5 Proven Home Insurance Script Ideas That Win Clients

Home insurance script is the little-known weapon behind every successful insurance agent’s presentation. A great script creates trust, clarity, and increased conversions. Whether you’re a rookie or veteran, having a trusted script can be the difference maker.

In the competitive insurance environment of today, your words are more important than ever. Customers desire confidence, clarity, and care—all in seconds. That is why having a winning home insurance script is crucial to closing more sales.

Table of Contents

What is a Home Insurance Script?

A home insurance script is a formal communication strategy that directs insurance agents during interactions with prospective or current customers. It comprises critical elements such as greetings, explanation of coverage, dealing with objections, and a call to action.

By scripting, agents prevent common mistakes such as omitting important coverage details or coming across as ill-prepared. One of the best trust-builders in insurance selling, says the Insurance Information Institute (III), is clear policy communication.

Key Elements of an Effective Home Insurance Script

In order to be effective, your home insurance script needs to be more than a sales pitch—if it’s done correctly, it should resemble a useful conversation that’s specific to the client’s requirements. Here’s a step-by-step analysis of the major components that make a script professional and compelling:

A Warm Introduction

First impressions matter. Your home insurance script should begin with a friendly, confident greeting that instantly builds rapport. Use the client’s name if possible and introduce yourself and your company with a tone that’s warm but professional. For example:

“Hi John, this is Emily from TrustPoint Insurance—I hope you’re having a great day!”

This sets a positive tone and makes the customer feel valued and open to conversation.

Client Needs Assessment

Rather than jumping headlong into the sale, a good home insurance script contains considered questions to evaluate the client’s circumstances. These can be:

- “Do you own or rent your house currently?”

- “Have you previously had insurance or is this a new policy for you?”

- “Do you have any special objects or buildings you’d like to cover?”

These questions steer the conversation while demonstrating interest in the client’s requirements, enabling you to make your offer exactly as needed.

Clear Value Presentation

After you know the client’s requirements, your script can move into a straightforward and uncomplicated description of the coverage recommended. Don’t use industry terms—use plain talk instead to define terms such as:

- Dwelling coverage: coverage on the dwelling of the house.

- Liability coverage: coverage if a person gets hurt on the property.

- Personal property coverage: coverage for personal belongings such as furniture and electronics.

This establishes trust and makes clients completely aware of what they’re buying.

Objection Handling

Regardless of how concise your home insurance script is, customers will have questions or objections. Be prepared with truthful, non-defensive answers. Typical objections could be:

- “It’s too pricey.”

- “I have to consider it.”

- “I’m not certain that I require all this coverage.”

A good script equips you with answers such as:

“That’s completely reasonable. Let’s review it together closely and see if we can scale the coverage so that it serves both your interests and your budget.”

This maintains the dialogue positive and useful as opposed to pushy.

Call to Action (CTA)

Any good home insurance script finishes up with a strong, action-led step. This might be:

- “Would you like to proceed and secure your quote today?

- “May I send over a summary so you can review everything at your own pace?”

- “Let’s plan a quick follow-up call tomorrow—what time is good for you?”

The CTA must be a natural ending to the conversation and give the client an easy way to move forward.

These components keep your home insurance script organized but loose—and what’s more important, that it really makes the client feel enlightened, guided, and prepared to purchase.

5 Proven Home Insurance Script Examples

Getting the home insurance script right can be the difference between a lead going cold and a policy being signed. Whether you’re closing a deal or cold-calling, using the right words at the right moment instills trust, communicates value, and increases conversions.

Below are five battle-proven scripts—and how and why they work.

