Home Insurance Construction Type: 10 Important Facts

Home insurance construction type is a critical component that significantly affects your insurance rates, coverage types, and long-term property safeguard. The type of materials and methods applied in constructing your home dictate how well your home can resist common perils like natural disasters, fires, wind damage, and other risks. Therefore, insurers carefully consider your type of construction prior to writing coverage, which can significantly influence the price, terms, and availability of your policy. Your house being constructed of wood framing, solid brick, or reinforced concrete creates a unique risk exposure in the view of your insurer.

Knowing the subtleties of construction types—frame, masonry, or joisted masonry—is important for homeowners who want to ensure they receive maximum protection at an affordable cost. Most individuals under-appreciated the effect that construction classification has on replacement costs, premium rebates, and even policy eligibility. This article considers seven important facts about home insurance construction type that most individuals do not pay attention to. These observations will enable you to make wiser choices, prevent pitfalls, and possibly lower your house insurance costs using astute planning and precise documentation.

(Source: Clovered.com)

Table of Contents

1. Construction Type Directly Influences Insurance Premiums

Frame vs. Masonry: Understanding the Basics:

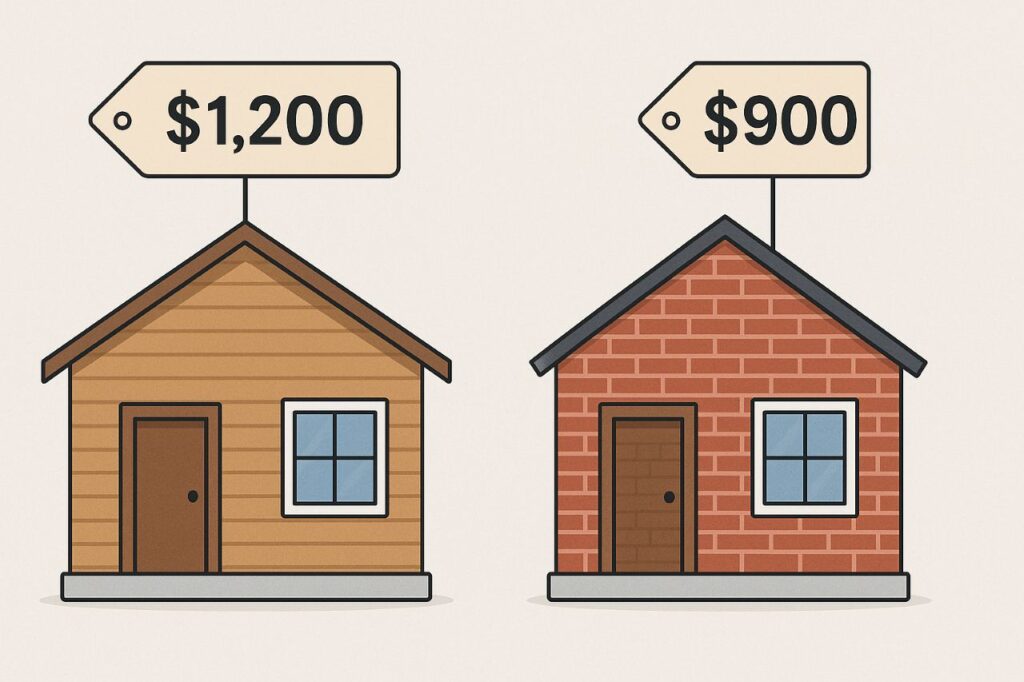

The most critical but underappreciated aspect of what determines your premium is the construction type of your home insurance. Insurers analyze the risk involved in the manner in which your house is constructed to estimate the possibility and expense of future claims. Wood-frame homes are generally less expensive to construct, but they are also riskier—particularly for fire, termites, and wind damage. The higher exposure often results in increased premiums for frame homes.

(Insurance | Clovered.com | OKFB Insurance)

Conversely, masonry houses—buildings constructed of brick, stone, or concrete blocks—are typically more resilient in the face of natural perils. These buildings promote greater resistance to windstorms and fire, which qualifies them for a lesser risk from an insurer’s viewpoint. Therefore, masonry building types tend to become eligible for reduced insurance rates, particularly in high-risk zones such as coastal or wildfire areas.

