Home Insurance Claim Adjuster Secret Tactics: 5 Tricks

Home Insurance Claim Adjuster Secret Tactics are usually the unobvious moves that can break or make your settlement. Whether you’re submitting for storm damage, fire, theft, or water penetration, adjusters tend to employ tactful tactics to limit the insurer’s obligation—leaving homeowners shortchanged or not paid at all for valid claims.

Understanding these adjuster tactics gives you the upper hand. By learning how they evaluate damage, question evidence, or leverage policy language, you can better prepare, advocate, and maximize your claim. This article uncovers the most common Home Insurance Claim Adjuster Secret Tactics, providing real-life examples and actionable tips so you can spot red flags, avoid pitfalls, and secure a fair settlement.

Table of Contents

1. The Underestimation Tactic: Home Insurance Claim Adjuster Secret Tactics

One of the most common home insurance claim adjuster secret tactics is underestimation—a subtle but powerful way insurers minimize their payouts. The adjuster’s role might appear helpful on the surface, but behind the scenes, the focus is often on protecting the insurance company’s bottom line. This tactic involves presenting you with a settlement offer that is significantly lower than the actual cost of repairs. Unless you’re well-prepared and vigilant, you might unknowingly leave thousands of dollars on the table.

Let’s look at the three main ways this tactic is applied and how you can defend against it.

Lowball First Offers:

One of the oldest home insurance claim adjuster secret tactics is to issue a lowball offer—typically presented as a fast solution to your problem. Adjusters bank on your emotional vulnerability, especially after damage from storms, fires, or water leaks. The initial offer may not even cover the full scope of the repair work. However, many homeowners accept it out of convenience or lack of knowledge.

Real Example: According to Consumer Reports, a homeowner in Texas was offered just $3,000 to repair major water damage. After consulting with licensed contractors, the actual repair cost was nearly $8,500. The homeowner eventually negotiated a higher payout after challenging the original estimate with proper documentation.

Tips to Avoid Lowball Offers:

- Get 2–3 independent estimates from licensed contractors.

- Ask for a line-item breakdown of the insurer’s cost calculations.

- Don’t accept verbal promises; request everything in writing.

By being proactive, you avoid falling victim to one of the most frequently used home insurance claim adjuster secret tactics.

Depreciation Tactics: Home Insurance Claim Adjuster Secret Tactics

Another way adjusters minimize your claim is through strategic depreciation. While some depreciation is expected (especially for older items), unethical adjusters may inflate depreciation values to reduce payout amounts significantly.

For example, let’s say your 8-year-old roof is damaged. An adjuster may claim it has zero value left, even if it’s in good condition. This is a clear misuse of the actual cash value (ACV) principle. However, many policies also include replacement cost value (RCV)—which should reimburse you for the cost of replacing the item at current market rates, not its depreciated value.

According to the National Association of Insurance Commissioners (NAIC), understanding your policy type—ACV vs. RCV—can significantly impact your final payout. Most homeowners are unaware that these differences could cost them thousands.

How to Counter Depreciation Tactics:

- Take dated photos and record maintenance history to prove the usable condition of items.

- Confirm whether your policy is ACV or RCV-based.

- Challenge excessive depreciation with data from recent purchase receipts or contractor input.

This tactic is often buried in the fine print—another reason why knowledge of home insurance claim adjuster secret tactics can save you from unfair reductions.

Inflated Overhead & Profit Cuts:

While legitimate estimates include contractor overhead and profit (O&P) charges—typically around 10% each—adjusters may attempt to reduce or eliminate these costs, especially if you’re not using an insurer-approved contractor. This can significantly reduce your total payout.

Some adjusters argue that O&P isn’t applicable unless you use a general contractor for multiple trades (e.g., roofer, plumber, electrician). However, many states allow O&P even for single-trade jobs, as long as coordination or management is involved.

In a detailed report by United Policyholders, a nonprofit advocating for insurance consumers, O&P denial is one of the most underreported home insurance claim adjuster secret tactics. The report highlights how claimants can demand fair contractor compensation with industry-standard estimates (e.g., Xactimate software printouts).

Best Practices:

- Insist on contractor estimates that clearly include O&P.

