5 Home Owners Insurance Emergency Services Coverage Explained

Home owners insurance emergency services coverage is more than just a line item on your insurance policy—it’s a vital layer of protection that can make all the difference when a crisis strikes your home. Whether it’s a burst pipe in the middle of the night, fire damage, or a tree crashing through your roof during a storm, emergency services coverage ensures that help is on the way fast. For homeowners, particularly in disaster areas, this policy offers peace of mind and financial assistance during the most stressful times of life.

In essence, home owners insurance emergency services coverage is meant to intervene when emergency assistance is required—providing services such as 24/7 response teams, temporary repairs, clean-up, and relocation support. It minimizes out-of-pocket cost, accelerates claim settlement, and gets you back to normal life sooner. In this article, we’ll delve into how this kind of coverage operates, what it entails, and why it’s a must-have part of any homeowner’s coverage plan.

Table of Contents

What is Home Owners Insurance Emergency Services Coverage?

Understanding the Basics:

Home owners insurance emergency services coverage is an essential component of a homeowners insurance policy that gives an immediate response in times of unforeseen home emergencies. This coverage is particularly meant to minimize damage, restore safety, and enable homeowners to initiate recovery swiftly. From a pipe explosion at midnight or a high-wind-loss roof, emergency coverage ensures that professionals respond to take care of pressing matters—safeguarding your home and family.

In the majority of standard homeowners policies, emergency services coverage is included, but the extent can be quite different between companies. Some insure only basic home emergency response, while others have more comprehensive protection as an optional add-on. It’s best to examine your policy carefully and inquire with your insurance company what kind of home owners insurance emergency services coverage they have available to you.

As outlined by the Insurance Information Institute (III), knowing your emergency provisions under your policy is the key in preventing delays or out-of-pocket expenses where time is of the essence. The III encourages that homeowners take an active approach in knowing what is and is not covered under emergency response.

Key Services Offered:

With home owners insurance emergency services coverage, you usually get to have access to numerous critical services that can help limit loss and preserve the structural integrity of your home. These might include:

- Fire and smoke cleanup: Following a house fire, emergency teams may be able to clear away soot, ashes, and smoke residue to prevent further damage and health hazards.

- Urgent electrical and plumbing repairs: From a leaky pipe to exposed cables, fully qualified operators can be dispatched at once to secure the problem.

- Water removal and mold protection: Prompt action following flooding or leaks is needed to stop the growth of mold and water damage.

- Tarping and boarding of the roof: If a tree hits your roof or a window shatters in a storm, tarping and boarding can hold your property together until complete repairs start.

- Temporary living expenses: If your house is uninhabitable, this policy might pay for temporary housing, food, and transportation until it’s repaired.

The National Association of Insurance Commissioners (NAIC) also emphasizes the need to select a policy offering 24/7 emergency team access, as the initial hours following an accident are critical to avoiding permanent damage.

Why This Coverage Matters:

Having emergency services coverage under home owners insurance can provide you with the comfort that expert assistance is a phone call away, at all hours and under any circumstance. During emergencies, every minute matters. Without the coverage, you may have to pay dearly upfront, experience delays in response, or access-restricted services during a local disaster when demand surges.

For instance, during Hurricane Ida, most homeowners with comprehensive emergency services coverage were able to have speedy roof tarping and water removal performed in 24 hours—while others, without coverage, had to wait days and shell out thousands of their own money.

Common Situations Covered by Emergency Services

Disasters happen when you don’t expect them to, and that’s where home owners insurance emergency services coverage comes in. These emergencies, which are typically life-threatening, need professional help immediately to contain the damage and help safeguard your property, as well as your health. Some of the most frequent situations where such coverage comes to your rescue are listed below.

Fire and Smoke Damage:

One of the worst kind of emergencies that can be experienced by a home owner is a house fire. Even if fire is put out in its early stages, the residues are dangerous and toxic. This is where homeowners insurance emergency services coverage helps in a life-saving manner.

Services generally involve:

- Soot and smoke odor removal with industrial strength air scrubbers and ozone treatments.

- Decontamination of poisonous debris to avoid respiratory risks.

- Boarding up broken or burned windows and doors to weatherproof and protect against theft.

There are more than 350,000 residential fires in the U.S. each year, most of which need professional post-fire services in hours in order to avoid permanent damage, according to the U.S. Fire Administration.

Storm and Weather-Related Damage:

Severe weather, like hurricanes, tornadoes, hailstorms, and high winds, can result in vast destruction. Home owners insurance emergency services coverage is, however, tailored to respond fast in such circumstances, ensuring further structural loss is avoided.

What’s generally covered:

- Covering exposed roofs to keep out water.

- Clearing down trees or branches obstructing doors or roofs.

- Removing water from flooded portions of basements or lower levels to avoid mold development.