Key differences:

- Frame Homes:

- Built mostly with wood.

- High fire and wind hazard.

- Generally more costly to insure.

- Masonry Homes:

- Constructed using brick, stone, or concrete.

- More resistant to disasters and long-lasting.

- Can often qualify for premium rebates.

Joisted Masonry: A Middle Ground:

Between frame and full masonry is the classification joisted masonry. With this type of home insurance construction, walls consist of noncombustible material (such as concrete or brick), but floors and roof are framed by combustible wood joists. This combination structure offers middle-level fire and wind protection and is cheaper than full masonry construction.

Due to its mixture of materials, joisted masonry is generally middle-priced in regards to insurance premiums. It’s an urban favorite and provides insurers with a balanced risk profile. But classification matters—falsely reporting your construction type might overstate your premium or leave you uncovered in the event of a disaster.

(Clovered.com)

Insurance Management Tips by Construction Type:

- Request discounts offered for masonry or fire-resistant construction from your insurer.

- Utilize construction-type-specific endorsements if you are replacing materials.

- Make sure precise documentation in the event of renovating or reconstructing sections of your home.

2. Accurate Classification Prevents Coverage Issues

Importance of Correct Construction Type:

Properly determining your home’s construction type for insurance purposes is not merely a technicality—it has a direct bearing on your access to proper coverage and equitable premium charges. If your insurance company classifies your home as a more risk-prone construction type (e.g., frame rather than masonry), you may pay too much for insurance or collect smaller settlements when you file a claim. Such a mismatch is more prevalent than many homeowners know.

(Policygenius | Clovered.com | Reddit)

Incorrect classification also places you in danger of claim denial. Think about filing for repairs due to fire damage only to find that your insurer has made a different construction assumption and consequently denies coverage for part of your claim. That’s why making your insurer aware of your home’s actual construction is important.

Common Mistakes to Avoid:

- Assuming wood panel exteriors are masonry.

- Failure to notify your insurer following renovations.

- Sticking with merely older policy documents.

How to Verify Your Home’s Construction Type:

To be properly covered, take a moment and verify your home’s construction type and make sure it is accurately noted in your policy.

Steps to Complete:

- Check Architectural Plans:

- Your original blueprints or architectural plans will specify the very materials used.

- Engage a Licensed Inspector:

- A home inspector or structural engineer can inspect your home’s construction and send written verification.

- Request a Policy Review:

- Call your insurer and request a copy of the Declarations Page to check how your type of construction is noted.

Pro Tip: If you just bought a home, compare the seller’s disclosure and the appraisal report to ensure consistency in construction type. This will ensure your home insurance construction type is correctly noted from the beginning.

3. Construction Materials Affect Disaster Resilience

Impact on Natural Disaster Protection:

Your home construction type under insurance is also critical in ascertaining how resilient your home would be in the face of natural disasters such as hurricanes, wildfires, and earthquakes. Some materials—such as concrete blocks, brick, and reinforced steel—are more protective compared to the conventional wood framing, which is highly susceptible to fire and wind destruction. Insurers consequently provide lower premiums for homes constructed with disaster-resistance materials.

(FEMA.gov | AP News | Clovered.com)

For instance, in hurricane-risk regions such as Florida or the Gulf Coast, houses that are made of masonry or concrete blocks tend to be preferred by insurers. They are less susceptible to complete loss, which is less of a risk for insurers and keeps your rates down.

Disaster Resilient Construction Types:

- Masonry Non-Combustible: Brick or stone houses that resist high wind and fire.

- Superior Construction: Steel frame, poured concrete, or ICF (Insulated Concrete Forms).

- FORTIFIED Homes™: Certified to perform better than building codes in storms and high winds.

Benefits of Choosing Resilient Materials:

Spending extra on more resilient construction benefits not only your home’s longevity but also earns you possible disaster-related discounts.

Top Benefits:

- Lower Premiums: Less risk = lower cost.

- Fewer Claims: Less damage = fewer insurance hassles.