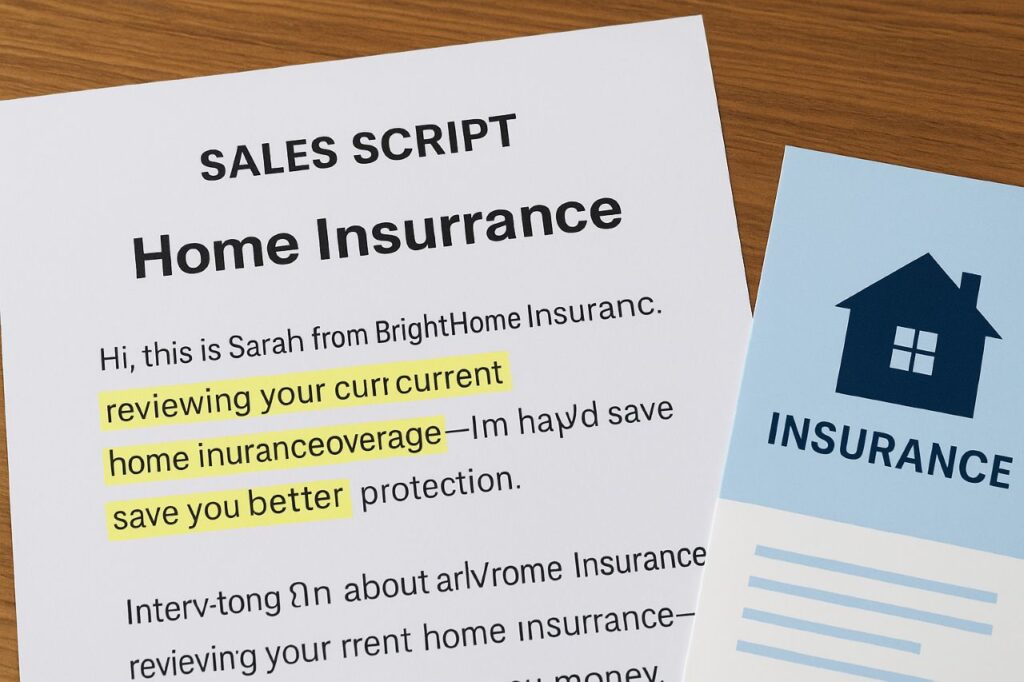

Cold Call Introduction Script

- Script: “Hi, this is Sarah from BrightHome Insurance. I’m calling to ask if you’d be willing to take a look at your existing home insurance policy—it may save you money and provide better protection.”

- Why It Works: This opening sentence applies curiosity and benefit-oriented communication without being aggressive. It provides homeowners with a reason to keep talking without obligation.

- How to Personalize It: Replace “save you money” with a precise statistic (e.g., “an average of $350 a year”) or use their neighborhood if you know local prices.

- Best Use: Initial cold calls, inbound call follow-ups, or lead-in emails.

Follow-Up With a Lead

- Script: “Just following up on our previous discussion. Did you get a chance to compare the estimate we went over? I’d be glad to take you through your choices again.”

- Why It Works: This home insurance script demonstrates persistence without pressure. Follow-up with empathy and assistance establishes rapport—crucial in long sales cycles.

- How to Personalize It: Refer to the exact quote value or distinctive detail from your previous conversation: “the waterfront policy,” “your new kitchen renovation,” etc.

- Best Use: Utilize this through phone or email 2–5 days after the first quote or when a lead has fallen silent.

Follow-ups build consistency and trust, key traits valued by consumers according to Forbes.

Quoting Coverage Script

- Script: “Given the size and location of your home, here’s what I think is best: a $300,000 dwelling coverage, $100,000 liability, and a $1,000 deductible. Let me break down what each means for your protection.”

- Why It Works: Simplifying coverage numbers into everyday language demonstrates openness and honesty. Consumers don’t need jargon—they need simplicity.

- How to Personalize It: Specifically state risks for their area (floods, wildfires, etc.) or connect the policy information to real-world situations such as roof replacement or theft.

- Best Use: When reviewing quotes in person or on Zoom during consultations or policy explanations.

