Funeral Home Business Insurance: 8 Powerful Reasons

Funeral home business insurance is not just a backup plan—it’s a key support for a sound and sustainable funeral service business. Whether you’re operating an old-fashioned funeral parlor or opening up a new establishment in this delicate line of business, insurance guards your services, reputation, and assets against unforeseen cash shocks. With the extraordinary risks involved—from dealing with human remains to driving specialized vehicles and facilities—the correct coverage can mean recovery or devastation.

The funeral industry is unlike any other. It involves emotional interactions, compliance with stringent health regulations, and 24/7 operational demands. With growing legal liabilities, rising costs, and the emotional nature of services, funeral home business insurance has become not just recommended but indispensable. In this guide, we’ll break down the most important reasons to get covered, what policies you should consider, and how to tailor protection to your funeral home’s unique needs.

Table of Contents

Understanding Funeral Home Business Insurance

What it Covers:

Funeral home business insurance offers extensive coverage that’s specifically designed for the special risks funeral service providers have. Unlike general commercial insurance policies, it’s crafted to cover your property, staff, vehicles, and professional methods.

These are the main areas protected:

- Property Damage: This provides coverage for funeral homes, crematories, embalming rooms, and storage facilities. Policies usually cover against fire, theft, vandalism, and natural disasters. For instance, if a cremation chamber is destroyed in a fire, repair or replacement cost will be covered under insurance.

- Liability Coverage: Protects against legal costs and settlements of bodily injury, property damage, and emotional distress to clients or third parties. In this highly emotive business, lawsuits for mishandling of remains or service mistakes are not out of the question.

- Business Interruption: If your operations are forced to close due to unforeseen events like floods, fires, or government-ordered closures (as seen during the COVID-19 pandemic), this coverage helps recoup lost revenue and maintain payroll.

Providers like Nationwide and The Hartford offer specialized funeral home business insurance packages with all these inclusions and more.

Why It’s Unique to Funeral Services:

Operating a funeral home is its own unique set of risks that most other service industries do not face. That’s why funeral home business insurance cannot be just like any other service business insurance.

Here’s why it’s different:

- Biohazard Risks: Embalming fluid, infection exposure, and working with human remains present real health and legal risks. Insurance has to include environmental liability and proper waste handling coverage.

- Specialized Equipment and Vehicles: High-value equipment such as embalming machines, crematories, and refrigerated storage facilities, as well as hearses and limousines, is utilized by funeral homes. Without proper protection, it would cost financially disastrous amounts to repair or replace the equipment.

- Emotional Liability: The very emotional atmosphere of funerals heightens the potential for lawsuits when a family perceives services were not done well. For example, labeling remains incorrectly or sending the wrong urn could lead to lawsuits based on charges of emotional distress.

- Real Case Example: In 2020, a Michigan funeral home was brought to court for the improper storage of remains, and it sparked a lot of public outrage. The funeral home business insurance policy at the facility included legal expenses, reputation management, and partial settlement—ultimately enabling them to recover operations and reputation.

These intricacies make it certain that taking a blanket business insurance policy might leave gaping holes in your coverage. According to Insurance Journal, many funeral homes under-appreciate their liability exposure until they are faced with a lawsuit or compliance case, Insurance Journal found.

Key Policies Every Funeral Home Needs

Operating a funeral home entails unique risks not covered by typical insurance. A customized funeral home business insurance package must therefore integrate several key policies—each of which addresses a unique part of your business. Following is an explanation of the essential coverage you’ll need to protect your reputation, your staff, your vehicles, and your physical property.

General Liability Insurance:

This is the basis for any funeral home business insurance policy.

- Third-Party Injuries: If a guest falls on a wet floor while attending a service, this policy pays medical expenses and legal defense.

- Property Damage: Shields you from suits if you unintentionally damage a client’s property.

- Personal or Advertising Injury: Shields your funeral home from libel, slander, or false advertisement claims.

Learn more on The Hartford’s General Liability page.