- Peace of Mind: Increased protection during severe weather conditions.

Pro Tip: Think about retrofitting older houses with hurricane straps, fire-resistant siding, or impact-resistant roofs to enhance their rating—and their insurability. Your house construction type for home insurance might be upgraded after assessment, resulting in potential savings.

4. Construction Type Influences Replacement Costs

Understanding Replacement Cost and Its Link to Construction:

Replacement cost is among the most vital considerations in any home insurance policy, and your home insurance construction type directly contributes to its determination. Replacement cost is how much it would cost to reconstruct your house with equivalent materials and labor in the current market—not what you paid for it initially or its current market value.

(ValuePenguin | Policygenius | Clovered.com)

Houses constructed with premium materials—wood, brick, or steel—will be more expensive to rebuild or fix in case of a disaster. Therefore, their insurance premium and coverage limits are normally higher. On the other hand, houses made from low-cost materials like wood frames may be less costly to replace but are also most susceptible to damage.

Real-World Example:

A 2,000 sq ft brick house could cost $300,000 to replace, while a comparable wood-frame home might only take $250,000—but the brick house might have more disaster resistance, offsetting the extra price with long-term savings.

Tips to Manage and Estimate Replacement Costs:

Having your coverage equal your home’s actual rebuilding value is key to avoiding surprise costs.

What You Can Do:

- Arrange a Professional Appraisal:

- Work with a professional appraiser to get your home’s rebuild value as of now.

- Use Your Insurer’s Replacement Calculator:

- The majority of insurers provide replacement cost estimation tools based on home insurance construction type, square footage, location, and amenities.

- Reevaluate After Renovations:

- Any major improvements such as kitchen remodeling or roof replacement should trigger a policy review.

Quick Tips:

- Don’t try to save on premiums by under-insuring—just might leave you short-protected.

- Inquire of your insurer whether you are eligible for extended or guaranteed replacement cost coverage.

- Check your policy once a year to ensure inflation and material price movement values are updated.

Tip: Minor wrong estimation in replacement cost may result in gaps of thousands of dollars. Always include your home insurance construction type for an accurate and equitable policy.

5. Building Codes and Standards Matter

Compliance Affects Insurance Rates and Coverage:

Another frequently underappreciated fact regarding home insurance construction type is how it can play into local building codes and standards. Houses constructed to or better than current safety standards are usually more durable, which lessens risk for insurers. Consequently, insurance firms routinely reward these houses with lower premiums or expanded coverage options.

(Farmers Insurance | NAIC | Clovered.com)

For example, a house in a region subject to hurricanes that meets newer wind-resistance building codes will be less prone to damage in the event of a storm. This tracks directly to your home’s construction type in your home insurance policy, since adherence typically means greater, safer materials and building techniques.

Examples of Code-Driven Upgrades:

- Roof straps or clips.

- Impact-resistant doors and windows.

- Fire-resistant siding or roofing.

- Higher foundations in flood areas.

Advantages of Following Current Building Standards:

Compliance with local or upgraded building codes provides not only physical protection—but financial benefits as well through your home insurance.

Key Benefits:

- Lower Premiums: Safer homes equal less risk for insurers.

- Quicker Claim Approvals: Code-compliant homes are simpler to assess and repair.

- Improved Resale Value: Buyers prefer up-to-date-code homes, particularly in regions prone to disasters.

Pro Tip: If you’re building or renovating, ask your contractor to follow the latest building codes and mention this to your insurance provider. Your home insurance construction type classification might improve, leading to lower long-term costs.

6. Renovations Can Alter Construction Classification

Impact of Home Improvements on Insurance Type:

One of the most significant things that homeowners underestimate is how renovations can influence their home insurance construction classification. If you’ve installed a brick veneer, upgraded from shingles to a metal roof, or swapped wooden siding for fireproofing materials, your home might now fit into a different (and perhaps less expensive) insurance classification.

(Clovered.com | Hippo Insurance | Policygenius)

However, if your insurer is not notified, they’ll keep on charging you according to the old structure type. It can result in you either overpaying or not being adequately covered.