The National Weather Service urges people to board up their homes as soon as possible after a storm, citing water infiltration and debris as major safety concerns.

Burst Pipes or Water Leaks:

Water emergencies are one of the most frequent—and expensive—claims made under home owners insurance emergency services coverage. A burst or frozen pipe has the potential to inundate an entire floor in a matter of minutes, destroying walls, floors, and personal property.

Emergency coverage generally encompasses:

- Direct water shut-off through emergency plumbing services.

- Industrial drying and water extraction by means of dehumidifiers and blowers.

- Mold prevention treatments to prevent spores from germinating in 24–48 hours.

From Water Damage Defense, 14,000 American homeowners suffer a water damage crisis at home or the workplace every day. Without emergency services, damage and cost escalate rapidly.

5 Life-Saving Protections Explained: Home Owners Insurance Emergency Services Coverage

When disaster hits, swift action can be the difference between property damage and an all-out disaster. That’s why home owners insurance emergency services coverage is so important—it guarantees prompt, professional assistance when your safety and property are threatened. Here are five life-saving protections this coverage usually provides.

1. Emergency Fire and Smoke Mitigation:

Fires not only burn what they destroy, but they leave hazardous residues, structural hazards, and poisonous air. Thankfully, homeowners insurance emergency services coverage usually includes immediate fire damage mitigation, which is instrumental in reducing long-term effects.

The most important emergency services are:

- Elimination of smoke and soot by means of specialized vacuums and air scrubbers.

- Boarding over broken windows, doors, or walls to avoid additional weather or burglary-related damage.

- Debris and soot removal to remove health risks and avoid corrosion.

House fires resulted in more than $8 billion worth of property loss in the United States alone, as reported by the National Fire Protection Association (NFPA), within a single year. Having quick-response fire clean-up crews at your beck and call with your home owners insurance emergency services coverage can cut these costs dramatically—and even save lives.

2. Flood Response and Burst Pipe Repair:

Water disasters are one of the most prevalent insurance claims—and they propagate damage quickly. Be it a burst pipe or clogged drain, home owners insurance emergency services cover ensures quick water damage response, allowing home owners to halt leaks before they become larger problems.

Emergency services usually consist of:

- 24/7 availability of certified plumbers to turn off and fix frozen or burst pipes.

- Water removal and drying services to extract standing water.

- Mold prevention treatments and dehumidifiers to prevent biological threats.

The Environmental Protection Agency (EPA) alerts that mold can develop within 24–48 hours in wet conditions, particularly following floods. This is why quick action through home owners insurance emergency services coverage is required—it not only safeguards the home but also your family’s lungs.

3. Storm Damage Control and Tarping Services:

Severe storms have the potential to rip part of a roof off, shatter windows, or simply bring down trees through your living room. When that happens, home owners insurance emergency services coverage has emergency stabilization services that protect your home from further damage.

Typical services include:

- Emergency tarping of roofs to cover damaged structures and avoid rain damage.

- Removal of tree and limb to clear access and avoid injury.

- Boarding up or securing entry points to deter looting or animal intrusions.

The Federal Emergency Management Agency (FEMA) encourages homeowners to tarp their roofs and protect openings within hours of a storm to minimize future claims. This is often covered through your home owners insurance emergency services coverage and can save thousands in damages.

4. Temporary Housing and Safe Shelter:

When your residence is made unsafe by fire, flood, or structural damage, having a place to stay safely is paramount. Homeowners insurance emergency services coverage may provide loss of use benefits, assisting in the payment for emergency accommodations.

What’s typically included:

- Temporary housing or hotel reimbursement for displaced households.

- Food and meal allowances.

- Relocation or travel coverage based on policy conditions.

Consumer Reports says most homeowners don’t realize how expensive even a week away from home will be, particularly when arranging for children, pets, or older family members. By using home owners insurance emergency services coverage, you don’t have to pay these charges out-of-pocket.

5. Rapid Dispatch and Emergency Response Teams:

No emergency happens on its own schedule—and neither should your insurance provider. Perhaps the most vital advantage of home owners insurance emergency services coverage is rapid dispatch functionality, particularly at the height of crisis seasons when service providers are busiest.

Critical response benefits:

- 24/7 emergency claim lines to report immediately.

- Local, pre-approved vendor dispatch in hours, not days.

- On-site triage teams to evaluate, stabilize, and document damage.

The National Association of Insurance Commissioners (NAIC) suggests selecting insurers with robust local networks, citing that emergency service delays can raise overall losses by 30% or more. With home owners insurance emergency services coverage, these perils are largely eliminated.

All of these protections are manifestations of the real-world effect of having home owners insurance emergency services coverage. It’s not money, though—it’s peace of mind, quick recovery, and safeguarding your family’s health and well-being at the moment when they need it most.

