Does Home Insurance Cover Oil Tank Leaks? Shocking Truth

Does your home insurance cover your oil tanks? This is an important question that many homeowners overlook. Oil leaks can cause serious environmental and property damage, which can be expensive and difficult to repair.

In many cases, the cover depends on that particular guideline and the cause of the leak. Without proper protection, adjustment and repair costs are overwhelming. If you understand the guidelines in advance, you can avoid expensive surprises.

Table of Contents

Understanding Oil Tank Leaks

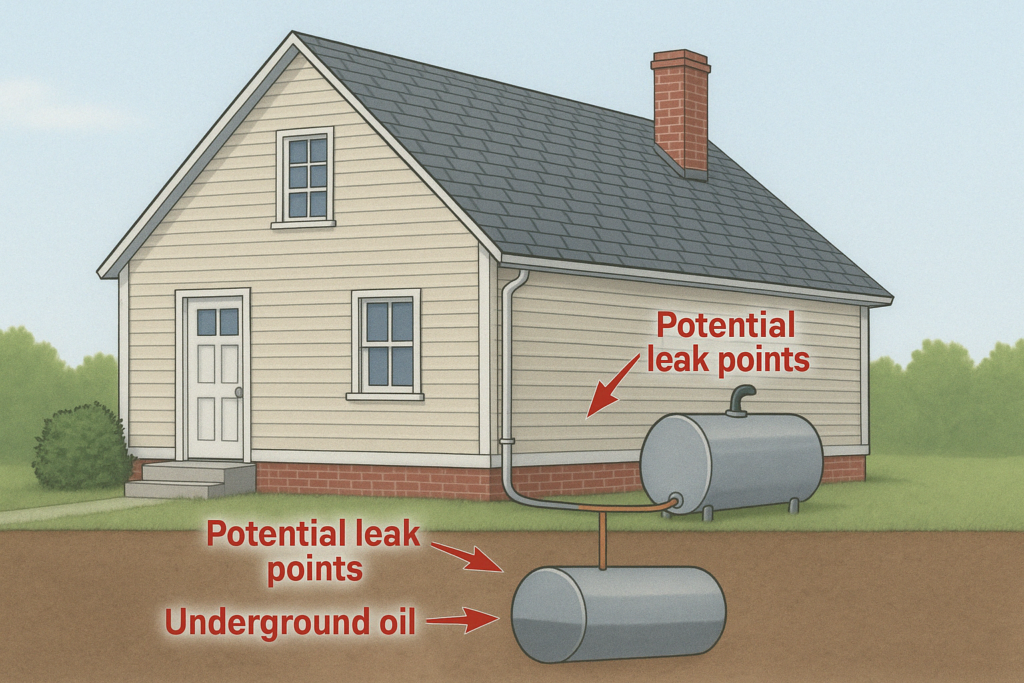

Oil tanks are more common than most homeowners would expect. These leaks can damage not only their property, but also their surrounding land and water supply. In many older or country homes that use heating based on oil, oil tanks remain a quiet threat hidden in the basement, backyard, or even underground.

What Causes Oil Tank Leaks?

Oil tankers can arise from a combination of environmental, mechanical and human factors. Recognizing the cause early can help prevent expensive damage and environmental hazards.

1. Corrosion

Corrosion is one of the most common causes of oil tanks. Over time, moisture and oxygen react with the metal, leading to the formation of rust. This process is particularly quick in older tanks or tanks exposed to different temperatures and humidity levels. As soon as the tank corrodes, small holes and cracks will form, allowing oil to escape slowly or suddenly.

2. Overfilling

Random overcrowding during oil delivery is another major cause. If the tank capacity is exceeded or the delivery process is not carefully monitored, the oil can exit the ventilation pipe or filler tube. These spots contaminate the surrounding soil and can represent a fire hazard if not addressed immediately.

3. Faulty fittings or piping

The tank is connected to a network of pipes and equipment that can wear over time. Cracks, loose connections, or degraded seals can lead to slow and persistent leaks. These types of leaks are particularly dangerous as they remain unnoticed for a long period of time and lead to considerable contamination.