Real Scenario: A Colorado homeowner renovated their wood-frame house by adding fire-resistant cement board siding. Their insurer failed to update the classification, and a wildfire claim was underpaid according to the previous frame-home risk profile.

Steps to Ensure Proper Classification After Renovations:

Updating your insurer after major work is crucial—not only for saving money but also for protection.

What to Do:

- Notify Your Insurer Right Away:

- Exterior wall, roof, or structure changes must be notified.

- Request an Inspection Again:

- Some insurers provide free inspections to reclassify the construction type of your home after improvements.

- Keep All Records:

- Retain receipts, contractor information, and before/after pictures to confirm the type of work done.

Major Renovations That Can Trigger Reclassification:

- From wood to brick or stone.

- Replacing a new roof with impact-resistant material.

- Strengthening walls or foundation with concrete.

- Converting a garage or constructing a new room using other materials.

Pro Tip: Even cosmetic upgrades can change your risk profile. Always double-check with your insurer if these changes update your home insurance construction type—it could open new savings or improved protection.

7. Geographic Location Interacts with Home Insurance Construction Type

Regional Risks and Their Influence on Construction Type:

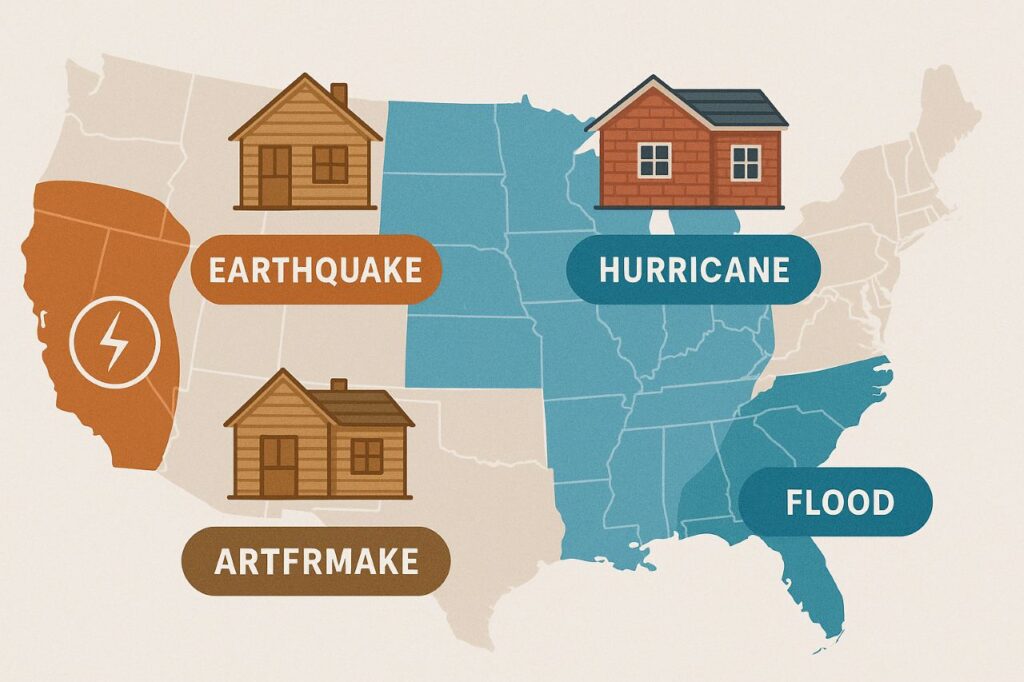

Your home insurance construction type can be either very effective or highly ineffective based on your geographic location. What is best in one area is a liability in another. Masonry houses, for instance, are effective in hurricane territory such as Florida because of their wind resistance but will crack from the seismic pressure in earthquake areas such as California.

(FEMA) (Bankrate) (Clovered.com)

Insurers weigh regional perils against their underwriting significantly. A house in a wildfire state constructed out of fireproof material could see high premium reductions, but the same house in a floodplain would likely require additional coverage irrespective of construction.

Actual Example: In California, numerous homes that were originally constructed with unreinforced masonry still need to be retrofit because of earthquake risk—despite being technically more resistant to fire.

