How to Sell Home Insurance: 5 Secret Tricks Top Agents Use

How to sell home insurance is one of the most urgent questions for both new and old insurance agents. Among a market saturated with numerous providers, standing out requires not only technical expertise but smart marketing, sales psychology, and outstanding customer relationship skills.

In this comprehensive guide, we’ll explore strategies that go beyond the basics. From identifying your target market to leveraging digital tools and handling objections like a pro, you’ll discover actionable insights to increase your close rate. Whether you’re a solo agent or part of a larger agency, understanding how to sell home insurance effectively can be the key to consistent growth and long-term client retention.

Table of Contents

5 Secret Tricks Top Agents Use – How to Sell Home Insurance

1. Understand the Product Before Selling It – How to Sell Home Insurance

Perhaps the most essential step in learning how to sell home insurance is cultivating a clear and thorough understanding of what you’re selling. Top agents in this business aren’t merely selling policies—they’re selling peace of mind. That can only occur when you have a solid idea of what your product entails and how it works when it comes to daily perils homeowners face.

Know What Home Insurance Really Covers

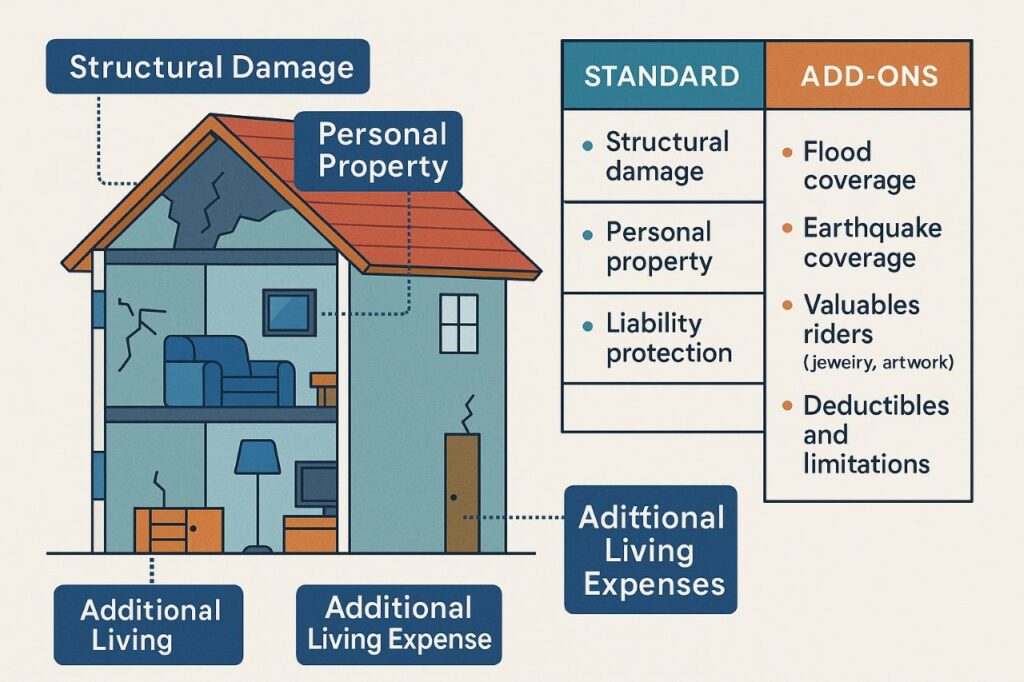

Before attempting to pitch any policy, you need to have a good idea of what home insurance usually covers. Standard homeowner insurance policies—informally known as HO-3 policies—are typically written to cover:

- Structural Damage: Pay for fixes to the home’s actual structure, such as the roof, walls, and foundation, due to fire, hail, or wind.

- Personal Property: Insures items within the house, like furniture, appliances, and clothing, against covered risks like theft or vandalism.

- Liability Coverage: Provides financial help if a person is hurt on the property or if the homeowner is held responsible legally for damage to property.

- Additional Living Expense (ALE): Covers hotel bills, food, and other living expenses temporarily if the home is made uninhabitable by a covered loss.

In order to be an expert at selling home insurance, you must demonstrate these coverage with examples. For instance, if a tree branch comes crashing through the roof of a house during a storm, describe how the structural coverage takes over. Or if a visitor slips at the homeowner’s party and breaks an ankle, liability insurance may cover thousands in attorney fees.