Professional Liability Insurance (Errors & Omissions):

Also referred to as E&O insurance, it is not negotiable funeral home business insurance.

- Service Mistakes: Pays for lawsuits resulting from mistakes such as delivering an incorrect urn or mishandling remains.

- Religious and Cultural Sensitivity: Certain services are subject to strict procedural handling that, if breached, may lead to legal conflicts.

For further details, check out Next Insurance’s Funeral E&O Guide.

Commercial Property Insurance:

Funeral homes contain expensive infrastructure and valuable stock. This policy covers you.

- Building Protection: Covers the chapel, crematory, preparation rooms, and refrigeration units.

- Asset Coverage: Shields caskets, urns, displays, computers, and tools from fire, theft, or vandalism.

Learn more at Nationwide’s Commercial Property Guide.

Workers’ Compensation Insurance:

Most U.S. states mandate this policy for employee-owned businesses, such as funeral homes.

- Injury Coverage: Treatment and lost pay for a funeral director if they are injured lifting a casket.

- Occupational Illness: Pays claims if employees get sick from working with embalming fluids over long periods of time.

State-specific information is available at U.S. Department of Labor.

Commercial Auto Insurance:

Funeral homes routinely make use of multiple vehicles—hence the importance of this coverage.

- Fleet Coverage: Covers hearses, limousines, flower vans, and transportation vehicles.

- Accidents and Theft: Reimbursement for repair or replacement and legal responsibility from accidents involving vehicles.

View commercial auto choices at Progressive Commercial.

Business Interruption Insurance:

Your business relies on continuous access to facilities and equipment. This policy provides essential financial continuity.

- Revenue Replacement: Replaces income lost during periods of temporary shut-down due to fires, flooding, or public health crises.

- Fixed Expense Coverage: Covers recurring expenses such as payroll, rent, and utilities.

Learn more at Allianz’s Business Interruption Resource.

Having these six pillars of funeral home business insurance guarantees your operations are safeguarded against the day-to-day risks and uncommon catastrophes alike. It’s not simply about financial recovery but also maintaining families’ trust in your services—particularly when emotions are most vulnerable.