Handling Objections Script

- Script: “I get that price is a concern. But would you object if I demonstrate how this plan really guards you against the largest risks—and how lower-cost plans may exclude them?”

- Why It Works: This home insurance script follows a consultative sales strategy. Rather than disputing, it frames a conversation between value and price, restoring attention to protection.

- Inquire what’s most important to them—”Do you think more about flooding or liability?” Then make the explanation responsive to those interests.

- Best Use: When a client compares your policy to a less expensive competitor or exhibits price resistance.

This approach, taught in HubSpot’s sales training, encourages a value-first mindset.

Closing the Deal Script

- Script: “Excellent! All I require now is your authorization to send over the policy and have you up and running with coverage today. You’ll be receiving your electronic copy in minutes.”

- Why It Works: This home insurance script is concise, actionable, and assertive. It makes the next step simple and takes friction out of the buying process.

- How to Personalize It: Offer to go over the policy together after sending, or include a thank-you gift such as a complimentary home safety checklist.

- Best Use: End of a successful call or meeting when the customer is ready to close.

Final Tip

Regardless of which home insurance script you follow, always listen first. Wonderful scripts are not rigid, but rather flexible. Adapt your tone, pace, and content according to the customer’s personality and issues—and you’ll convert leads into loyal clients.

Tips to Customize Your Home Insurance Script

A well-crafted home insurance script is only as good as your ability to customize it to each client’s individual requirements. Personalization is not only a nicety—it’s a tested means of establishing trust, getting around objections, and boosting conversions.

Here’s how to dial it in for greater success:

Differentiate by Client Type

New homeowners and experienced property owners have very different worries.

- Newcomers can get intimidated. Educate, defining terms such as “deductible” and “liability” in straightforward terms. Ease their minds:

- “Because you’re a first-time homeowner, I’ll guide you through every step so everything doesn’t seem confusing.”

- Regular buyers may be shopping around for providers or for improved rates. Emphasize value-added features or how your policy complements gaps:

- “In contrast to many policies, ours comes with flood endorsements specific to your zone.”

Personalizing your home insurance script based on the level of experience with the buyer helps establish credibility and trust.

Address Regional Risk Factors

Homeowners in various locations are exposed to various threats. Utilize geographically specific terminology to make your proposal sound topical and timely.

- For wildfire-affected areas:

- “This policy offers extended replacement cost for losses related to wildfires—something critical to your area of California.”

- For flood-prone areas:

- Since you are near a floodplain, I would suggest throwing federal flood coverage on top of your base policy.”

A home insurance script adapted to their habitat—and concerns—illuminates your comprehension, as well as compassion.

Match the Emotional Tone

Everyone reacts in diverse ways by nature and frame of mind. Hear them out actively and resonate the tone properly:

- When a customer sounds panicky or lost, answer warmly and reassuringly

- “I totally get it—insurance jargon is tricky. Let’s walk through it together step by step.”

- If the customer is blunt and businesslike, make it direct and to the point:

- “Here’s what’s most important for your property. We can have this done today if you’re ready.”

Reading emotional nuances and matching tone makes the interaction sound personal, not rehearsed.

Use Tools to Refine Messaging

To have your home insurance script sound natural and concise:

- Use writing tools such as Grammarly Business to keep tone and professionalism.

- Experiment with sales enablement tools such as HubSpot or Outreach to A/B test iterations of your pitch.

- Record and listen to calls to determine what works best with various client profiles.

These tools assist you in refining your script based on actual performance data, not intuition.

Final Thought:

Customizing your home insurance script isn’t about rewriting the whole thing—it’s about tweaking the delivery. A small change in tone, timing, or emphasis can turn a generic sales pitch into a meaningful client connection.

Let me know if you want script templates for specific customer profiles (e.g., flood-prone areas or senior homeowners), or if you’d like an infographic-style summary of this section!