Tailoring Construction to Fit Your Region:

Choosing the most suitable materials and methods according to your region can significantly enhance your insurability and safety in the long run.

Regional Construction Adapters:

- Seismic Zones: Employ flexible materials such as wood framing or retrofit masonry with steel bracing

- Hurricane Zones: Employ concrete block construction and impact-rated windows

- Fire-Danger Zones: Employ cement board siding, metal roofing, and enclosed eaves

- Flood Zones: Raise foundations and employ water-resistant materials on lower floors

Fast Tips:

- Discuss area-specific risks with local insurers and contractors.

- Utilize FEMA flood maps and seismic zone handbooks when selecting materials.

- Ask your insurance company for regional hazard discounts.

Pro Tip: Always match your home insurance construction style with the natural hazards of your region. This strategic move not only enhances your safety, but can lower your premiums substantially.

8. Insurance Discounts Are Often Tied to Construction Type

How Home Insurance Construction Type Unlocks Savings:

Most homeowners are not aware that the construction type for their home can earn them substantial discounts. Insurers tend to give lower premiums for houses made with fire-resistant, wind-resistant, or non-flammable materials since they are less of a risk.

(Insurance.com | Clovered.com)

For example, masonry fire-resistant houses can be given discounts in areas where fires are common, and houses with impact-resistant roofs can be given premium discounts in storm-prone areas. The discounts are included in the insurer’s risk-reduction approach.

Potential Discount Categories:

- Fire-Resistant Construction (example: concrete or metal roofs).

- Hurricane-Proof Materials (example: ICF walls, impact windows).

- Green Building Materials (low-risk, eco-friendly homes).

How to Avail These Discounts:

- Inquire of your insurer whether your home insurance construction type is eligible for material-based or safety-related discounts.

- Provide documentation or certifications from builders or inspectors.

- Opt to retrofit to discount-eligible standards.

Pro Tip: An easy construction upgrade such as the replacement of a wood roof with a Class A fire-resistant roof may reduce your annual premium by hundreds of dollars.

9. Insurance Providers May Classify the Same Home Differently- Home Insurance Construction Type

Why Classification Isn’t Always Consistent:

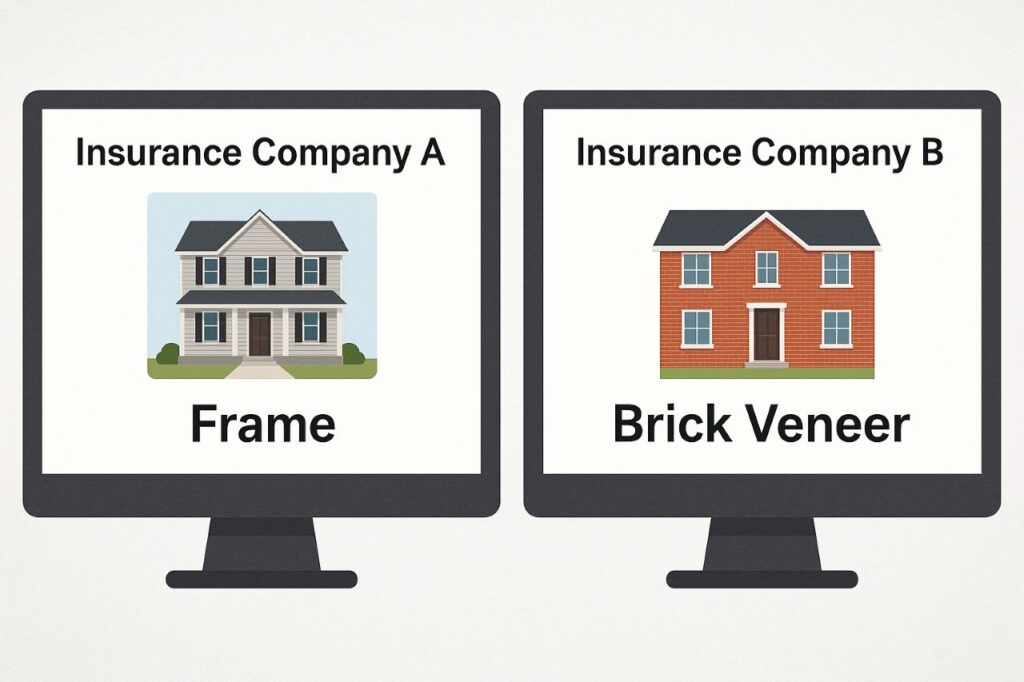

Did you know that two separate insurers may categorize the same house into different home insurance construction types? This can result in extremely different quotes for the identical building. The reason is that every insurance company has its own underwriting guidelines and risk assessment tools.

