Bankwest Home Insurance: 7 Eye-Opening Reasons

Bankwest Home Insurance is a standout in Australia’s busy insurance landscape by providing complete insurance tailored to the changing needs of homeowners. As one of Australia’s most respected financial institutions, Bankwest has earned a reputation for providing policies that offer the ideal balance between wide-ranging protection and customer-friendly features. Whether you are a new homeowner, an experienced property investor, or just wanting to change providers, Bankwest provides flexible and secure options to meet a broad range of property types and personal situations.

In this article, we’ll delve into seven compelling reasons why Bankwest Home Insurance is a smart and strategic choice for homeowners in 2025. From robust coverage options that protect both your home and valuable belongings, to a streamlined claims process and impressive customer satisfaction ratings, Bankwest demonstrates its commitment to giving homeowners the security they deserve. Find out how this insurer exceeds normal offerings to provide true peace of mind and long-term value for one of your life’s largest investments—your home.

Table of Contents

1. Comprehensive Coverage Options

In selecting a policy for home insurance, homeowners first seek comprehensive protection for the property and its contents. Bankwest Home Insurance offers just that—good cover if it’s structural damage or personal items that are threatened.

Building and Contents Protection:

One of the strongest selling points of Bankwest Home Insurance is its double coverage for building and contents. This implies that your policy doesn’t only cover the actual structure of your house but also everything within it—furniture, appliances, electronics, clothes, and so on. If your house is destroyed by a natural calamity or if your belongings are stolen by burglars, Bankwest’s policy is ready to indemnify you for the loss.

As per Bankwest’s authentic PDS, this full cover prevents the inconvenience of handling individual policies or scattered claims. Such coverage is necessary, particularly for property owners in risky zones, where phenomena such as storms, bushfires, or floods have the potential to cause concurrent damage to the building and contents.

Other top institutions like CHOICE also commend Bankwest for its comprehensive coverage options, saying that it does as well in affordability and claim settlement.

Legal Liability Coverage:

Another essential aspect of Bankwest Home Insurance is the fact that it comes with legal liability cover—up to a very generous $20 million. This component of your policy protects you if a person gets accidentally injured or their property gets damaged while they are on your property. For example, if you have a delivery driver fall on your driveway or someone visiting you falls on a loose tile, you might be responsible for their loss of wages or medical bills. Bankwest protects you from being financially devastated by such lawsuits.

This limit of liability positions Bankwest in the more generous than average insurers in Australia. Sources like Home Loan Experts and Wikipedia’s list of Australian insurance companies verify that liability coverage on this scale is well above industry average, which makes it perfect for homeowners with many visitors or rental tenants.

Bankwest Home Insurance not only insures the essentials but also looks to the surprises, so homeowners are covered through every turn and surprise. With building, contents, and legal liability all wrapped up in one policy, it’s no wonder more and more Australians are looking to Bankwest as a best-in-class option in 2025.

2. Flexible Policy Options

One of Bankwest Home Insurance’s selling points is its flexibility. Unlike blanket policies, Bankwest offers tailored policy choices that cater to the various needs of contemporary home-buyers, such as investment property owners or serial travelers.

Residential and Investment Packages:

Whether you’re insuring your main home or wanting to protect an investment property, Bankwest Home Insurance has packages available for both situations. These policies vary in risk exposure, use frequency, and asset security so that you’re only paying for what is necessary.

For instance, landlords can get specialized cover for risks associated with tenants, including malicious damage or default rent, while homeowners can emphasize personal effects and structural cover. As per Bankwest’s official residential insurance guide, the policy can be tailored based on property type, location, and value.

