cancellation letter is the best way to initiate a smooth experience.

In the current competitive insurance environment, most insurers have made their cancellations as easy as possible. But do not think you can be sloppy about it. A home insurance cancellation letter written sloppily may cause you delay or lead to miscommunication with your insurer. This handbook will take you through the basics of writing a cancellation letter, expose the most frequent errors to shun, and give practical advice to make your cancellation smooth sailing. You will also learn through real-life examples and know-how on how to safeguard your interest during the process.

Table of Contents

Understanding the Home Insurance Cancellation Letter

What is a Home Insurance Cancellation Letter?

A home insurance cancellation letter is an official, written notice that informs your insurance company that you want to cancel your homeowners insurance policy. This letter serves as the official record of your action, including the date of cancellation and any other information necessary about your policy. In contrast to a phone call or text message, a written notice gives documented evidence of your request, which can defend you in case of billing error or dispute.

The majority of insurance providers need the request for cancellation in writing to start the process. This provides certainty and helps avoid any misinterpretation of your intentions. For example, popular insurance sites such as Policygenius and The Zebra also suggest that policyholders utilize written communication when applying for policy modifications or cancellations, particularly when changing providers.

Example: If your policy is with State Farm or Allstate, their procedure usually has you send a home insurance cancellation letter by fax, email, or mail. It’s part of their official cancellation process and ensures compliance on both sides.

When Should You Send One?

There are several valid reasons to submit a home insurance cancellation letter, and timing is crucial. Below are common situations where sending the letter becomes necessary:

- You’re switching to a new insurance provider: You’ve found better rates or coverage and plan to switch to a different company. Make sure the new policy is active before submitting your cancellation.

- You’ve sold your house: When you sell your house, the current policy is no longer needed. A cancellation notice prevents you from being charged after the closing.

- Your mortgage has been satisfied: Some homeowners reassess their insurance requirements after they satisfy their mortgage, particularly if coverage was part of the lender’s requirement.

- You’ve found better coverage or rates: Market research may reveal a provider offering more value. In such cases, writing a home insurance cancellation letter is the first step to transitioning.

In any of these scenarios, the letter serves as your formal notice and helps prevent unnecessary charges, misunderstandings, or coverage lapses.

Why a Written Letter is Crucial:

Even with modern technology, the majority of insurance companies continue to want or need a home insurance cancellation in writing—either typed and sent, emailed, or posted to an online portal. This isn’t only old-fashioned; it’s protective.

Here’s why a written cancellation is necessary:

- Legal proof of request: It leaves a traceable paper trail indicating you made the request in good faith and on a particular date.

- Clarity and precision: A written cancellation letter for home insurance stipulates your specific intentions, with fewer opportunities for misinterpretation.

- Avoids future conflicts: Should your insurer attempt to charge premiums on an already-cancelled policy, your letter can serve as proof.

- As provided by NerdWallet, it’s also best to send the letter through certified mail or ask for a confirmation email to ensure that your cancellation is received and processed properly.

Moreover, if your policy is tied to your mortgage escrow account, not submitting an appropriate home insurance cancellation letter may end in forced-place insurance, typically more costly and less complete than common protection.

Writing a Home Insurance Cancellation Letter: Best Practice

What to Put in the Letter:

Writing a clear and professional home insurance cancellation letter is important to prevent confusion or policy termination delays. Your letter must be brief but sufficient to contain all the information required by your insurance company. Insurance firms can process cancellation requests more effectively when the letter contains all the needed elements initially.

