Selling Medicare Insurance From Home: 5 Proven Steps

Selling Medicare insurance at home provides a fun and flexible means of establishing a successful career. With nearly 10,000 Americans reaching age 65 each day, the demand is overwhelming—and remote selling makes it simpler than ever to capitalize on the potential.

For instance, numerous agents today achieve six‑figure incomes by serving seniors right from their own homes.

Selling Medicare insurance from home begins with understanding compliance, obtaining the necessary licenses, and mastering technology to streamline remote consultations. Whether you’re introducing Medicare Advantage, Supplement, or Part D plans, having a solid process ensures efficiency, trust, and consistent revenue.

In this detailed guide, we’ll take you through selling Medicare insurance from home step-by-step. You’ll learn effective tactics, actual examples, and helpful hints for generating leads, remaining compliant, closing sales, and building your business—everything you need to thrive in the exploding remote Medicare market.

Table of Contents

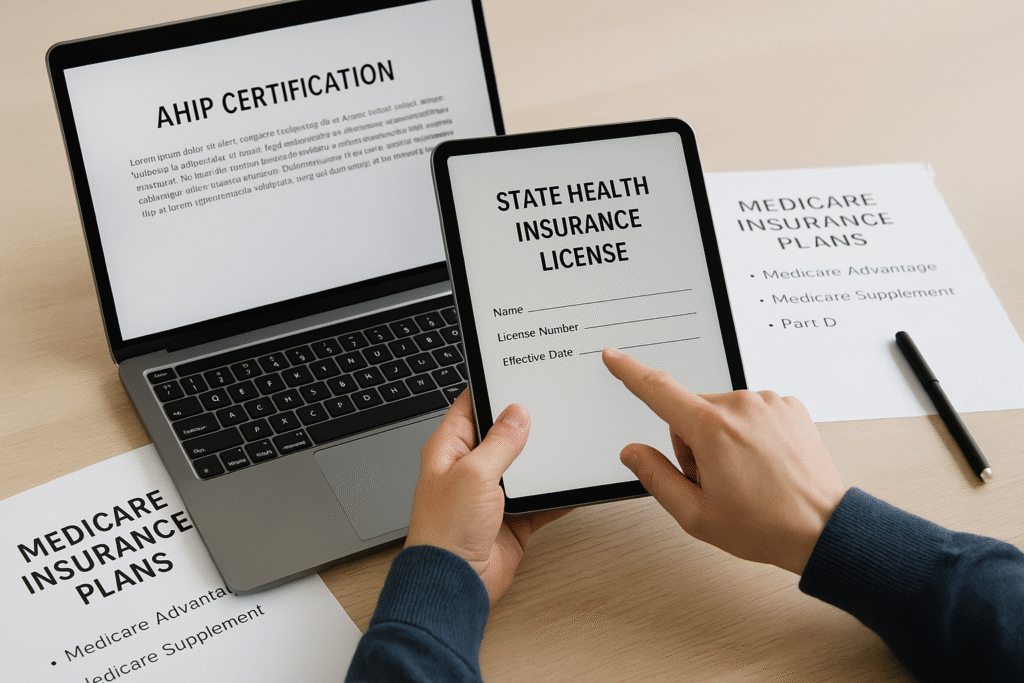

1. Get Certified, Licensed & Ready

A sound foundation is necessary before you can start selling Medicare insurance from home—beginning with appropriate licensing, certifications, and carrier appointments. Legitimacy and compliance are key to lasting success, particularly in a heavily regulated industry.

A. Secure State Licensing:

Every agent must first obtain a health insurance license in their resident state. This is a prerequisite for selling Medicare insurance from home legally. In most states, you’ll need to complete a pre-licensing course, pass a state exam, and submit a background check.

You can find websites such as PSM Brokerage and NearHub with thorough guides that take you through the licensure processes for every state. Even online prep courses for rapid-track licensure are available from some states.

Once your resident license is approved, you can proceed to obtain non-resident licenses in other states to grow your remote Medicare business presence.