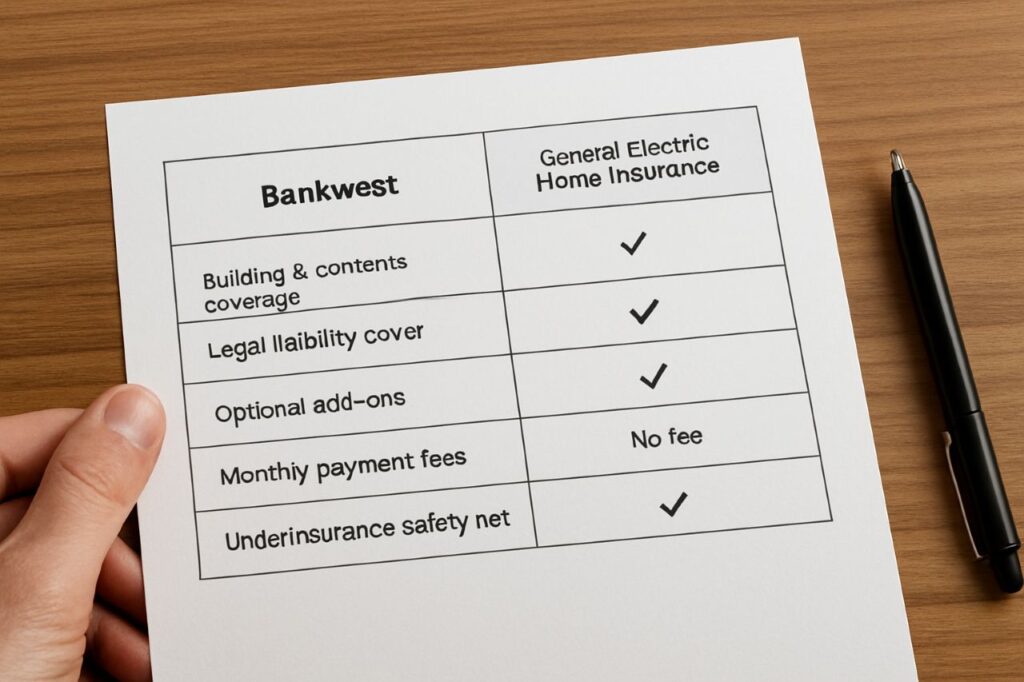

Such flexibility is particularly appealing in Australia’s dynamic property market, where individuals often own multiple properties across different regions. Homeowners appreciate this adaptability when comparing Bankwest Home Insurance with general providers like General Electric Home Insurance (GEICO), which may not always offer market-specific customization.

Optional Add-Ons:

To provide greater protection, Bankwest Home Insurance offers an array of optional add-ons. Perhaps most useful is portable contents cover that safeguards items like laptops, smartphones, cameras, and jewelry even when removed from the home—perfect for travelers and professionals who are always on the move.

As per Bankwest’s home insurance product website, these add-ons could be added with minimal effort and expense, giving additional peace of mind in the event of theft or accidental loss while traveling.

Bankwest stands out in this regard over traditional carriers such as General Electric Home Insurance, which might not always accommodate extensive customization without lengthy endorsements or exorbitant premiums.

Some of the other optional features available from Bankwest are:

- Accidental Damage Cover: For those unexpected spills, drops, or breakages in the home.

- Motor Burnout Protection: Repairs household appliances that are damaged because of electric motor burnout.

- Flood Cover: A must-add-on for flood-risk areas in Australia.

Bankwest Home Insurance simplifies building a policy that’s yours. By providing both base and personalized options, Bankwest gives you the freedom to safeguard what’s most valuable, without paying too much for unnecessary coverage. The ease of customization is one of the main reasons why it keeps surpassing generic rivals such as General Electric Home Insurance in customer satisfaction and retention.

3. Competitive Pricing and Discounts

Affordability is a key factor in choosing the most appropriate insurance provider. Bankwest Home Insurance not only offers quality protection but also excels due to its competitive pricing and customer-focused discount system. Homeowners looking to make side-by-side comparisons will appreciate this cost visibility as a significant benefit compared to more inflexible policies such as those offered by General Electric Home Insurance.

No Monthly Payment Fees:

Unlike most insurance companies that incur additional costs for monthly premium payments, Bankwest Home Insurance does not charge additional fees for monthly payments. This feature accommodates household budget planning, particularly for families or individuals with multiple monthly bills.