What’s Included and What’s Not

It’s only when disaster hits that you find out the true extent of home owners insurance emergency services coverage. Not all emergencies are equal, and what one company offers may not be offered by another. Being aware of what’s covered and what’s not will prevent you from being denied a claim and charged unbudgeted expenses.

Typically Included in Emergency Services Coverage:

Most typical policies that include home owners insurance emergency services coverage extend aid in the initial response to a covered loss, which is designed to stabilize the home and avoid further damage.

This is what’s usually covered:

- Emergency structural stabilization – In case of damage to part of your home due to fire, storms, or vehicle collision, emergency services can provide temporary supports, tarping, or bracing.

- Electrical and plumbing repairs – Quick service by qualified professionals to repair burst pipes, faulty electrical wiring, or unsafe electrical panels.

- Water and fire damage restoration – Involves extraction, drying, smoke removal, and air cleaning to avert mold and toxic residue growth.

- Temporary accommodations – If your residence is declared uninhabitable, you might be entitled to hotel accommodations, meals, and transportation under the “loss of use” rider.

Emergency services are usually included under “additional living expenses” and “other structures coverage” in most standard homeowners policies, according to the National Association of Insurance Commissioners (NAIC). Exact coverage, though, differs based on your provider and type of plan.

Usually Not Included in Emergency Services Coverage:

Home owners insurance emergency services coverage is comprehensive, yet not entirely so. There are exclusions that may leave homeowners paying out-of-pocket for some situations.

Here are typical exclusions:

- Pest infestations – Rodent problems, termite infestations, or bed bug infestations are maintenance problems, not emergencies resulting from a covered cause.

- Cosmetic-only repairs – Minor scratches, scuffs, or damage to the surface that do not affect the livability or safety of the home are usually excluded.

- Pre-existing conditions – Existing conditions such as a long-standing leak, aged plumbing, or structural degradation are not covered by emergency unless abruptly exacerbated by a covered event.

According to Investopedia, homeowners are expected to maintain the property and reduce risk. Loss due to negligence or lack of proper maintenance is not a sudden emergency in most policies.

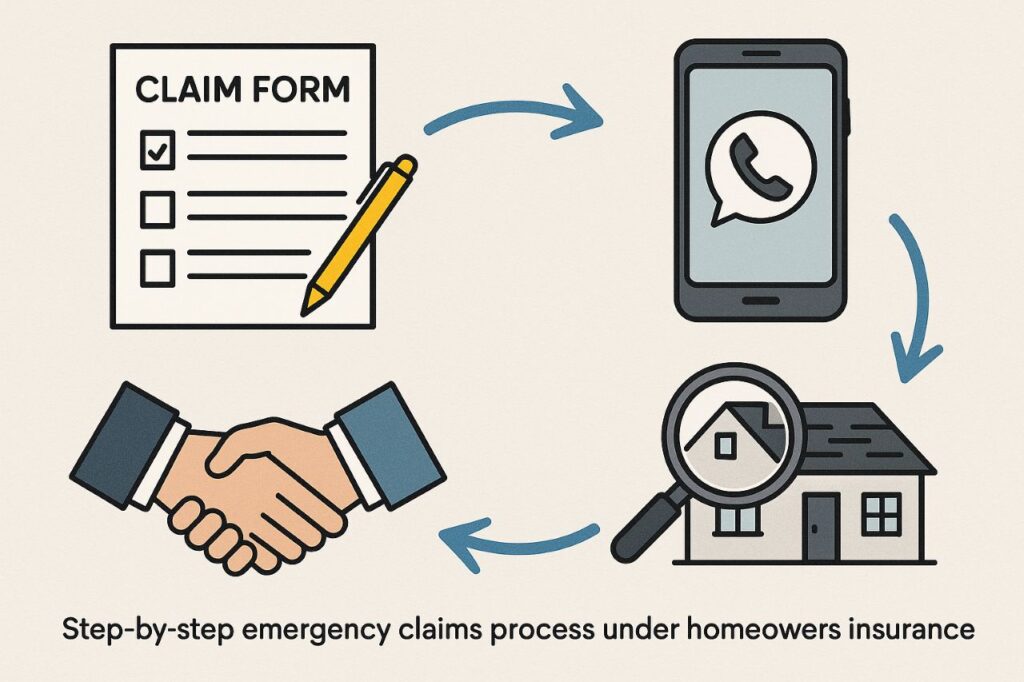

How the Emergency Claims Process Works

In the event of disaster, speed is essential—and so is having some idea what to do. Thankfully, emergency services coverage through home owners insurance is meant to provide quick assistance, but the claims process still includes crucial steps. Knowing the process beforehand ensures prompt response, efficient communication, and complete coverage for costs associated with emergencies.