B. Complete AHIP & Carrier Certifications:

Once licensed, you’ll need to complete AHIP certification (America’s Health Insurance Plans) annually. This is mandatory for agents offering Medicare Advantage (MA) and Part D prescription drug plans.

- AHIP checks your knowledge of CMS regulations, compliance regulations, and fraud prevention. It’s accepted by virtually all the big carriers and has to be passed with a minimum of 90%.

- Resources such as Trkingim, Hub.Quotit, and NearHub offer useful guides and study materials to pass the exam.

After AHIP, each carrier (like Aetna, Humana, or UnitedHealthcare) requires additional product-specific certifications. Failing to complete these on time may block your ability to sell for that plan year.

C. Get CMS-P & FMO Appointments:

In order to work with Medicare carriers, agents need to also obtain a CMS Producer Number (CMS‑P) through the Centers for Medicare & Medicaid Services (CMS). This is identification that connects you with approved carrier systems for quote and enrollment.

More significantly, you must become appointed through either a carrier directly or by going through an FMO (Field Marketing Organization). FMOs serve as middlemen and provide:

- Working with elite carriers.

- Marketing collateral.

- Lead programs.

- Training assistance.

As noted by PSMBrokerage, partnering with a solid FMO is probably the most significant choice you can make in selling Medicare insurance from home. Certain highly rated FMOs provide 100% commission with no override fees.

Here are resources such as CrankWheel and Reddit forums that indicate one should review FMOs on:

- Transparency of commission structure.

- Lead support.

- No forced exclusivity.

- Tech and CRM access.

2. Set Up Tech Tools & Remote Infrastructure

To succeed at selling Medicare insurance out of your home, your home office should be outfitted with effective, compliant, and client-focused tech. These systems simplify your workflow and enhance professionalism.

A. Quoting & Enrollment Software:

Centralized quoting and enrollment platforms allow you to comparison shop plans and submit e-apps without getting up from your desk—imperative when selling Medicare insurance out of your home.

- Software such as MedicareCompareUSA’s CSG Quoting & Enrollment Tool enables you to generate multiple plan quotes and enroll clients straight from a single dashboard.

- Lead Advantage Pro from Senior Market Sales combines quoting, enrollment, and compliant call recording into one system—perfect for remote agents.

- PlanEnroll by Integrity provides clients with access to zip-code based plan comparison and self-service, allowing you to capture leads even outside of office hours.

These tools are essential to sell Medicare insurance from home, with real-time plan information, compliance functionality, and electronic signatures that will streamline client onboarding.