- Ask your adjuster for the written basis of any O&P denial.

- Submit state guidelines or legal precedents if applicable.

Understanding how these figures are manipulated helps you fight back with facts—especially when you’re armed with the knowledge of home insurance claim adjuster secret tactics that insurers hope you’ll ignore.

2. The Scope Creep Diversion: Home Insurance Claim Adjuster Secret Tactics

Among the more subtle home insurance claim adjuster secret tactics is a strategy called scope creep diversion. This involves quietly altering or narrowing the scope of your damage report or coverage without your full awareness. Adjusters may ask for endless documents, suggest in-house inspections only, or reframe the damage cause—pushing you to accept a limited version of your claim.

These tactics are especially effective when homeowners are unfamiliar with policy terms or the standard claims process. Here’s how adjusters implement scope creep, and how you can defend against it effectively.

Asking for Extraneous Details:

One method adjusters use to delay or devalue a claim is repeatedly asking for non-essential documents. This gives the illusion of thoroughness while creating administrative fatigue—hoping you’ll eventually give up or settle for less.

For example, homeowners have reported being asked for maintenance logs from years prior, irrelevant security system history, or even HVAC servicing dates after fire damage—none of which are required under most standard homeowner policies.

According to Insurance.com, unnecessary documentation requests are one of the most common delay tactics used to wear down claimants.

How to Respond:

- Ask the adjuster to list only the necessary documents in writing.

- Keep a timeline of submissions and follow up with polite but firm reminders.

- Push back on unreasonable or unrelated requests by citing policy terms.

Staying focused helps you avoid wasting time on distractions—one of the key defenses against home insurance claim adjuster secret tactics.

Claim Scope Reduction:

Adjusters may deliberately interpret the damage as less severe or more isolated than it is. For instance, if your roof leaks into the wall and floors, they might only approve repairs for the roof—claiming the rest is pre-existing or unrelated.

This selective acknowledgment of damage, often without comprehensive inspections, is a common tactic to reduce payout liability.

Real Case: A homeowner in Florida filed for hurricane damage, including roof, attic insulation, and drywall. The adjuster only approved the roof repair. After bringing in a licensed public adjuster, the claim expanded to include water-damaged insulation and flooring—adding $11,000 more to the payout.

How to Protect Your Full Claim:

- Use a detailed scope of work from an independent inspector.

- Take clear photos of all damage, no matter how minor.

- Ask the adjuster to write down each item damaged.

Taking proactive steps with documentation eliminates this common home insurance claim secret of the adjuster.

How to Incite Internal Estimates: Home Insurance Claim Adjuster Secret Tactics

Most adjusters encourage the use of contractors approved by the insurer, saying it expedites things. However these contractors may have preset pricing structures that work for the insurance company and not for you.

While not all in-network contractors are unethical, relying solely on their assessments can lead to underreported or undervalued damage.

According to Forbes Advisor, homeowners have every right to hire their own contractor—and doing so can improve repair quality and claim accuracy.

Smart Tips:

- Always get an independent quote from a reputable local contractor.

- Compare it with the insurer’s estimate to spot discrepancies.

- Ask the adjuster if you’re allowed to choose your own contractor (you almost always are).

Choosing your own service provider is a critical safeguard against one of the more manipulative home insurance claim adjuster secret tactics—steering you toward cost-saving rather than quality solutions.

3. The Delay & Deny Play: Home Insurance Claim Adjuster Secret Tactics

Another one of the most frustrating home insurance claim adjuster secret tactics is the classic “delay and deny” strategy. The longer an adjuster drags out the process, the more desperate or tired you may become—especially when temporary housing, ongoing damage, or financial pressure is involved. The goal is simple: make you settle for less or give up entirely.

Let’s break down the specific delay tactics adjusters use, along with examples and effective countermeasures to help you stay in control.

Taking Too Long to Respond:

Time is not on the homeowner’s side after a disaster. Adjusters may take weeks to return calls, delay scheduling inspections, or “lose” submitted documents—resulting in unnecessary setbacks.

For instance, a policyholder in Louisiana reported that their flood damage claim went unanswered for over 30 days, delaying much-needed restoration work. According to FEMA guidelines, insurers are expected to respond within a reasonable period—often 14 calendar days.