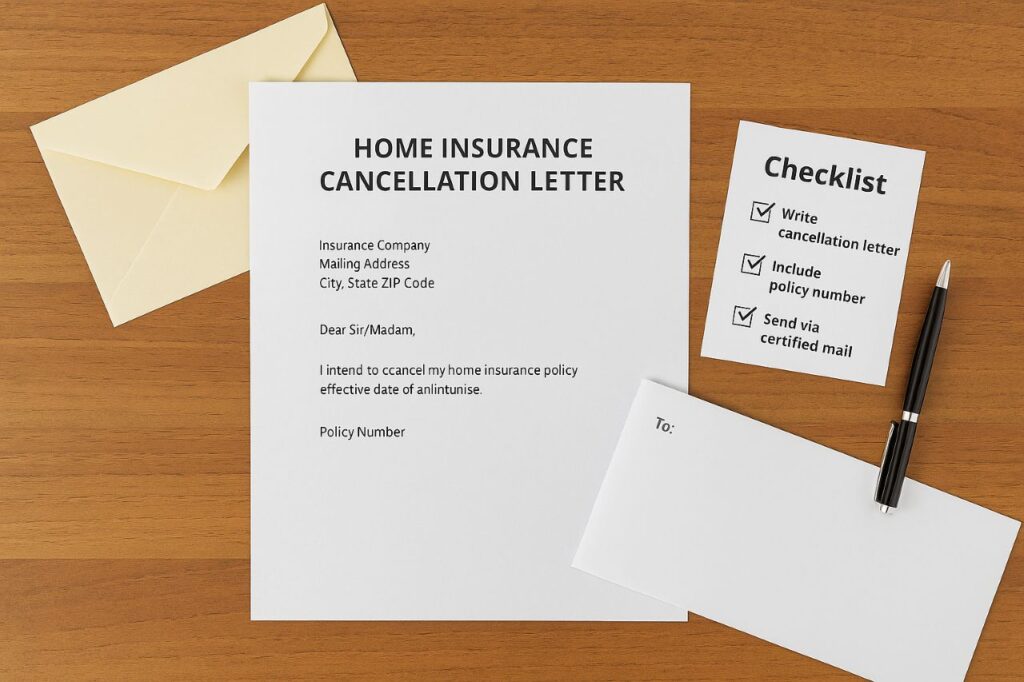

Here’s what your home insurance cancellation letter should include:

- Full Name and Contact Information: Provide your name, mailing address, email address, and phone number so that the insurer can recognize you and reach you if required.

- Policy Number: Always refer to your existing policy number. This is very important for searching and processing your cancellation request correctly.

- Insured Property Address: Clearly state the address of the house insured through the policy you are canceling.

- Requested Date of Cancellation: Enter the specific date you desire the policy to terminate. This avoids accidental lapses or overlap in coverage.

- Reason for Cancellation (Optional): You can simply mention your reason—if selling the house, for better rates, or change of provider. Though not required, it gives useful background.

- Signature (for mailed letters): If mailing a hard letter, always sign at the bottom. This provides formality and ensures genuineness.

Omitting any of these details may cause delays or refusals from your insurance provider. Sites such as Insurance.com highlight the need to be meticulous in your paperwork to avoid hiccups.

Template Example:

Here is an easy yet efficient home insurance cancellation letter template to make use of:

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

To: [Insurance Company Name]

Subject: Home Insurance Cancellation Letter

Dear Sir/Madam,

Accept this letter as written notice of my intention to cancel my home insurance policy (#12345678) on the property at [insert full property address], effective [insert desired cancellation date].

Please write to confirm the cancellation and inform me whether any further action is necessary.

Thank you for your service.

Sincerely,

[Your Signature if mailing]

You may send this letter by:

- Certified mail.

- Fax (if accepted).

- Email (attach as a PDF).

A few companies, such as Progressive, also permit electronic filing through their customer portal, but it’s still good practice to make a copy of the letter for your own files.

Tips for Accuracy:

Accuracy is paramount in composing a home insurance cancellation letter, where minimal errors can lead to unforeseen issues. Use these tips to sidestep typical mistakes:

- Verify the Policy Number Twice: A wrong policy number can cause your request to be rejected or posted to the wrong policy.

- Don’t Have a Break in Coverage: Ensure your new homeowners insurance policy is effective before your old one is revoked. As per NerdWallet, even a three-day gap in coverage can put you at grave financial risk.