4. Physical damage

Oil tanks are susceptible to physical damage from a variety of sources. Foundation shifts, soil movements, and even the effects of vehicles and heavy devices can cause structural damage. Underground tanks are particularly affected by changes in the pressure of the surrounding Earth, which can lead to references and cracks.

5. Aging

Oil tanks have a lifespan of 15-30 years. As age increases, materials decrease and the likelihood of failure increases. Old tanks made of thin steel or made without a protective coating are susceptible to leaks, especially when regular maintenance is ignored.

Types of Oil Tanks

Understanding the type of oil tank you have is essential for maintenance and leak prevention.

1. Above-Ground Oil Tanks

These are usually installed in outdoor spaces such as basements, supply rooms, or backyards. You can see them, so the rec is easy to see early. Maintenance is generally easy to manage, and replacing or repairing these tanks is cheaper than underground models. In many cases, accessibility and low risk of undiscovered leaks are preferred.

2. Underground Storage Tanks (USTs)

USTs are usually buried in an invisible place, under meters or entrances. It saves space and is more aesthetically pleasing but represents a bigger challenge for inspection and maintenance. UST’s recs often remain unaware until they cause significant soil or groundwater contamination, making renovations expensive and complicated. Many old USTs were installed without proper corrosion protection, increasing the desires of old age.

Environmental and Financial Risk

Leaky oil tanks represent serious environmental and financial threats. Even small, undiscovered leaks can damage local ecosystems and lead to major groundwater and soil contamination that affect drinking water supply. These leaks often require extensive site assessment, soil excavation and environmental improvements.

Cleanup costs alone can surprise USD 10,000-100,000 depending on the question of whether the contamination range and whether it spreads to adjacent properties. Homeowners may also be liable for oil being discharged across nearby water sources or property boundaries. This could lead to complaints, fines and forced renovations that further escalate the financial burden.

In addition to direct cleaning costs, property values may drop, and insurance premiums may increase. If your tank is not covered by homeowner guidelines, you may need to pay all costs from your pocket. These risks provide early detection and regular maintenance for all those who have oil tanks on their property.

Top Insurers Offering Oil Tank Coverage

Not all home insurance companies offer oil tank covers by default. In fact, limit or exclude it, especially when it comes to underground tanks. However, some large insurers offer special notes or drivers that can heal homeowners with oil heating systems. Below you can find a comparison of how some of the top providers generally handle oil tank covers.

1. Allstate

Under certain conditions, Allstate will provide an oil tank note. This insured for cleaning and property damage. Underground tanks can be covered but are usually under strict conditions. Additional premiums are available, and cover is usually granted only after draft approval.

2. State Farm

State farms provide oil tank notes only on ground tanks. These guidelines include compensation for sudden sponsorships and related property damages, but underground tanks are excluded due to the high risk of long-term, undiscovered leaks. Homeowners with buried tanks may need to look for alternative reports through special insurance companies.

3. Liberty Mutual

Liberty Mutual offers limited coverage of oil tanks, often with notes that need to be added to standard homeowner policies. The cover can extend to ground tanks and, in some cases, expand to underground tanks if certain safety and maintenance standards are met. However, scopes are generally narrow and exclude environmental damage or long-term corrosion is common.

4. Travelers Insurance

Travelers are one of the more flexible providers that provide oil tank covers via drivers. The driver can include both ground and underground tanks, but typically includes strict approval requirements, such as regular maintenance documents, age restrictions and, in some cases, environmental risk reviews. The amount of cover and deductible may vary depending on the type and location of the tank.

5. Amica Mutual

Amica does not provide oil tank notes as part of the standard home ownership. Coverage of damage, particularly those related to underground tanks, is generally excluded. Homeowners who rely on oil heating may need to look for another directive to environmental liability or change providers if oil tank covering is essential.

When Does Home Insurance Cover Oil Tank Leaks?

Standard home insurance generally does not offer a wide range of coverage for oil tank leaks, but there are certain conditions in which insurance companies offer limited protection. In most cases, damage should be classified as more sudden and accidental than as a result of long-term wear, corrosion, or poor maintenance. This means that if leaks are caused by unexpected external events or sudden mechanical errors, they are entitled to a refund.