Find out more from Insurance Information Institute to remain current with what standard policies cover.

Discover the Policy Add-Ons and Limits

Each house is unique, and so are risks for homeowners. That’s why endorsements and add-ons are instrumental in making a policy truly cover your client. As you practice becoming an expert at selling home insurance, these added coverage can be great opportunities to up-sell—if you know them and explain them appropriately.

Some key policy options and limitations to keep in mind are:

- Flood and Earthquake Insurance: These types of natural disasters are typically not included in standard homeowners insurance. You can provide National Flood Insurance Program (NFIP) coverage or private flood/earthquake policies where necessary. FEMA’s FloodSmart is a good resource to learn about eligibility and risks.

- Valuables Riders: Jewelry, antiques, artwork, and collectibles usually cost more than the limits provided by regular personal property coverage. Special endorsements or floater policies enable clients to cover these items for their full appraised amount.

- Deductible and Premium Adjustments: You can have your client up their deductible to lower their monthly premium or opt for a lower deductible for greater peace of mind. Knowing how this balance works allows you to provide versatile options according to their comfort zone.

Agents who desire to become experts at selling home insurance do not need to avoid talking about these limitations. Transparency regarding what isn’t covered actually builds confidence and establishes you as an expert advisor instead of a salesperson.

- Tip: Develop a fill-in-the-blank coverage checklist for clients based on your insurance company’s options. This visual can break down complicated issues and make decision-making less complicated for your clients.

By making yourself thoroughly acquainted with every aspect of the product—core coverage, voluntary endorsements, and policy exclusions—you can come to each sales conversation with knowledge and compassion. This in-depth product knowledge is the first and most important step in learning to sell home insurance in today’s competitive market.

2. Target and Identify the Correct Market – How to Sell Home Insurance

One of the most important aspects of learning how to sell home insurance FEMA’s successfully is learning about the person you are selling to. Not all homeowners share the same needs, concerns, or buying habits. By targeting high-potential client segments and adjusting your messaging to meet their needs, you can greatly boost your conversion rates.

Target First-Time Home-buyers and Real Estate Referrals

First-time home-buyers are probably the most open audience when it comes to how to sell home insurance. They’re going through a bewildering maze of mortgages, inspections, and regulations—perhaps for the first time. This presents the perfect opportunity for you to walk in as a resourceful guide instead of merely another salesperson.

Here’s how to access this market:

- Partner with Real Estate Agents: Build ties with regional realtors and mortgage brokers. Numerous first-time home-buyers confide in their agents, and being their insurance provider of choice instills immediate credibility.

- Go to Open Houses or Community Events: Getting together at local events can assist you in developing a rapport with new buyers in your region.

- Provide Free Resources: Develop downloadable guides or checklists like “Top 5 Home Insurance Blunders to Steer Clear Of” or “First-Time Home-buyer’s Guide to Home Insurance.”

Utilize NAR’s Realtor Statistics to discover more about real estate buyer trends within your local area.

When you’re focused on how to sell home insurance to this group, clarity and education are your biggest allies. Avoid industry jargon and highlight the protection aspect in real-life terms—like replacing a stolen laptop or fixing water damage from a burst pipe.

Understand the Needs of Different Buyer Segments

The more you know about your market, the simpler it is to tailor your sales pitch. Various buyers prioritize differently, so your strategy needs to be flexible.

Here is a breakdown of some of the most important buyer segments:

| Segment | Key Concern | Your Strategy |

|---|---|---|

| First-Time Buyers | Confusion, fear of hidden costs | Simplify coverage explanations and offer support |

| High-Net-Worth Clients | Protection of luxury items | Emphasize valuables coverage and customization |

| Real Estate Investors | Property protection and liability | Promote multi-property or landlord coverage |

| Seniors and Retirees | Fixed income, risk aversion | Focus on affordability and dependable service |

- Tip: Leverage resources such as Statista’s housing market statistics to spot high-growth regions where you can strategically sell your services.

Knowing your audience allows you to address them directly and remove friction from the decision-making process. If you want to learn seriously how to sell home insurance, segmenting prospects and customizing your pitch will differentiate you from competitors who use a “one-size-fits-all” model.