8 Powerful Reasons Funeral Home Business Insurance is Non-Negotiable

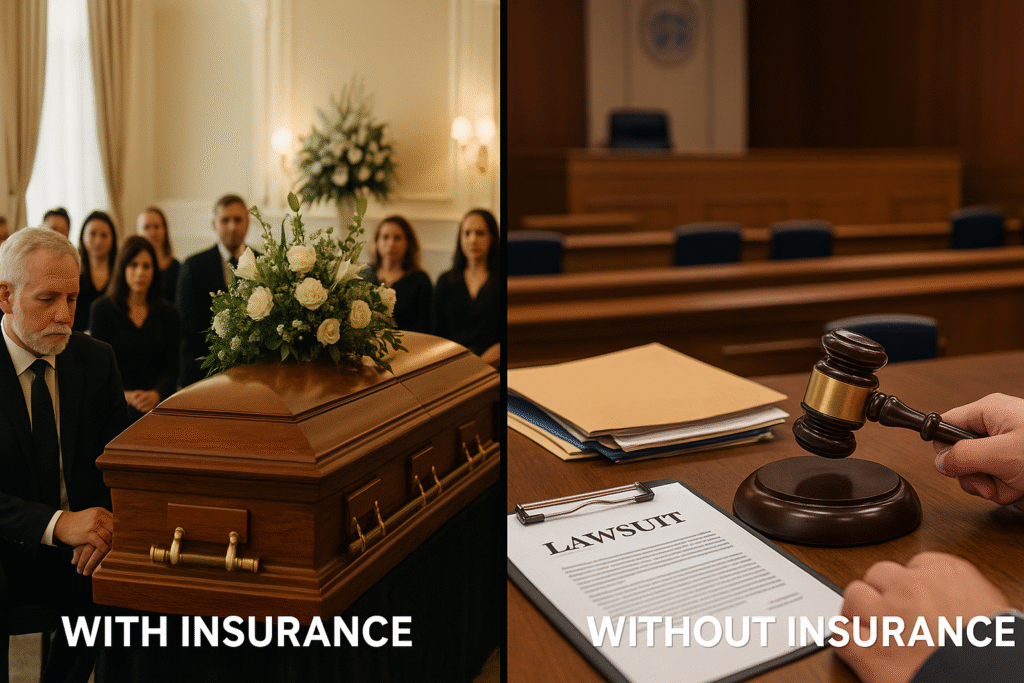

With a company founded on empathy and trust, even a minor mishap can leave permanent impressions. That’s why funeral home business insurance is not merely a choice—it’s non-negotiable for long-term existence and reputation protection. The following are eight strong reasons why all funeral homes require extensive coverage.

1. Emotional Risks Are High:

Working with bereaved families involves emotions and, therefore, they are already high-strung, making funeral homes prime targets for lawsuits.

- Even the little things such as misspelled names on gravestones or releasing the incorrect urn can result in claims of emotional distress.

- It only takes one error to escalate into an expensive lawsuit if a family has been disrespected or emotionally wounded.

Example: In a highly publicized 2019 case, an Illinois funeral home was sued for cremating the wrong body. Their funeral home business insurance policy paid for legal expenses and defended their license.

To learn more about emotional distress claims, see Nolo’s legal guide.

2. State Licensing & Legal Compliance:

Most U.S. states have laws requiring special insurance for licensed funeral homes.

- Not having required funeral home business insurance can lead to license suspension, fines, or complete closure.

- A few states also mandate liability coverage to lawfully operate crematories or embalming facilities.

Tip: Always check with your state’s funeral board. For example, California’s Cemetery and Funeral Bureau demands proof of insurance prior to license renewal.

For state needs, check the National Funeral Directors Association.

3. Natural Disaster Protection:

Funeral homes are especially exposed to environmental catastrophes because of the delicate nature of their work.

- Floods can destroy refrigeration equipment and stored bodies.

- Fires can burn cremation ovens, records, and chapels.

Real-World Example: When Hurricane Harvey struck Texas in 2017, a number of funeral homes in Houston were flooded. Due to robust funeral home business insurance policies, most reopened within weeks with little financial loss.

FEMA’s natural disaster preparation guide for businesses is worth reading.

4. High-Value Equipment Insurance:

Equipment and machinery employed in funeral work is specialized and costly.

- Equipment such as embalming machines, crematory retorts, and medical-grade refrigerators may range from $10,000 to $50,000.

- Theft or vandalism without adequate funeral home business insurance may drive you out of business.

For a comprehensive breakdown of mortuary equipment expense, see Funeral Business Advisor.

5. Business Continuity:

Disruptions aren’t just a hassle—they’re economically catastrophic if you’re not properly covered.

- Funeral home business insurance with business interruption coverage keeps payroll, rent, and utilities paid when operations are suspended.

- It allows you to resume service quickly and maintain trust in your community.

Learn how business interruption insurance works via Investopedia.

6. Staff Safety and Lawsuits:

Employees in funeral homes are exposed to physical and emotional stress regularly.

- Injuries due to lifting, chemical exposure, and overtime are prevalent.

- Suits by former employees against wrongful termination, discrimination, or harassment can be similarly expensive.

Learn more about EPLI coverage.

7. Vehicle Protection:

Most funeral homes have a limited number of vehicles, such as hearses, flower vans, and limousines.

- These are costly and critical to operations.

- Theft, accidents, or mechanical failure can mean expensive downtime or damage to reputation.

Example: A funeral home in Georgia had a theft of their main hearse. Their commercial auto coverage in their funeral home business insurance package replaced the vehicle within 48 hours.

For commercial fleet insurance protection, view Progressive’s commercial auto insurance.

8. Reputation Management:

When disaster strikes, your reputation is at stake—particularly in a trust-based business.

- Suits, headlines, and negative word-of-mouth can destroy future business.

- A good funeral home business insurance policy must provide for legal defense and public relations assistance.