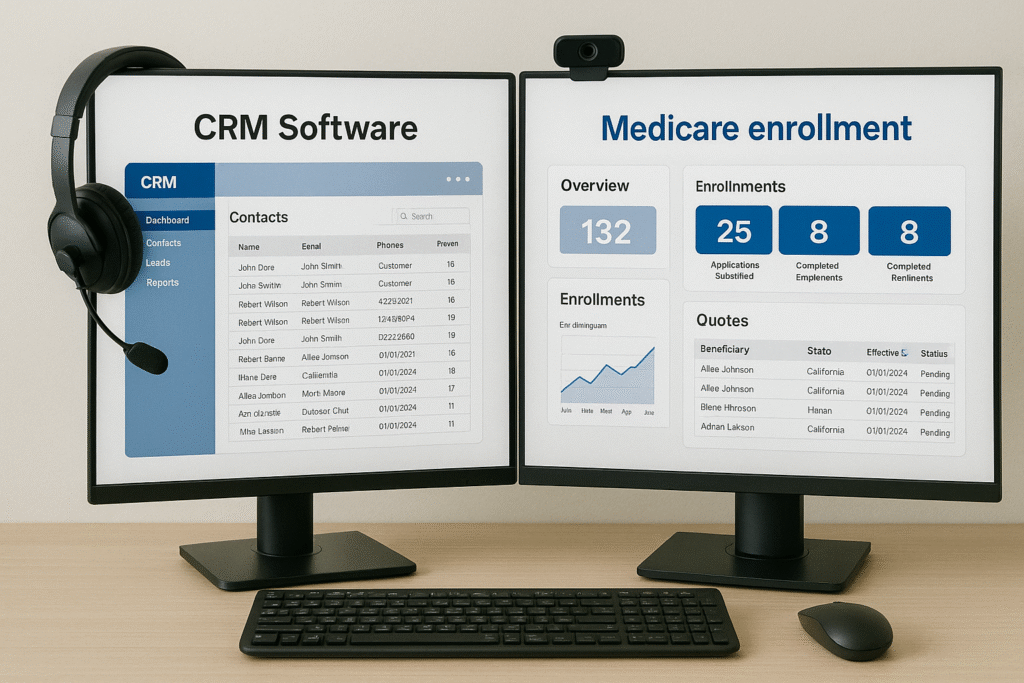

B. CRM & Lead Management Systems:

A strong CRM is essential to track leads, appointments, follow-ups, and renewals when selling Medicare insurance from home.

Recommended choices:

- MedicarePRO CRM – designed for Medicare agents; tracks SOA, monitors commissions, and handles compliance workflows.

- HubSpot CRM – free, scalable solution with automated follow-ups and lead scoring.

- Zoho CRM – extremely customizable; combines email, workflows, and task automation.

- AgencyBloc or Insureio – insurance-oriented CRM with application handling and marketing features.

- MedicareCENTER CRM – free to contracted agents, fully integrated with quoting and enrollment.

Reddit agents rave:

“I utilize the free CRM available through my FMO, Insurance Advisors Direct (IAD)… Enjoy the CRM and the FMO!”

Free or paid, a CRM assists you in cultivating leads, following up on conversations, setting up reviews—all while selling Medicare insurance from home effectively.

C. Communication Tools: Phone, Video & Virtual Reception:

When selling Medicare insurance from home, your technology needs to mirror in-office professionalism:

- Virtual phone systems such as RingCentral or Grasshopper allow you to utilize business lines with call forwarding and texting.

- Video conferencing software (Zoom, GoToMeeting) allow for face-to-face client meetings—a must for establishing trust over the phone.

- Screen share and e-sign tools keep clients active and compliant during enrollment.

Connecting these tools with your CRM facilitates seamless tracking of calls, SOAs, and follow-ups—key to selling Medicare insurance from home.

D. Documentation, Call Recording & Compliance:

CMS demands documentation (SOAs, enrollment records) and, in most instances, call recordings:

- Most quoting software automatically records calls made during AEP.

- CRMs such as MedicareCENTER and MedicarePRO save electronic SOAs, notes, and e-apps in one searchable location .

- Cloud storage (e.g., Google Drive with encryption) provides secure storage for your sensitive client information and makes it accessible.

Putting quoting software, CRM, and call logs together ensures compliance and protects your business while selling Medicare insurance from home.e.

3. Master Lead Generation & Marketing Strategies

Lead generation is the lifeblood of Medicare insurance selling from home. Without a consistent flow of qualified leads, even the best agents can’t convert. Fortunately, the digital age has given us some incredibly potent marketing tools you can leverage from the comfort of your home office.

A. Build a Professional Online Presence:

Your online presence is usually a client’s first impression—and it has to scream “credible and trustworthy.”

- Launch a basic, professional website using platforms such as WordPress, Wix, or Squarespace. Have your services, contact forms, testimonials, and educational blog posts.

- List yourself on local directories such as Google Business Profile, Yelp, and HealthMarkets to boost local SEO.

- Set up a branded email address (e.g., you@youragency.com) for professionalism in outreach.

A solid web presence increases credibility when selling Medicare insurance out of your home, particularly to seniors and caretakers searching online for agents.

B. Leverage Social Media & Content Marketing:

Facebook, YouTube, and LinkedIn are lead generation goldmines when selling Medicare insurance from home.

- Create a Facebook Business Page and place localized ads focusing on seniors 64+. Make use of testimonial videos, educational reels, and plan comparisons.