Tips to Stay on Schedule:

- Keep a communication log with dates, names, and call summaries.

- Send follow-ups via email to create a paper trail.

- If delays exceed 15 days, escalate to a supervisor or your state insurance department.

Staying organized is your best defense against these slow-moving home insurance claim adjuster secret tactics.

Requesting Vague “Clarifications”:

Sometimes, adjusters prolong the claim by requesting additional “clarifications” that have already been addressed. They may cite missing information, unclear invoices, or request duplicate photos—all to buy time.

In one example from United Policyholders, a claimant was asked three times to resend the same inspection report due to “technical file issues.” Each request delayed processing by over a week.

Avoid the Loop:

- Ask for specific instructions on what’s unclear or missing.

- Reconfirm submission status with each new upload or email.

- Keep a checklist of documents already submitted and include it with future messages.

This helps prevent rework—a key step in neutralizing these common home insurance claim adjuster secret tactics.

Denial by Omission: Home Insurance Claim Adjuster Secret Tactics

Sometimes, adjusters deny a claim not based on the facts—but by citing minor procedural oversights, such as missed deadlines, incomplete forms, or unclear policy language.

For example, a homeowner in Arizona was denied a fire damage claim because the “proof of loss” form wasn’t submitted within the required 60 days—despite the fact they had communicated directly with the adjuster multiple times.

The Insurance Information Institute notes that while insurers are bound by timelines, so are policyholders. Knowing your responsibilities can keep you protected.

Best Practices:

- Review your policy’s claim filing timeline immediately after the incident.

- Request a written summary of requirements from your adjuster.

- Send time-sensitive items by email and certified mail to confirm delivery.

These procedural tactics are among the most powerful home insurance claim adjuster secret tactics—because they use your own actions (or inaction) to justify denial.

4. The Documentation Trap: Home Insurance Claim Adjuster Secret Tactics

One of the trickiest home insurance claim adjuster secret tactics involves challenging or discrediting your documentation. Adjusters know that most homeowners aren’t insurance experts—and they often use that to their advantage. They may question the validity of photos, receipts, or even contractor estimates to reduce or deny your claim.

If you’re unprepared, these tactics can catch you off guard. But with a solid paper trail and awareness of your rights, you can defend your claim with confidence.

Questioning Photo Credibility:

Even when you submit photos of the damage, adjusters might claim they’re too blurry, too dark, staged, or taken at the wrong time. This casts doubt on the severity or timing of the incident

For example, a homeowner in Illinois was told that their flood photos “lacked evidence of active damage,” even though they were taken within 48 hours. Without visible timestamps or context, the photos were dismissed as insufficient proof.

According to The Balance, including metadata like time and location in your photos increases their credibility significantly.

Smart Photo Tips:

- Use your smartphone’s timestamp and geolocation features.

- Take wide-angle shots, then zoom in for details.

- Photograph both the damage and surrounding unaffected areas for contrast.

This prevents adjusters from using one of the most common home insurance claim adjuster secret tactics—discrediting your visual evidence.