- Employ a Traceable Means: Mail your home insurance cancellation notice by certified mail or email with return receipt to show your request was received.

- Request Confirmation: Request a written confirmation of your cancellation on your own records. This can avoid problems if your provider still sends bills after the effective date of cancellation.

By being mindful of these best practices and using a professional, structured writing style, you’ll have an effective and efficient home insurance cancellation letter. Getting this process right could save you money in the form of future charges or denied claims.

5 Shocking Mistakes to Avoid Now

When drafting a home insurance cancellation letter, minute lapses can result in major issues. From untimely policy cancellations to surprise charges or coverage lapses, being meticulous and strategic in your cancellation strategy is paramount. Follow are the top five blunders homeowners frequently make—along with actual examples, advice, and avoidance measures.

Mistake #1: Failure to State Crucial Details:

One of the top reasons a home insurance cancellation letter is rejected or delayed is the lack of essential information. Insurance companies require certain information to verify your policy and cancel it properly.

Elements Often Left Out:

- Your complete legal name and contact information.

- An active policy number.

- The entire property address covered under the policy.

- The specific date requested for the cancellation.

If any of these specifics are omitted, your cancellation could be postponed—or altogether.

Mistake #2: Cancelling Before Replacement Coverage Begins:

To cancel your home insurance before your new policy takes effect is a risky mistake. Having a gap-even for a day—leaves you open to severe financial vulnerability, particularly if you have an accident during that time.

Real Example: In 2022, a Florida homeowner terminated their policy early, anticipating that their new insurer would begin coverage on day one. But because of a processing lag, the house was uninsured for 8 days—during which period a tropical storm knocked $18,000 from the roof. The homeowner was left with no pay-out because the loss fell outside of both policies.

Mistake #3: Failing to Save Proof of Cancellation:

Some homeowners think that sending a letter is sufficient—but unless you have evidence that your home insurance cancellation letter was read and accepted, you’re exposed to being charged after the termination date or involved in legal controversies.

Effects of No Evidence:

- Recurring automatic payments.

- Charge of non-payment or expiration.

- Disputes with mortgage lenders.

Mistake #4: Overlooking the Policy Cancellation Provisions:

Each insurance policy has certain rules and regulations for cancelling it. These can include notice periods, penalties, or refund terms. Forgetting these while preparing your home insurance cancellation letter can result in surprise charges or delays.

What to Check For:

- Minimum notice period (usually 10 to 30 days).

- Refund policies for unused premiums.

- Early termination fees.

Mistake #5: Not Notifying Your Mortgage Lender:

If you’re a homeowner with a mortgage, your lender probably demands evidence of ongoing homeowners insurance. Failing to notify them when you cancel your home insurance policy can lead to force-placed insurance, which is usually more costly and has limited coverage.

Why This Matters: Lenders are informed when a policy cancels. If they don’t see documentation of new coverage, they may purchase insurance on your behalf—and bill it to your loan.

NerdWallet says that force-placed policies are lenders’ last option and typically are much more expensive and have less protection for the homeowner.

By not committing these five fatal errors while drafting your home insurance cancellation letter, you can ensure a hassle-free, worry-free switch. From adding the proper information to being in the know about your lender obligations, every step is a part of guarding your financial health and compliance with policy and mortgage regulations.

Legal and Financial Consequences of Cancelling Home Insurance

Canceling your home insurance policy takes more than signing a home insurance cancellation letter—it involves legal and financial repercussions that most homeowners do not mind. From contract provisions to lender regulations and possible refunds, knowing what is in play can assist you in making an informed decision and steer clear of expensive surprises.

Can You Cancel at Any Time?

In general, yes—you are free to cancel your home insurance policy at any given moment. That being said, the majority of insurance companies do have policies or contractual stipulations governing how and when a home insurance cancellation letter is to be filed.

- Standard Policy Requirements: Notice Period: Most firms will require a minimum of 10 to 30 days’ written notice prior to the policy actually being canceled.