The target situation can include:

- During the storm, the tree falls, crushing the oil tank and opening it.

- Pipes connected to the oil tank burst unexpectedly, loosening the oil into your home or garden.

- A fire or explosion can damage the oil tank, leading to leaks and structural damage.

- The inside oil tank suddenly breaks down and fills the basement or supply chamber with oil.

These cases are usually considered by insurance companies to exceed homeowner control, and the likelihood of successful claims is increased, especially if the tank is properly maintained and meets security standards.

In these scenarios, your home insurance can cover it.

- Oil Spill Cleanup: Clean oil contamination Costs associated with cleaning oils made with floors, walls, insulation and household systems.

- Property Damage: Repairing physical structures that are affected by leaks, such as walls, floors, carpets, furniture.

- Environmental Remediation: Professional removal and decontamination of oil-soaked soil, and groundwater treatment when contamination spreads.

- Temporary Living Expenses: If your home is difficult to live during cleanup, hotel stay, meals and transportation guidelines can be paid as part of a loss of use terms.

Important Steps to Take When Filing a Claim

Acting promptly and thoroughly is important to improve your reporting potential.

- Report the Leak Immediately: Contact your insurance company immediately if you find a leak. Delays can weaken your claim.

- Document Everything: Take photos of the damage, collect receipts and record all cleaning and repair efforts.

- Get a Licensed Contractor’s Inspection: Get an inspected contractor Insurance companies often require a formal evaluation by a licensed professional to determine the source and scope of the leak.

Remember that all insurance policies are different and some insurance can include exclusions or require notes in your oil tank. We recommend that you carefully review the guidelines and consult your insurance agent to understand the cover.

When Home Insurance Doesn’t Cover It

Despite the risks, many home insurance does not cover oil tanks caused by long-term neglect or progressive deterioration. Many homeowners are surprised here.

Common Exclusions Include

- Corrosion or rust due to age.

- Lack of maintenance.

- Underground tank leaks unless explicitly added to the guidelines.

- Environmental damage without confirmation.

- Slow, long-term penetration over weeks or months.

If the insurance provider determines the problem is avoidable, or if the tank is too old, they will likely refuse the claim.

Why Are Claims Denied?

Many claims are rejected because:

- The homeowner did not perform regular inspections.

- The tank was already beyond its typical lifespan.

- The cause of the leak was not clear.

- The homeowner was unable to update the old tank.

Optional Add-Ons: Endorsements for Oil Tanks

To bridge the coverage gap, many insurance companies offer oil tank endorsements. These are political add-ons that protect against oil tanks and their associated consequences:

What Does an Endorsement Cover?

- Soil remediation

- Tank replacement

- Environmental cleanup

- Repairs to structures or personal property

- Liability if neighbors are affected

How Much Does It Cost?

Adding an oil tanker typically costs USD 100 per year, depending on the location of the tank (up or underground), age and capacity. Some providers may require a professional examination prior to approval.

How to Add It?

- Please contact your insurance company.

- Request a written confirmation offer.

- Enter your fuel details (age, location, materials).

- Plan a professional armored craftsman space if necessary.

Not all insurance companies offer oil tank covers. You may need to change your company or work with a special insurance company.

Cost of Oil Tank Leak Damage

Oil leaks are expensive to improve not only property damage but also environmental liability.

Estimated Costs

| Type of Damage | Estimated Cost |

|---|---|

| Small Ground Leak | $5,000 – $10,000 |

| Moderate indoor spill | $10,000 – $30,000 |

| Underground Ground Cleaning | $20,000 – $100,000+ |

| Fuel removal/replacement | $1,500 – $5,000 |

| Legal/environmental fines | Varies, often severe |

Some US and Canada states may need to report contamination and clean up even if the guidelines are exceeded.

Steps to Take If You Discover a Leak

Stop Using the Tank Immediately

Stop using the tank immediately If you notice or suspect an oil tank, your top priority is to switch tanks and stop using the heating system. Continuing the system can exacerbate leaks and increase environmental and financial impacts.