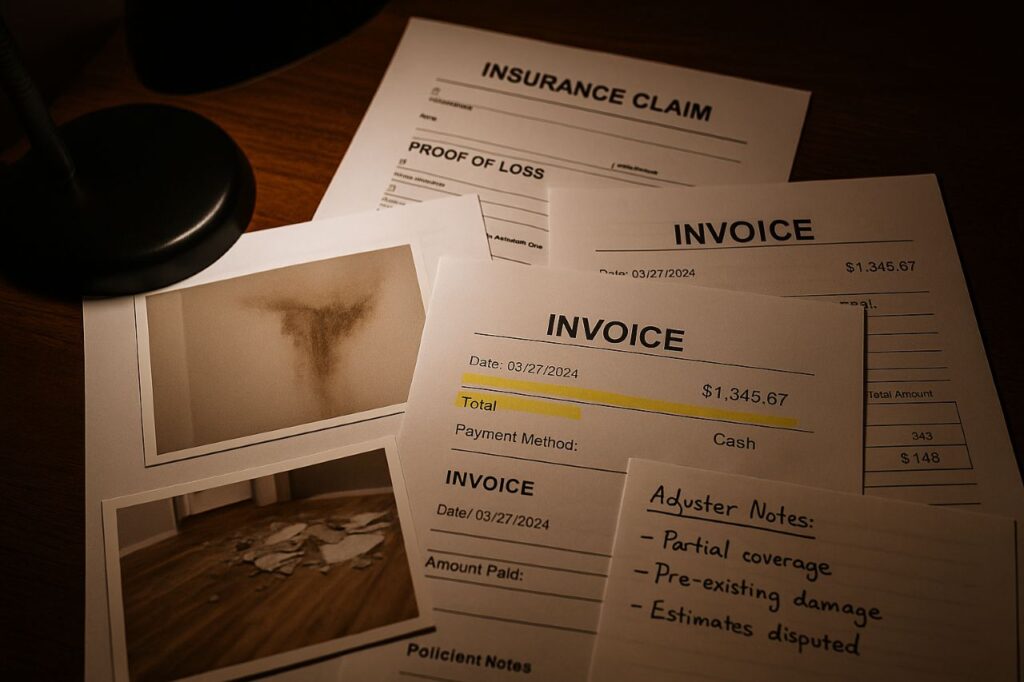

Disputing Receipts and Invoices:

Another tactic is to challenge the validity or necessity of expenses you’ve already paid for—especially emergency services like water extraction, boarding up windows, or hotel stays.

Adjusters may argue that:

- The repair cost was too high.

- The service was not pre-approved.

- The invoice lacks sufficient detail.

In one real case documented by Nolo, a homeowner’s emergency tarp service after a hailstorm was denied because it was done before the adjuster’s visit—despite the risk of further damage.

How to Strengthen Your Paper Trail:

- Get itemized invoices showing labor, materials, and hours.

- Keep credit card statements and canceled checks.

- Ask emergency contractors to include a reason for urgency on the invoice.

Proper documentation weakens this deceptive home insurance claim adjuster secret tactic designed to shave dollars off your reimbursement.

Depreciation Documentation:

Adjusters also apply depreciation unfairly when homeowners can’t provide strong proof of an item’s original value and condition. Without receipts or records, they may default to aggressive depreciation models.

This is especially problematic with big-ticket items like appliances, furniture, or HVAC units. A 6-year-old water heater might be depreciated by 75%, even if it had 5+ good years left.

According to Policygenius, insurers often use proprietary software to estimate depreciation—but you can challenge these values with real-world evidence.

To Counter Unfair Depreciation:

- Keep a home inventory with photos, model numbers, and receipts.

- Use manufacturer websites to verify estimated life spans.

- Ask for a written depreciation breakdown from your adjuster.

Documentation is your first line of defense against one of the most technical—but devastating—home insurance claim adjuster secret tactics.

5. The Policy-Language Leverage: Home Insurance Claim Adjuster Secret Tactics

One of the most manipulative home insurance claim adjuster secret tactics is the strategic use of policy language to minimize or deny your payout. Insurance policies are often filled with legal jargon, ambiguous phrases, and hidden exclusions—making it easy for adjusters to twist interpretations in favor of the insurer.

This section shows how policy fine print is being used by adjusters against you and how you can guard against misinterpretation or exploitation.

Emphasizing Fine Print Exclusions:

Adjusters are schooled to identify exclusion clauses—even hidden ones—to make claims invalid. Standard exclusions cover damage caused by mold, wear and tear, floods, or ground movement. The issue occurs when exclusions are applied in a sweeping manner or misleadingly to deny valid claims.

For example, a homeowner in California reported a roof leak due to heavy rain, but the claim was denied under an “ongoing maintenance” exclusion, even though the roof had passed inspection six months prior.

As Investopedia explains, it’s essential to understand all exclusions upfront so you’re not blindsided during the claim process.

Tips to Counter Misused Exclusions:

- Highlight ambiguous language and request clarification in writing.

- Ask the adjuster to cite specific pages and clauses.

- If in doubt, have a public adjuster or attorney review the denial.

Recognizing this policy loophole tactic helps you beat one of the more legalistic home insurance claim adjuster secret tactics.