- Cancellation Window: Some insurers will only process cancellations during specific billing intervals.

- Early Termination Fees: Although not common, some insurers will impose an administrative fee for early termination.

Top insurance guides such as Insurance.com highlight the need to study policy small print, particularly in cases of early termination conditions.

Will You Get a Refund?

Yes—if you’ve paid your premium in advance and decide to cancel your policy, most insurance providers offer a prorated refund for the unused portion of the policy. However, this depends on how the cancellation is processed and the reason for termination.

Refund Scenarios:

- Pro-rated Refunds: You’re refunded the amount corresponding to the unused days of coverage.

- Short-rate Refunds: In some cases (like voluntary early cancellation), a small penalty may reduce your refund slightly.

According to Policygenius, refunds are usually processed within 15 to 30 days of receiving the home insurance cancellation letter—but always confirm with your provider.

Impact on Mortgage Lenders:

If you have an outstanding mortgage, your lender will likely require that you maintain ongoing homeowners insurance. The insurance covers the lender’s interest in your home. When a home insurance cancellation notice is provided to your company, your insurer is also required to inform your lender of the cancellation.

Penalties of Not Reporting Your Lender:

- Force-Placed Insurance: In case your lender doesn’t get confirmation of new coverage, they might buy insurance on your property and add the cost to your mortgage. This is “force-placed” or “lender-placed” insurance.

- Higher Premiums: Force-placed policies tend to have higher costs and have limited coverage, with the primary goal being to cover the lender—not your personal belongings.

As emphasized by NerdWallet, failing to update your lender about changes in coverage can also affect your escrow account and future mortgage payments.

Switching Insurance Providers the Smart Way

Should you be planning to drop your existing homeowners insurance policy, the best strategic move is to change companies the intelligent way. That involves doing your homework, weighing your choices, and timing your switch so you don’t leave yourself without coverage. Filing an on-time home insurance cancellation letter is merely half the game.

Steps to Make a Smooth Switch:

Switching insurers is a shrewd financial decision, particularly if you want more efficient coverage, enhanced customer support, or reduced premiums. Here’s a step-by-step guide to assist you in changing providers without putting your home or pocketbook at risk:

Step 1: Compare Rates and Coverage Options:

Before you draft your home insurance cancellation letter, you need to secure a suitable replacement. Utilize reliable platforms such as:

- NerdWallet for comparing consumer satisfaction and rates.

- Policygenius to receive immediate quotes from highly-rated insurers.

Search for a provider that provides:

- Competitive prices.

- Full coverage.

- High claim satisfaction ratings.

Step 2: Choose a New Policy and Start Date:

After you’ve chosen a provider, arrange the new policy to start the same day that your present policy expires. This closes any gaps in coverage and keeps your mortgage lender’s needs met.

Important: Do not terminate your existing policy until your new policy is totally active and recorded.

Step 3: Send Your Home Insurance Cancellation Letter:

Having your new policy set up, you can now comfortably send your cancellation letter for your current insurer. Ensure the cancellation date of your old policy coincides with the beginning date of your new policy perfectly.

Bundle Discounts Can Maximize Savings:

Changing providers also introduces the possibility of further savings through multi-policy bundling. Several insurers will discount if you bundle your homeowners coverage with other policies—most notably auto insurance.

Advantages of Bundling:

- Discounts between 10% and 25% on premiums.

- Single bill and single renewal date for multiple policies.

- Simpler claims handling among coverage types.

For instance, Progressive and Allstate both provide bundle discounts that could greatly reduce your yearly expense.

Alternatives to Cancelling Home Insurance

Sending a home insurance cancellation notice might appear to be the only option, but it’s always best to see if cancellation can actually be avoided. Depending on your circumstances, there could be wiser, safer options available that leave coverage in place while adapting to your changing requirements. Here are three functional solutions to consider before cancelling your policy in its entirety.