Call a Licensed Professional

Call a licensed professional Contact your oil provider, licensed HLK technician, or environmental specialist to inspect your tank. Experts can determine the cause of the leak and recommend safe next steps to contain and resolve the issue.

Contain the Spill (If Safe)

If this is safe and legal, you can try to suppress the area with sandbags or absorbent materials to prevent oil from being sprayed. Proper ventilation is very important, especially for internal leaks, to avoid exposure to harmful steam.

Notify Your Insurance Provider Immediately

Time is important – contact your home insurance company as soon as possible. Most guidelines require immediate reporting of sudden incidents. Delaying notifications can reduce the likelihood that your claim will be approved.

Document Everything

Make clear photos and videos of affected areas, tanks, pipes, and visible damage. Keep detailed notes, keep receipts and receive written inspection reports from the expert who evaluated the tank.

Do Not Attempt Cleanup Yourself

Do not clean spills yourself. Improper handling can violate environmental regulations and exacerbate damages. Cleaning should only be performed by a certified professional with an approved method.

Comparing Providers and Policies

Not all guidelines are the same in terms of home insurance, especially when dealing with oil tank covers. If you have an oil tank or are considering buying one home, it is important to ask the right questions and carefully compare guidelines to avoid unexpected costs on the street.

Ask: “Do You Cover Oil Tank Leaks?”

First, ask your insurance company if the standard command covers oil tank leaks. In many cases, standard homeowner insurance does not provide insurance coverage unless the leak is suddenly, random, and from a well-maintained tank. Make sure the fund explains the specific terms and conditions that contain oil.

Ask: “Do You Offer Endorsements for Oil Tanks?”

Some insurers provide endorsements or drivers that can be added to the basic directive at an additional cost. These memos can cover third-party oil contamination, adjustment costs, soil remediation and even liability if nearby property is affected. If the provider offers such coverage, there is a clear understanding of borders, self-preservation and conditions.

Ask: “Are Underground Tanks Excluded?”

Many insurers exclude underground warehouse tanks (USTs) only from standard covers due to the high risk and costs associated with undiscovered leaks. If you own or buy a home with a burial tank, you should ask yourself if special underwriting is required to ensure protection, or if another environmental directive is required.

Ask: “What Documentation Is Required for Coverage?”

Finally, ask what type of document you need to maintain the report’s report. Insurance companies often expect regular maintenance, professional inspections, and sometimes evidence of age or condition of the tank. Maintaining a detailed record of maintenance and upgrades can compensate for the difference between successful claims and rejections.

If you are actively involved in political shopping during the purchasing process, you are not ready if a leak occurs. Asking these questions in advance will help you better compare offers from several providers and choose a plan that offers the right balance of protection, flexibility and affordability.

Final Thoughts

Oil tanks are one of the most expensive and often overlooked risks for homeowners, especially those who rely on oil for heating. Standard home insurance may offer limited protection, but rarely cover it over time through corrosion, aging tanks, or slow penetration of penetration. This makes it important for homeowners to not only understand current politics, but also consider adding oil tank confirmations for full compensation.

Proactive maintenance, regular inspections, and timely tanker sets can significantly reduce the risk of leaks and the associated financial burden. By keeping detailed records and working with licensed professionals, all future insurance claims can also be strengthened. Ultimately, it is the best way to avoid the shock of rejected claims and the high costs of environmental robbery.

Does your home insurance cover your oil tanks? It may not be a strategy dependent strategy. With the right steps now, you can save thousands and give real peace of mind.

Read our article: Ultimate Trusted Choice Auto and Home Insurance for Peace of Mind

Frequently Asked Questions (FAQs)

Does home insurance cover oil tank leaks automatically?

No, most standard policies do not. You usually need an endorsement.

Is cleanup covered?

Only if the leak is sudden and accidental—and only to a certain limit.

What if my underground tank leaks?

Most insurers exclude USTs unless specifically endorsed. Cleanup is often not covered.

Can I get oil tank coverage for an old tank?

Maybe, but insurers may require inspection or deny coverage based on age and condition.

How can I reduce my premium?

Upgrade your tank, maintain it regularly, and install leak alarms or secondary containment.

One Comment