(Forbes Advisor | Policygenius)

One insurer will categorize your home as frame according to its wooden roof and floors, while another will categorize the same home as joisted masonry because its exterior walls are made of concrete.

What You Can Do:

Gather quotes from at least two different insurers and see what each classifies your home insurance construction type

- Request a written explanation of how your construction type affects your premium.

- Supply clear documentation (photos, materials list, inspections) for proper classification.

Pro Tip: Next time you’re comparing quotes, have the agent precisely explain to you how they classify your home’s construction class—it can clarify huge price disparities.

10. Outdated Records Can Cost You Money

The Risk of Using Old or Inaccurate Information:

If your Home Insurance Construction Type is basing their records on old data—such as a 20-year-old property appraisal or outdated appraiser reports—your home construction type may not accurately represent the current condition. Particularly after the flip, remodel, or code upgrade of a home.

(NAIC.org | Hippo.com)

Even minor updates such as updating vinyl siding with fiber cement or the roof can change your home’s risk class and impact premiums.

Updating Your Info:

- Request a full policy review every 1–2 years.

- Keep receipts and renovation permits as proof of material changes.

- Ask your insurer for a reclassification inspection if you’ve made upgrades.

Pro Tip: Updating your Home Insurance Construction Type with accurate, recent data is one of the easiest ways to reduce premiums and improve coverage.

Final Thoughts: Home Insurance Construction Type

Knowing the nuances of home insurance construction type is essential for homeowners who want to get proper coverage and effectively control insurance expenses. Starting from what materials are used for construction to local considerations, every element contributes to your insurance premiums and level of cover.

By remaining educated and proactive—checking your home’s classification, complying with building codes, and adapting construction decisions to your area—you can maximize insurance coverage. Meet with insurance experts to review your existing policy and weigh options for savings and increased protection.

Also Read: Bankwest Home Insurance: 7 Eye-Opening Reasons It’s Worth It in 2025

Frequently Asked Questions (FAQs)

What does home insurance construction type mean?

Home insurance construction type refers to the materials and structural methods used to build your home, such as wood frame, masonry, or joisted masonry. Insurance companies use this classification to assess the risk of damage from fire, weather, and other hazards when determining your premium and coverage options.

Why does my home insurance construction type affect my premiums?

Different construction types carry different risk levels. For example, frame homes are more susceptible to fire and storm damage, resulting in higher premiums. Masonry or reinforced homes are more resilient, often qualifying for lower rates. Your home insurance construction type directly influences how much you’ll pay for coverage.

How can I find out my home insurance construction type?

You can determine your home insurance construction type by reviewing your building plans, hiring a home inspector, or contacting your insurance provider. It’s crucial that your policy accurately reflects your home’s construction type to avoid overpaying or facing claim issues.

Can renovations change my home insurance construction type?

Yes. If you upgrade materials (e.g., from wood siding to brick), your home insurance construction type may change. Always notify your insurer after major renovations to ensure proper classification and accurate coverage.

Is one home insurance construction type better than the others?

There’s no universally “best” construction type—it depends on your location and risk factors. Masonry might be ideal in hurricane zones, while frame construction may be better in earthquake-prone areas. The key is choosing a home insurance construction type that balances safety, cost, and insurability for your region.

Can choosing the wrong home insurance construction type affect my claim?

Yes. Misclassifying your home insurance construction type can lead to claim delays or even denials. For example, if your policy lists your home as masonry but it’s actually frame, you may receive less coverage than needed after a loss.

One Comment