Misclassifying Cause of Loss:

Another clever move is when adjusters misclassify the root cause of your damage to shift it into a non-covered category. For instance, they may label water damage from a burst pipe as “flood damage” to invoke a flood exclusion.

In one documented case from UPHelp.org, a claimant in Texas had a pipe burst during a freeze. The adjuster claimed it was due to “groundwater seepage,” which wasn’t covered—despite photos showing a ruptured pipe.

How to Challenge Misclassification:

- Take timely, detailed photos of the cause (e.g., burst pipe, damaged appliance).

- Request a written explanation for the assigned cause of loss.

- Consider hiring an independent inspector or contractor to provide their findings.

- Correctly identifying the cause is critical, and being aware of this tactic is key to outsmarting deceptive home insurance claim adjuster secret tactics.

Using Endorsement Gaps:

Endorsements (also called riders) modify your coverage, either expanding it or adding limits. Adjusters may exploit endorsement gaps—situations where coverage appears to exist, but fine print limits or changes it.

For example, a standard policy might include theft coverage, but an endorsement might cap payouts on jewelry at $1,500, even if you lost $6,000 worth during a burglary. Adjusters may avoid mentioning this limit until you file the claim.

As noted by The Zebra, reviewing endorsements during the buying process helps avoid surprises later—but most homeowners are unaware of them until too late.

Protect Yourself from Endorsement Loopholes:

- Review all endorsements and sub-limits before disaster strikes.

- If valuable items are at risk (e.g., jewelry, electronics), schedule them separately.

- Request a coverage explanation in writing before filing the claim.

Mastering the language of your policy helps neutralize this advanced home insurance claim adjuster secret tactic—ensuring you don’t fall victim to a fine-print trap.

Conclusion: Outsmarting Home Insurance Claim Adjuster Secret Tactics

Navigating a home insurance claim is stressful enough without falling prey to the many home insurance claim adjuster secret tactics designed to limit your payout. From lowball offers and vague documentation requests to cleverly misused policy language and strategic delays, adjusters are trained to protect the insurer’s financial interests—not yours.

But now you’re equipped. You’ve learned how to recognize scope reduction, misclassification of damage, unjust depreciation, and psychological pressure. You’ve also seen real examples and actionable tips to counter each move. Whether it’s taking timestamped photos, hiring your own contractor, or pushing back against unfair exclusions—knowledge is your most powerful tool.

Final Tips:

- Always document everything—photos, receipts, emails, and call logs.

- Don’t hesitate to challenge an adjuster’s interpretation.

- Consider hiring a public adjuster or legal expert if your claim feels unfairly handled.

Before you file or accept any settlement, download our free Home Claim Checklist, review your policy thoroughly, and empower yourself to take control of your claim. Don’t let secret tactics stand between you and the compensation you rightfully deserve.

Your home is your sanctuary—protect it by staying informed and assertive.

Also Read: Home Insurance Nezirova: 7 Powerful Reasons It’s Trusted by Families

Frequently Asked Questions (FAQs)

What are home insurance claim adjuster secret tactics?

These are strategies used by adjusters to reduce or deny your claim, such as lowball offers, delaying responses, or misinterpreting policy terms. They’re often subtle and legal, but can cost you thousands. Knowing these tactics helps you defend your rights and secure a fair payout.

Can I reject the first offer from the adjuster?

Yes, you’re not obligated to accept the first offer. It’s often lower than what you’re actually entitled to. Get independent repair estimates and negotiate with supporting documents.

What should I do if the adjuster delays my claim?

Keep a written record of all communications with dates and names. Follow up by email and escalate to supervisors if needed. You can also report delays to your state’s insurance commissioner.

How do I know if my policy covers full replacement or cash value?

Check your policy for “RCV” (Replacement Cost Value) or “ACV” (Actual Cash Value). RCV covers new replacements; ACV factors in depreciation.

Understanding this difference is key to calculating a fair claim amount.

Can I hire my own contractor or adjuster?

Yes, you can hire a licensed contractor and even a public adjuster. Your insurer might suggest their network, but it’s not mandatory. Independent experts help ensure you get an unbiased damage assessment.