Modify Your Policy Instead of Cancelling:

If the intention is to reduce costs or change coverage, it may be more effective to make changes to an existing policy rather than issuing a home insurance cancellation notice. Most companies have flexible policy changes that can be customized to fit your finances and lifestyle.

Common Modifications:

- Raise your deductible: An increased deductible will decrease your premium, particularly if you don’t file claims frequently.

- Drop unnecessary riders: Delete unnecessary coverage (such as jewelry or identity theft) that no longer make sense.

- Revalue your home: Make sure your dwelling coverage isn’t overvalued, particularly if your home value is no longer increasing.

Based on NerdWallet, changing these factors can save money without sacrificing the essential protection your home requires.

Suspend Coverage Temporarily (Where Applicable):

In exceptional but reasonable circumstances—such as extended travel, deployment for the military, or short-term vacancy—some insurance companies can let you suspend some coverage areas instead of cancelling the whole policy.

What Suspension May Include:

- Suspension of liability coverage with retention of fire or theft protection.

- Temporary reduction of coverage limits.

- Placing the house in “vacant” status temporarily.

Although not always available, some companies (e.g., State Farm) will consider this option under extraordinary conditions. Suspension of coverage, however, will diminish the effectiveness of your coverage, and not all perils will be insurable.

Let the Policy Expire (Cautiously):

Another alternative is to allow your policy to lapse at its own expiration date without renewal. This method, however, needs careful coordination and communication to prevent your property from remaining uninsured.

Why It’s Risky:

- If your insurance company isn’t aware of your plans, they will automatically renew your policy and continue charging you.

- If your mortgage company doesn’t receive notice of replacement coverage, they can initiate force-placed insurance, usually expensive and with limited coverage.

Tools such as Policygenius recommend mapping out your expiration and new policy start dates with care to ensure uninterrupted coverage.

Final Thoughts on Home Insurance Cancellation Letter

A well-composed home insurance cancellation letter is a little but mighty document that can ward off enormous headaches. Whether you’re switching insurers or relocating to another property, processing the cancellation can save you from gaps in coverage, fines, or unwarranted charges. By knowing what to include in your letter, staying clear of general errors, and carefully planning your transition, you can navigate your home insurance with ease and assurance.

If you’re going to cancel your home insurance in the near future, apply the templates and advice included in this manual. And bear in mind—never cancel without obtaining a new policy. Look after your home, your money, and your sanity by doing it the first time correctly.

Ready to change home insurance the clever way? Begin by comparing reputable providers and utilize this article as your guide for crafting the ideal cancellation letter.

Also Read: Funeral Home Business Insurance: 8 Powerful Reasons

Frequently Asked Questions (FAQs)

What is a home insurance cancellation letter?

A home insurance cancellation letter is a formal request sent to your insurance provider asking them to terminate your homeowners insurance policy. It includes details like your policy number, property address, and the date you want the cancellation to take effect.

Do I have to send a home insurance cancellation letter in writing?

Yes, most insurance companies require a written home insurance cancellation letter via mail, email, or fax to formally document your intent and process the request accurately.

How much notice do I need to give before canceling my homeowners insurance?

Most insurers require a 10–30 day notice before cancellation. Check your policy or contact your provider before sending your home insurance cancellation letter to avoid fees or delays.

Will I get a refund after sending my home insurance cancellation letter?

If you’ve prepaid your premium, you’re usually eligible for a prorated refund for the unused portion. Some companies may deduct a small cancellation fee, depending on your contract terms.

Can I cancel my home insurance policy at any time?

Yes, in most cases, you can cancel your policy at any time by submitting a home insurance cancellation letter. Just make sure to avoid coverage gaps by having a new policy in place first.

What happens if I cancel my homeowners insurance while I still have a mortgage?

Your lender requires active insurance. If you send a home insurance cancellation letter and don’t provide proof of a new policy, the lender may issue force-placed insurance, which is often more expensive and less protective.

One Comment