- Establish expertise with brief YouTube explainers on such issues as “Medicare Advantage vs. Medigap” or “What is the Part D Donut Hole?”

- Blog frequently on LinkedIn, participate in insurance forums, and connect with financial planners or eldercare experts.

For content:

- Utilize software such as Canva to develop branded images and add some Medicare cheat sheets.

- Publish client testimonials, FAQs, and compliance-safe tips in posts and newsletters.

C. Purchase or Create Medicare Leads Online:

Although organic marketing is strong, most home agents expedite growth by purchasing leads. Best places to obtain them include:

- Lead Heroes.

- AgedLeadStore.

- Benepath.

- EverQuote.

These websites offer:

- Exclusive or common real-time leads.

- Pre-qualified turning-65 leads.

- TCPA-compliant contact information.

Also consider Facebook Lead Ads or Google PPC campaigns through Medicareful or RadiusBob to create your own high-intent leads.

D. Build Referral Funnels & Partnerships:

Word-of-mouth is strong—even online. Leverage existing relationships to power your business:

- Partner with local doctors, pharmacies, and elder care professionals.

- Provide “referral bonuses” to friends or existing clients (where permitted).

- Request testimonials and online reviews after enrollment.

Join Facebook groups for seniors, caregivers, and retirement communities. Provide value, respond to questions, and establish a presence in those communities to assist with selling Medicare insurance at home without cold calling.

E. Email Drip Campaigns & Retargeting:

Utilize CRM software such as Mailchimp, ConvertKit, or the platform provided by your FMO to send follow-up emails automatically.

Examples of campaigns:

- “Welcome to Medicare” turning-65 leads.

- “What You Need to Know About Medicare Part D”.

- “Do You Qualify for Extra Help?”

Blast emails with Facebook Pixel and Google Ads retargeting to remain top of mind online. This omnichannel strategy works extremely well for remote agents determined to sell Medicare insurance from home.

4. Stay Compliant with CMS Rules & Guidelines

While selling Medicare insurance at home, avoiding any non-compliance with CMS marketing and enrollment guidelines is not a choice. Rules safeguard both consumers and agents—evade violations by synchronizing your procedures with CMS guidelines.

A. Adhere to CMS Marketing & Communication Guidelines:

Agents are subject to the CMS Medicare Communications and Marketing Guidelines whether you’re selling Medicare insurance at home in person or selling Medicare insurance at home online.

- Educational content is okay at any time, but marketing messages, advertisements, or enrollment conversations will have to wait until October 1 of each year; enrollment opens October 15.

- You cannot use absolutes, such as “best” or “free,” unless completely explained—words like ‘$0 premium’ must be qualified.

- All marketing materials (print, email, web, social) require advance CMS approval if mentioning specific plans.

By remaining compliant, you gain trust and keep your home-based Medicare selling business free from fines or suspension of licenses.

B. Get & Document Scope of Appointment (SOA):

If you’re selling Medicare insurance at home, you need to have your prospects sign a Scope of Appointment (SOA) prior to discussing individual Medicare plans.

- The signed SOA should be dated a minimum of 48 hours prior to the planned meeting—unless an unscheduled walk-in or within 4 days of enrollment deadlines.

- SOAs remain effective for 12 months, but need to be retained on file for 10 years, even if no sale is made.

- Utilize secure platforms such as MedicareCENTER to email, text, or record and store SOAs electronically automatically

Tight SOA management keeps your virtual consultations compliant while selling Medicare insurance from home.

C. Record Sales & Marketing Calls:

When selling Medicare insurance from home, all marketing, sales, or enrollment calls should be completely recorded, according to CMS’s TPMO guidelines.

- Start calls with explicit disclaimers: not a Medicare affiliate, and calls are being recorded.

- Record calls end-to-end when broaching MA or Part D plans—software such as Lead Advantage Pro and PlanEnroll do this automatically

- ritterim.com

- Securely store recordings according to HIPAA/PCI standards for a minimum of 10 years.

- Correct recording covers you and enforces transparency when selling Medicare insurance from home.