3. Master the Art of Consultative Selling – How to Sell Home Insurance

Key to learning how to sell home insurance is mastering consultative selling—a customized process centered on discovering the client’s needs prior to suggesting a solution. It is not about selling policies. It is about listening, informing, and positioning yourself as a trusted guide.

Build Trust Before Pitching

Leaping directly into policy features or pricing is one of the largest errors insurance agents commit. Customers are more likely to buy from someone who knows their unique fears and objectives. That is why establishing trust from the very beginning is vital.

Ask significant questions such as:

- “What do you worry most about insuring?”

- “Did you ever have home insurance? If so, what did you like or dislike?”

- “Do you know what your current policy covers—and doesn’t cover?”

These are more than just icebreakers; they reveal the emotional motivations behind buying decisions. For instance, a customer who’s had flood damage might be more willing to talk about flood insurance coverage, whereas a new homeowner might require reassurance on the fundamentals.

For customer behavior and psychology insights, read Harvard Business Review’s consultative selling guide.

Agents who focus on building trust ultimately sell more leads into loyal customers. That’s why one of the greatest responses to how to sell home insurance is: stop selling, begin listening.

Educate Rather Than Sell

Most homeowners don’t grasp the technical details of insurance—words like “deductibles,” “exclusions,” and “personal liability limits” leave them bewildered. Your role is to make the complicated simple and enable the client to make smart choices.

Here’s how

- Break It Down: Describe deductibles as the amount the customer pays out-of-pocket before insurance coverage becomes effective. Use common examples, such as car repairs or weather damage.

- Make Exclusions Clear: Explain what’s not covered, like earthquakes or floods, unless specifically included.

- Make Coverage Limits Clear: Illustrate how each part of their policy—dwelling, personal property, liability—has a maximum payout and why that is important.

- Use Visuals to Educate: Visual explanations work wonderfully with policy structure. You can create simple info-graphics illustrating the disparity between coverage levels, comparing policy levels, or displaying premium versus deductible scenarios.

Applications such as Canva or Visme make it possible to craft branded visuals within minutes—with or without any design experience.

- Tip: Include a small visual or chart in every policy presentation. Clients are 65% more likely to remember information paired with visuals, according to Forbes.

In your journey of discovering how to sell home insurance, becoming an educator will always outperform being a mere salesperson. When clients feel understood and informed, they don’t just buy—they stay.

4. Leverage Technology and Automation – How to Sell Home Insurance

In today’s insurance environment, knowing how to sell home insurance is closely linked to how you adopt digital tools. Technology not only makes your work easier but also enhances the client experience—making you more efficient, available, and reliable in a competitive market.

Create an Online Presence That Converts

Your site is the entrance to your company. In a world where 75% of customers base a company’s credibility on how its site looks, a solid online presence can be the make-or-break point when it comes to whether or not someone asks for a quote—or goes elsewhere.

This is what you need to have on your site:

- Mobile Optimization: Since most users are now accessing the internet on their smartphones, ensure your website is responsive. Check if your website is mobile-friendly via Google’s Mobile-Friendly Test tool to confirm that it functions on different devices.

- Trust Factors: Add client testimonials, case studies, and professional associations. Actual stories such as,

- “John from Austin saved 20% and had full flood coverage due to our customized plan,”

- make your service more personalized.

- Lead Capture Forms: Don’t use generic contact forms. Utilize quote calculators, survey-forms, and pop-ups to lead visitors to action.

- Pro Tip: Add a comparison feature that allows users to view the difference between policy levels (basic, standard, premium). This empowers clients to select what best fits them.

Read more about trusting online with Nielsen’s Trust in Advertising Report.

When you’re determining how to sell home insurance successfully, your website needs to be your most diligent salesperson.

Take advantage of CRM and Email Automation

CRM (Customer Relationship Management) tools allow you to follow up on every interaction with your clients—initial inquiry through policy renewal—without missing a single opportunity.

Leading CRM software for insurance agents are:

- HubSpot: Provides tracking of contacts, automated emails, sales pipelines, and seamless integration with websites.

- Zoho CRM: Inexpensive and configurable, perfect for small agencies.

- AgencyBloc: Created specifically for insurance agents to track leads, policies, and commissions.

- Automation can assist you:

- Set Auto-Reminders: Send birthday messages, renewal reminders, or reminders such as “Is your home prepared for storm season?”

- Trigger Follow-Ups: If someone fails to finish a quote form, send an email or text within 24 hours.