Step-by-Step: Navigating an Emergency Services Claim

- Call the insurer’s emergency hotline right away:

- Most home owners insurance emergency services providers have 24/7 emergency hotlines available. This is your initial action after making sure everyone is safe. There are even specialized disaster response units with some insurers for catastrophic occurrences.

- Check your insurer’s site or use their mobile app for fastest entry.

- Most home owners insurance emergency services providers have 24/7 emergency hotlines available. This is your initial action after making sure everyone is safe. There are even specialized disaster response units with some insurers for catastrophic occurrences.

- Vendor is sent to your residence:

- After the call is placed, a vendor is sent—usually within 2–4 hours based on severity.

- Allstate says that using preferred vendors guarantees quicker claims and easier communication.

- After the call is placed, a vendor is sent—usually within 2–4 hours based on severity.

- Temporary repairs are made to stabilize the condition:

- Services included within home owners insurance emergency services coverage—such as water removal, roof covering, or board-ups—are started immediately. These repairs are meant to prevent additional damage, not finish the total repair.

- Documentation gathered and your complete claim is started:

- While emergency services are in progress, insurers will ask for photos, receipts, and information to start processing your complete claim. This can include hotel expenses, structural evaluations, and contractor estimates.

- Adjuster comes to your residence after stabilization:

- An adjuster from the insurance company will come in a few days to evaluate long-term repairs and confirm charges. They might ask for further documentation or go directly through the emergency vendor for proof of damages.

As per the National Association of Insurance Commissioners (NAIC), having prepared documentation and remaining proactive throughout the claims process ranks high as a method for optimizing insurance benefits in times of emergency.

By doing things right and applying the above tips, you can ensure your home owners insurance emergency services coverage comes through for you—saving time, money, and stress when you need it most.

Conclusion: Home Owners Insurance Emergency Services Coverage

Home owners insurance emergency services coverage could be the most important part of your policy—especially when time is critical. From halting water damage to securing your home after a fire or storm, these services are designed to protect your safety, health, and property. And with the five protections we’ve outlined, it’s easy to see why this coverage is essential.

Don’t wait until disaster strikes to find out you’re under-prepared. Talk to your insurance provider today and make sure your policy includes these life-saving features.

Check your existing homeowners policy. If emergency services are not explicitly included, request to add or upgrade. Your family—and your future—are worth that added measure of protection.

Read Also: Log Cabin Home Insurance: 7 Powerful Benefits

Frequently Asked Questions (FAQs)

What is home owners insurance emergency services coverage?

Home owners insurance emergency services coverage refers to the part of your homeowners policy that provides immediate help during urgent situations like fire, flooding, or storm damage. It typically covers emergency repairs, temporary housing, and cleanup efforts to prevent further damage.

Is emergency services coverage included in all home insurance policies?

Not always. While some home owners insurance emergency services coverage is included in standard policies, certain features—like service line repair, mold mitigation, or extended lodging—may require optional add-ons. Always check your specific policy or speak with your insurer.

What types of emergencies are usually covered?

Most providers cover emergencies related to:

1. Fire and smoke damage.

2. Water leaks or burst pipes.

3. Storm damage (e.g., broken roofs, fallen trees).

4. Electrical failures.

5. Temporary uninhabitability due to a covered peril.

Does it cover long-term repairs or only temporary fixes?

Home owners insurance emergency services coverage focuses on temporary stabilization—such as water extraction, tarping, or emergency boarding. Long-term repairs are typically handled under the broader dwelling coverage portion of your policy after the emergency is under control.

How fast can emergency teams arrive after a claim?

Most insurers with strong emergency services coverage dispatch vendors within 2–4 hours of your call. Some even guarantee 24/7 response windows. Using your insurer’s preferred network can speed up the process significantly.

What should I do right after an emergency occurs?

Immediately:

1. Ensure everyone’s safety.

2. Call your insurer’s 24/7 hotline.

3. Take photos or videos of the damage.

4. Avoid starting repairs until advised.

5. Keep all receipts and document everything.

Will filing an emergency claim increase my premiums?

It’s possible. Emergency claims, like water damage or fire response, can influence your risk profile. However, the financial loss without home owners insurance emergency services coverage is often far greater than any potential rate increase.

Can I choose my own contractors during an emergency?

Some policies require you to use insurer-approved vendors for emergency services. Doing otherwise might reduce or void your reimbursement. Always check your policy or contact your claims representative for guidance.

How can I check if I have enough coverage?

Review your home owners insurance emergency services coverage with your agent once a year. Look specifically for:

1. What types of emergencies are covered.

2. Coverage limits.

3. Deductibles.

4. Response time guarantees.

5. Temporary lodging benefits.

Is emergency services coverage worth it?

Absolutely. The cost of emergency services out-of-pocket can reach thousands of dollars. For a small annual premium or included protection, you get peace of mind, faster recovery, and professional help when you need it most.