D. Disclose TPMO & Follow Privacy/Consent Rules:

Since you are a home-based seller, you might be associated with a Field Marketing Organization or so—full disclosure is a must:

- Apply the standard TPMO disclaimer in all emails, landing pages, or calls in the first minute

- ritterim.com

- Get Permission to Contact (PTC) prior to marketing outreach when selling Medicare insurance remotely from home

- ritterim.com.

- If utilizing third-party lead providers, make sure they follow CMS regulations, data-sharing consents, and define your relationship accurately

- ritterim.com.

PTC and TPMO relationships transparency is crucial for legitimate remote Medicare sales.

E. Conduct Compliance-Focused Virtual Events:

When presenting online webinars or virtual workshops as part of your home-selling strategy for Medicare insurance, remember these CMS guidelines:

- Separate educational vs. sales events. Education-only can be at any time; sales events have to comply with marketing schedules and involve plan comparisons

- Don’t provide SOAs during educational events. Wait until afterward if you’d like to schedule for specific plan discussions

- Offer disclaimers, Plan Finder tips, and star-ratings information—even in remote sessions ritterim.com.

This keeps your live and recorded educational activities compliant while selling Medicare insurance from home.

5. Master the Remote Sales Process

To thrive on selling Medicare insurance from home, you must optimize your virtual sales process. From prospecting to enrollment, every step should be professional, compliant, and conversion-optimized—where face-to-face contact is out of the question.

A. Utilize High-Converting Virtual Tools:

While selling Medicare insurance from home, technology is your greatest ally. Opt for simple-to-use, CMS-compliant platforms to handle consultations and applications.

- CRM & Quoting Solutions: Utilize SunFire Matrix, MedicareCENTER, or Connecture for plan quotes in real-time, client management, and electronic enrollment.

- Video Calls: Utilize tools such as Zoom, Google Meet, or CrankWheel to host secure online consultations. CrankWheel is designed specifically for screen sharing on insurance sales calls.

- e-Signature Solutions: Tools such as DocuSign and SignNow enable clients to sign forms from any location.

Pro Tip: Make a professional Zoom background and pre-test your mic/camera for each call to look crisp and believable selling Medicare insurance from home.

B. Guide Clients Through Virtual Consultations:

Rapport-building is more important than ever when face-to-face isn’t an option. How you present and navigate clients will determine conversion rates selling Medicare insurance from home.

- Begin with a friendly greeting and make sure clients feel at ease using the call platform.

- Describe the SOA form, and obtain verbal permission to record if needed.

- Utilize screen sharing to guide through comparisons of plans, formularies, and star ratings. Use Medicare.gov’s Plan Finder to facilitate neutral, informative conversations.

- Your tone, clarity, and credibility substitute for a handshake when selling Medicare insurance from home. Practice describing coverage levels and out-of-pocket maximums in plain, conversational language.

C. Present Options Without Overwhelming:

Too many plan details can freeze up decision-making. Apply the “Good, Better, Best” approach when selling Medicare insurance from home:

- Good: Low-cost Medicare Advantage Plan with standard benefits.

- Better: Higher-rated Advantage plan with dental/vision.

- Best: Medigap Plan G + Part D for flexibility and lower long-term expense.

Highlight pros/cons of each and guide by lifestyle and health factors—not merely cost. Leverage visuals such as YourMedicareBot or FMO-provided tools to keep choices simple.

D. Handle Objections & Build Confidence:

Whether new or veteran, objections are standard when selling Medicare insurance at home. Practice answering with a calm and informative tone.

Standard Objections:

- “I don’t trust plans over the phone.”

- Solution: Point out your state license, CMS compliance, and secure tech. Provide offer of email verification.

- “It’s too confusing.”

- Solution: Utilize analogies. E.g., “Medigap is a car with full coverage, Medicare Advantage is a lease—lower monthly, but greater risk.”

- “I’ll think about it.”

- Solution: Provide an at-no-cost PDF summary with a reminder of the follow-up appointment.