Mistakes to Avoid in Home Insurance Scripts

Even an excellent home insurance script can bomb if it’s spoken the wrong way. Steer clear of these pitfalls that can transform interested prospects into lost prospects:

Sounding Robotic

Reading from a script verbatim with no feeling or inflection makes you sound detached and untrustworthy.

Fix: Practice your script to the point that it becomes second nature. Incorporate pauses, changes in tone, and everyday language to sound human, not read-from-a-script.

Using Too Much Jargon

Jargon such as “dwelling extension,” “endorsements,” or “actual cash value” can intimidate or confuse customers.

Solution: Speak in plain, understandable language. Substitute technical jargon with actual examples, such as “this protects your roof during a storm, even after wear and tear.”

Overlooking Client Cues

If you’re too busy reading from the script, you may overlook cues from your prospect—such as hesitation, confusion, or excitement.

Correct: Listen actively. Modulate your speed, rephrase your explanations, and pose clarifying questions. Excellent scripts facilitate, not control, the dialogue.

Last Tip: Flexibility Wins

Scripts are launching pads—not hard and fast rules. Utilize them as a springboard but be prepared to adjust in the moment.

Natural conversations trump stiff ones every time.

Tools & Resources for Building Better Scripts

Want to improve your home insurance team? These apps can assist you in developing, testing, and perfecting scripts for improved customer results and training your team:

Salesforce CRM

A robust software for saving and tailoring scripts according to lead type, history of calls, and client information. It aids agents in speedy access to the correct home insurance script for the call.

CallHippo

Provides call tracking, analytics, and real-time insights into script performance. Perfect for A/B testing varying versions of your pitches and refining script delivery.

Gong.io

Artificial intelligence-based software that analyzes sales calls and indicates what is effective. Gong is able to identify winning phrases, patterns of objections, and closing cues to refine your home insurance script approach.

These resources aren’t exclusive to large teams—they’re just as helpful for individual agents who want to scale their outreach and increase conversion rates.

Conclusion: Mastering the Art of Home Insurance Scripts

Mastering your home insurance script is not about memorization—it’s about relationship-building, real-world problem-solving, and bringing peace of mind to every homeowner you interact with.

The proper script enables you to take customers through tough decisions confidently and clearly. It assists you in:

- Beginning with ease.

- Smoothing objections.

- Describing coverage smoothly.

- Closing deals with credibility and professionalism..

If you’re a new agent learning the ropes or an experienced pro honing your style, utilize the tried-and-tested home insurance scripts, advice, and tools to hone your conversation and take your sales to the next level.

Because when your words work, your results follow.

Read: Smart & Proven Mobile Home Park Insurance That Saves You Thousands

What is the best way to start a home insurance script?

Start with a warm greeting and a value-oriented question, like “Are you open to reviewing your current coverage for better protection?”

Can the same script work for all clients?

Not always. It’s best to customize your home insurance script based on client type, location, and concerns.

How often should I update my home insurance script?

Review your scripts quarterly to match industry updates, compliance needs, and client feedback.

What if a client goes off-script?

Stay flexible. Use the script as a guide, not a rulebook. Prioritize listening and responding naturally.

How do I make my home insurance script sound natural?

Practice reading it out loud and adapt the tone to your speaking style. The goal is to make your home insurance script feel like a conversation, not a monologue.

Should I memorize my home insurance script?

It’s better to memorize the key points rather than every word. Use the home insurance script as a flexible guide so you can respond authentically in real time.

Can a home insurance script be used in emails or chats?

Yes! You can adapt your home insurance script for email or live chat formats—just make sure it’s concise, friendly, and easy to scan.

How long should a home insurance script be?

Ideally, a home insurance script should be 1–2 minutes long for initial calls. Keep it brief but comprehensive enough to build trust and gather essential info.

What’s the best way to train new agents using a home insurance script?

Combine role-playing sessions with real-world call analysis. Encourage new agents to internalize the home insurance script structure and adjust based on customer responses.

One Comment