Discover more about brand recovery options from Harvard Business Review.

By recognizing these eight key reasons, it’s evident that funeral home business insurance is so much more than a safeguarding measure—it’s a smart investment. Not only does it save you money in times of disaster, but it ensures that you’re maintaining the sacred trust families have in your care during life’s most vulnerable times.

Choosing the Right Insurance Provider

Finding the appropriate company for your funeral home business insurance isn’t merely a matter of comparing prices—it’s identifying an insurer that knows the unique risks your line of work presents. A commercial insurer may not be able to provide the specialized coverage to properly protect your funeral operation, from embalming suites to cremation exposure.

What to Look For in a Funeral Insurance Provider:

Not all insurance companies are capable of handling the specific requirements of funeral homes. Seek out companies that provide:

- Industry Experience: Companies with a proven history of insuring funeral homes are more likely to be able to provide policies covering specialized risks such as crematory errors or embalming-related exposures.

- 24/7 Claims Assistance: Funeral homes do not usually follow standard business operating hours. Your insurance company must be accessible around the clock, in the event of an emergency or claim.

- Tailor-Made Coverage Options: Your funeral home business insurance policy should carry endorsements for embalming, cremation, professional liability, and even cyber attacks (particularly if you store clients’ data online).

- Protective Add-Ons:

- Cyber Liability: Provides compensation for damages due to data breaches or cyber attacks

- Legal Expense Insurance: Assists in paying for legal advice and courtroom costs

- Reputation Management: Offers assistance if your brand is hurt by bad press or lawsuits

For advice on how to navigate what commercial insurers can do, see NAIC’s consumer insurance information.

Recommended Funeral Insurance Providers:

Here are four top-rated providers that provide specialized funeral home business insurance products:

- The Hartford:

- One of the most well-respected names in funeral-specific coverage.

- Provides flexible policy terms and add-ons specifically designed for mortuary operations.

- Has a reputation for rapid claims settlement and risk consulting.

- CoverWallet:

- An online platform that enables easy comparison of policies among several insurers.

- Ideal for small to mid-sized funeral homes that want to bundle coverage.

- Provides real-time quotes and digital policy management.

- Nationwide:

- Best for funeral homes with multiple locations.

- Offers industry-specific underwriting and claims knowledge.

- Offers commercial fleet insurance for funeral vehicles of transportation.

- Travelers Insurance:

- Comprehensive in risk management consulting and compliance training.

- Offers customized professional liability and property protection.

- Renowned for serving funeral businesses with high-value assets or sophisticated operations.

Questions to Ask Before Choosing a Provider:

To ensure you’re getting the best funeral home business insurance for your specific needs, ask these critical questions during the quote or consultation phase:

- Are cremation and embalming explicitly covered?

- Not all providers automatically include coverage for these specialized services. Confirm that these are included or can be added.

- What exclusions exist in the policy?

- Understand if there are limitations regarding bio-hazard incidents, vehicle use, or data breaches.

- Is there a per-incident or an annual limit on liability?

- Ensure your policy limits are sufficient to pay out against potential claims, particularly emotional distress cases.

- Do you have business interruption coverage?

- This is essential for funeral homes with much fixed overhead and can’t quickly move in emergencies.

- Are discounts available if policies are bundled (auto + property + E&O)?

- Most providers provide 10–25% savings if you combine your coverage under one umbrella policy.

- What’s the claim filing process? Is it online?

- Make the claim process quick, clear, and free from unnecessary bureaucracy.

Selecting the ideal funeral home business insurance carrier is not mere ritual—it’s a smart move that affects your chances for recovery in tough times, serving families with honesty, and defending your legacy. Spare time to shop around, examine reviews, and don’t mind consulting industry-specific brokers or organizations such as the National Funeral Directors Association (NFDA).

Conclusion: Your Peace of Mind Begins with Insurance

Operating a funeral home involves incurring tremendous emotional and logistical burdens. One error or catastrophe can result in severe financial and reputational loss. That’s why funeral home business insurance isn’t only prudent—it’s essential. It shields your employees, clients, and assets while providing you with peace of mind to help provide for families in their times of grief.