Confidence and clarity are essential characteristics that clients react to when selling Medicare insurance from home without body language.

E. Submit Applications Securely & Efficiently:

It is important to have a seamless application process for retaining and getting referrals. Errors while selling Medicare insurance from home can result in declined enrollments or compliance violations.

- Utilize enrollment software from your FMO such as MyMedentineBot, PlanEnroll, or SunFire.

- Validate client information: address, Medicare number, effective date, network pharmacy, and provider network.

- Present during the call while screensharing, then validate with next steps and email receipts.

F. Monitor Results & Streamline Your Sales Flow:

You can work like a data-driven agency even from home. Leverage reporting tools on platforms such as RadiusBob, GoHighLevel, or your FMO’s dashboard to:

- Monitor lead-to-sale ratios.

- Keep track of appointment show rates.

- Recognize top plans by region.

- Track referral and retention numbers.

Streamlining your flow increases productivity and retention in the long run, allowing you to scale as you sell Medicare insurance from home.

Case Example: Agent John R., a home-based Medicare salesman from Arizona, utilized CrankWheel for demos, Mailchimp for lead nurturing, and SunFire for enrollments. Within 9 months, he developed a book of 300+ clients—all from home (source: PSM Brokerage).

Conclusion: Turn Your Home Office Into a Medicare Sales Powerhouse

Selling Medicare insurance from home isn’t something new—it’s an opportunity of the long-term variety for licensed agents who want freedom, flexibility, and financial success. With the proper tools, training, compliance habits, and client-focused mindset, you can establish a successful remote Medicare business without ever crossing the threshold of a traditional office.

This eBook took you through it all, from licensing, certifications, lead generation, sales tools, compliance, and virtual enrollment strategies—all designed to make you successful selling Medicare insurance from home.

Here’s your action plan:

- License, AHIP-certify, and FMO-align yourself.

- Establish your virtual office: CRM, e-signature, Zoom, quoting tools.

- Develop mastery of virtual consultations and compliant enrollments.

- Create systems for lead tracking, follow-ups, and retention.

Keep in mind, your clients aren’t looking for a plan—They need clarity, confidence, and someone who cares. Be that guide, even from a screen.

Also Read: Ponte Vedra Home Insurance: 7 Must-Know Truths to Avoid Regret

Frequently Asked Questions (FAQs)

Can I legally start selling Medicare insurance from home?

Yes. As long as you’re licensed, AHIP-certified, and follow CMS guidelines (including recording calls and storing Scope of Appointment forms), selling Medicare insurance from home is fully legal and widely encouraged by carriers and FMOs.

What certifications do I need to sell Medicare Advantage or Part D plans?

You’ll need:

1. A state health insurance license.

2. AHIP certification.

3. Carrier-specific certifications.

4. CMS producer number.

These are mandatory if you’re selling Medicare insurance from home or in person.

What tools do I need to sell Medicare remotely?

Must-have tools include:

1. CRM (e.g., RadiusBob, MedicareCENTER).

2. Quoting & enrollment platforms (e.g., SunFire, Connecture).

3. Secure video calling (Zoom, CrankWheel).

4. E-signature (DocuSign).

All these enable seamless selling of Medicare insurance from home.

How can I find leads while selling Medicare insurance from home?

Options include:

1. Digital ads (Facebook, Google).

2. Purchasing compliant lead lists.

3. Local Facebook Groups or community webinars.

4. Referrals from family, friends, and clients.

Some FMOs offer free or discounted leads for agents selling Medicare insurance from home.

What are the CMS compliance rules I must follow?

Key rules include:

1. Use SOAs before plan discussions.

2. Record all sales/marketing calls.

3. Include TPMO disclaimers.

4. Don’t cold call or mislead prospects.

These apply to all agents, especially those selling Medicare insurance from home.

Can I make good money selling Medicare from home?

Yes. Top-performing agents earn 5–6 figures annually. You earn per enrollment and renewal (lifetime residuals). Many agents build a book of 500–1000+ clients by consistently selling Medicare insurance from home year-round.