- Segment Your Audience: Send specific messages to first-time buyers, current clients, or flood insurance prospects.

- Tip: Make your emails action-oriented. Example:

- “Hi Sarah, a recent rate update could reduce your premium. Want me to look for you?”

- Tip: Make your emails action-oriented. Example:

Learn more about email timing and effectiveness from Campaign Monitor’s Email Benchmarks Report.

For those new to how to sell home insurance, automation provides consistency, which establishes credibility—and credibility drives conversions.

5. Overcome Objections and Close with Assurance – How to Sell Home Insurance

Even the best-delivered pitch will be met with resistance. Being adept at how to sell home insurance also means being prepared for objections and knowing how to overcome them with professionalism and compassion. Closing is not manipulation—it’s counsel.

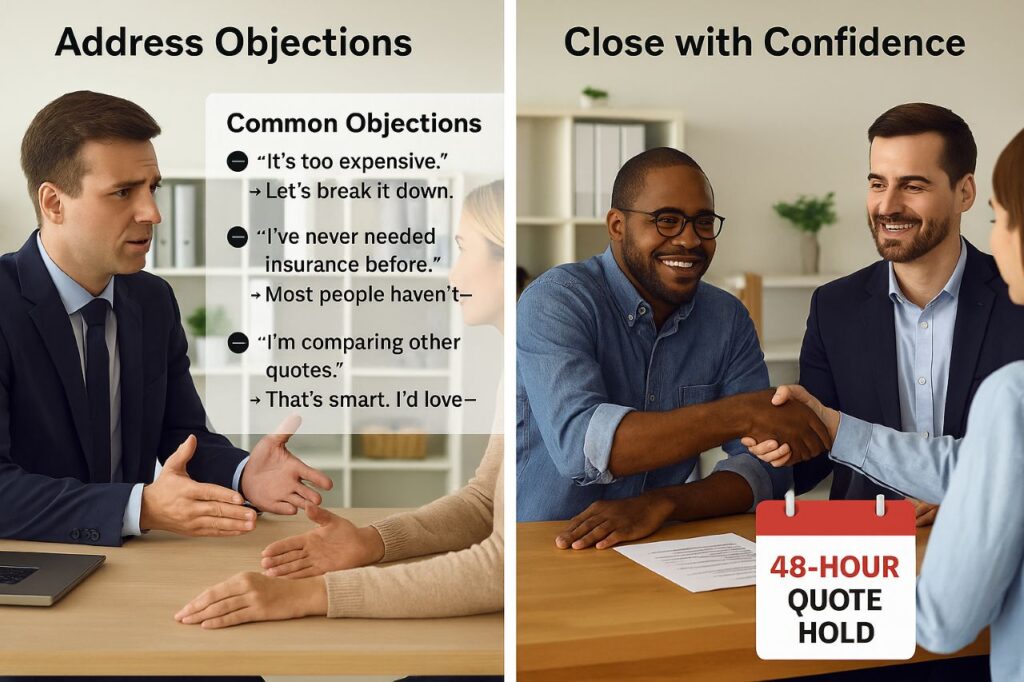

Objections and Responses

Customers usually hold back for expected reasons. Being prepared for these objections provides you with the ability to respond persuasively without being pushy.

- Objection 1:

- “It’s too costly.”

- Response:

- Break it down with me. It’s under $2/day to cover your entire house and its contents. Cheaper than that streaming service.”

- Objection 2:

- “I haven’t ever had to have insurance before.”

- Response:

- “That’s great! However, one weather storm or robbery could set you back thousands of dollars. Insurance is having security for when that unexpected occurs.”

- Objection 3:

- “I’ve got other quotes to compare.”

- Response:

- “Excellent! I always say bring it on and compare. Just remember, all policies are not equal. I’d love to guide you through the details so you can make an actually informed decision.”

Utilize Consumer Reports’ Homeowners Insurance Guide to illustrate unvarnished data on policy differences and customer satisfaction scores.

- Tip: Respond with empathy. Greet with a “That’s an entirely legitimate concern,” or an “I get that all the time, and it’s a fantastic question,” before providing your reply.

Techniques to Seal the Deal

To become expert at how to sell home insurance, closing should be an intuitive next step—rather than an awkward conclusion. Establish soft pressure and provide reassurance to make the client feel good about their choice.