From general liability and commercial auto to workers’ comp and interruption insurance, the right policies form a safety net around your business. Whether you’re expanding to a second location or just opening your doors, make insurance your first investment—not an afterthought.

Speak with a licensed insurance agent today to create a policy customized to the specific needs of your funeral home. The proper protection can help ensure your legacy of care and trust endure—no matter what life brings.

Also Read: United Home Life Insurance Company Ripoff? Know the Truth – Complete Guide 2025

Frequently Asked Questions (FAQs)

What is funeral home business insurance?

Funeral home business insurance is a specialized insurance package designed to protect funeral service providers from financial loss due to property damage, liability claims, employee injuries, professional errors, and more. It typically includes general liability, commercial property, workers’ compensation, and professional liability coverage.

Why do funeral homes need special insurance?

Funeral homes deal with sensitive tasks like body preparation, cremation, and family services. These unique risks—combined with the use of specialized equipment—make funeral home business insurance essential for financial and reputational protection.

Is funeral home business insurance required by law?

While not federally mandated, most U.S. states require specific types of coverage (such as workers’ compensation and auto insurance) for licensed funeral homes. Additionally, insurance may be required to meet state board licensing requirements.

Does insurance cover lawsuits from grieving families?

Yes. Funeral home business insurance that includes professional liability will typically cover legal fees and settlements in the event of lawsuits related to emotional distress, service errors, or cremation mishandlings.

How do I choose the best provider for funeral home business insurance?

Look for insurers with experience in the funeral industry, 24/7 claims support, customizable policies, and strong reviews. Providers like The Hartford, CoverWallet, Nationwide, and Travelers are known for offering specialized packages tailored to funeral homes.

What’s the difference between general liability and professional liability?

1. General liability covers bodily injury or property damage on your premises.

2. Professional liability (or E&O) covers claims related to service errors like mishandling remains or failing to fulfill funeral arrangements. Both are critical components of funeral home business insurance.

How much does funeral home business insurance cost annually?

Costs vary based on location, services offered, property value, and claims history. On average:

1. General liability: $500–$1,500.

2. Property insurance: $800–$2,000.

3. Workers’ comp: Based on payroll.

4. Commercial auto: $1,000–$2,500 per vehicle.

You can lower costs by bundling coverage or increasing your deductible.

Are cremation and embalming covered by default?

Not always. Some insurers require specific endorsements for cremation, embalming, or refrigeration-related coverage. Always verify these inclusions when purchasing funeral home business insurance.

Can I get coverage for business interruption?

Yes. Business interruption insurance—usually part of a broader funeral home business insurance package—helps cover lost income and operating expenses during forced closures due to disasters or emergencies.

Does this insurance cover funeral vehicles?

Absolutely. Commercial auto insurance included in your funeral home business insurance covers hearses, limousines, flower vans, and transport vehicles against accidents, theft, and vandalism.

Can I customize my funeral home business insurance policy?

Yes, many insurers offer customizable policies that allow you to select coverage specific to your funeral home’s operations, such as cremation, embalming, cyber liability, and fleet coverage

What happens if I don’t have funeral home business insurance?

Operating without insurance exposes your business to major financial risks from lawsuits, disasters, and workplace injuries. In many states, lacking proper coverage can also result in fines or license suspension.

Is cyber insurance necessary for funeral homes?

Yes. If your business stores sensitive client data, uses digital payment systems, or manages online records, cyber liability insurance is a critical add-on to your funeral home business insurance.

Will insurance cover damage from mold or bio-hazards?

Some policies may exclude mold or bio-hazard cleanup unless explicitly added. You’ll need environmental liability or pollution coverage to handle these issues under your funeral home business insurance.

Do I need insurance if I rent my funeral home property?

Yes. Even if you don’t own the building, you’re responsible for your operations, staff, equipment, and liabilities. You still need funeral home business insurance including liability, E&O, and contents coverage.

One Comment