- Scarcity Strategy:

- “This sale price is only valid for 48 hours because we’re about to make some regional adjustments. Let’s get it before it increases.”

- Urgency with a Personal Touch:

- “We’re about to enter storm season, and currently, you don’t have protection. I don’t want you to go through a claim without having coverage.”

- Decision Framing:

- “Would you like to begin with the regular package or the premium with identity theft and appliance coverage?”

- Tip: Always prepare a “Yes” question. For instance:

“Should I go ahead and create a quote with your valuables rider?”

Read successful closing tips from Sales Hacker’s insurance closing techniques guide.

Long-term success in the method of how to sell home insurance rests in the delicate balance of urgency and trust. When customers feel cared for, they buy quicker—and refer more frequently.

Final Thoughts – How to Sell Home Insurance

Learning how to sell home insurance is not just about knowing the terms of coverage—it’s learning to become a trusted advisor, a problem-solver, and a go-to resource for homeowners. In an age where clients are overwhelmed with options and information, being a standout insurance agent requires merging your knowledge with empathy, technology, and long-term relationship-building.

One of the keys to how to sell home insurance successfully is creating a client-centric philosophy. Rather than concentrating on making a fast sale, invest your time in learning the specific concerns, needs, and priorities of each homeowner. Provide them with solutions that are customized—not copied. Customers don’t need a salesperson; they need someone who listens, informs, and cares about safeguarding their home and future.

It’s no longer a choice to incorporate modern tools into your business processes—it’s necessary. Maintaining a professional online presence, employing CRM software for timely follow-ups, automated reminders, and delivering valuable home care content are all essential elements of a wise strategy for how to sell home insurance in today’s digital age. These tools keep you top of mind and maintain a solid connection even after the policy is sold.

Navigating objections clearly and confidently, closing the sale openly, and continually providing value creates trust over time. Trust is the real money in the insurance business—and the cornerstone of learning how to sell home insurance.

If you’re ready to take your insurance career to the next level, start by applying the principles outlined in this guide. Review your current processes, identify gaps, and begin implementing strategies that truly put your clients first.

Whether you’re a new agent or an old pro, now is the ideal time to take your game to the next level how to sell home insurance—because the agents who succeed are those who adapt, touch, and keep delivering value.

Also Read: Home Insurance Pre Existing Conditions: 5 Hidden Risks You Must Avoid

Frequently Asked Questions (FAQs)

What is the best way to start selling home insurance as a new agent?

Start by understanding your product thoroughly, obtaining proper licensing, and choosing a reputable insurance carrier or agency to work with. Focus on educating clients rather than hard selling. Building trust is a core strategy in learning how to sell home insurance effectively.

How can I find leads for home insurance clients?

Leads can come from multiple sources: online marketing, social media ads, referrals from real estate agents, attending local events, or using lead generation platforms like QuoteWizard. A combination of online presence and offline networking works best.

What objections do clients usually have when buying home insurance, and how do I handle them?

Common objections include cost, perceived lack of need, and comparing multiple quotes. Handle these with empathy and facts—break down costs, share real examples, and explain policy value clearly.

Is technology necessary to sell home insurance today?

Absolutely. A mobile-friendly website, CRM tools, email automation, and quote calculators are crucial in today’s digital market. Embracing tech is essential if you’re serious about mastering how to sell home insurance in a competitive environment.

How do I get more referrals from existing clients?

Provide excellent service, follow up regularly, and make it easy to refer you. Offer incentives like gift cards or discounts, and remind clients to share your name when they’re happy with your service.

What tools can help me learn how to sell home insurance more efficiently?

To master how to sell home insurance, use tools like CRM software (e.g., HubSpot, Zoho), email automation platforms, and quote comparison systems like EZLynx or HawkSoft. These help streamline your sales process, automate follow-ups, and keep client data organized.

How do I apply how to sell home insurance techniques when a client wants to switch providers?

When applying strategies for how to sell home insurance to a client switching from another provider, start with a coverage comparison. Highlight gaps in their current policy, demonstrate added value with personalized options, and build trust through transparency.

How can I up-sell using how to sell home insurance methods without being too pushy?

The best way to up-sell while following the principles of how to sell home insurance is through a consultative approach. Ask about valuables, rental properties, or renovations, and position extra coverage as smart protection—not an aggressive add-on.

One Comment