This facility is rare among Australian companies, with many of them continuing to charge small but regular fees that are substantial over time. Homeowners who change from companies like General Electric Home Insurance typically list this fee-free installment option as one of the major reasons they switch.

Underinsurance Safety Net:

A special benefit of Bankwest Home Insurance is its 25% under-insurance safety net. What this translates to is that if the cost of replacing or rebuilding your home and contents turns out to be higher than your insured value, Bankwest will cover the extra 25% to ensure you cover the deficit.

For instance, if your property is covered for $400,000 but the cost to rebuild following a catastrophe is $500,000, Bankwest will pay out up to $500,000—in effect, taking the hit of that $100,000 difference. This cushion, as noted by CHOICE, can be the difference between recovery and financial loss.

In contrast, traditional U.S. providers such as General Electric Home Insurance policies might not necessarily come with this kind of buffer, requiring the user to buy extended replacement cost endorsements in addition.

With equitable pricing and substantial protection, Bankwest Home Insurance prevents homeowners from falling into upfront as well as buried traps financially. In an international comparison of policies, one can see that the clear fee arrangements and protection against under-insurance of Bankwest place it ahead of competitors such as General Electric Home Insurance. This blend of value and prudence makes Bankwest an attractive proposition for frugal homeowners in 2025.

4. Exceptional Customer Service

Excellent insurance isn’t about coverage—about how well a company serves customers at stressful, urgent moments. Bankwest Home Insurance has built a reputation for excellent customer service, particularly where other insurers such as General Electric Home Insurance tend to fail.

Positive Customer Feedback:

One of the most satisfying measures of customer satisfaction is the frequency of complaints filed by policyholders. Based on current information from CHOICE, Bankwest Home Insurance received fewer complaints than other insurers of comparable size in Australia. This indicates that Bankwest policyholders tend to feel secure and cared for during their coverage.

Review sites such as Finder and Yelp reflect this, with customers often praising the promptness of Bankwest’s customer support and the ease of policy information. Most have commented that Bankwest provides a more hands-on approach compared to bigger, international providers such as General Electric Home Insurance, which tend to use automated systems and external customer service.

Efficient Claims Process:

When disaster hits, the last homeowners need is a messy claims process. Luckily, Bankwest Home Insurance features one of the more efficient processes available. Based on Bankwest SD Insurance news reports and review summaries on sites such as Pinterest, policyholders again and again refer to the claims experience as “simple,” “stress-free,” and “fair.”

This view is echoed by outside reviews comparing the claims process of different providers. For instance, a breakdown on Nationwide’s review site illustrates how U.S.-based providers like General Electric Home Insurance tend to involve long documentation and waiting times—something Bankwest has made a concerted effort to avoid.

Bankwest enables you to:

- Make claims online or over the phone 24/7.

- Monitor claim progress through customer portal.

- Get paid out quickly in approved cases.

From immediate, human assistance to a seamless claims experience, Bankwest Home Insurance does it all when it comes to taking care of customers. Unlike the more formal and bureaucratic experiences noted with General Electric Home Insurance, Bankwest’s personal touch and sense of responsibility bring much-needed relief to the world of insurance.

5. Additional Benefits

The distinguishing factors of top-notch insurance companies are the add-ons that come along with coverage. Bankwest Home Insurance is not only a reliable shield for your home and assets, but it also features a number of added-value perks that make it an attractive choice. These features see homeowners taken care of when they need it most.

Emergency Accommodation:

If your home becomes unsuitable for occupation as a result of an insured event—like fire, storm, or extensive damage to the structure—Bankwest Home Insurance covers up to $3,000 for temporary accommodation. This allows you and your family to find a safe, temporary residence without depleting your savings in the process.

As per CHOICE, the emergency assistance is especially beneficial in areas prone to recurring natural disasters like bush-fires or floods. It is also important to mention here that numerous international insurers, including General Electric Home Insurance, can make this add-on an optional feature or on more limited terms.

Coverage for Valuables:

Another highlight of Bankwest Home Insurance is the embedded coverage for valuables such as jewelry, watches, artwork, and collectibles. Although basic limits are standard, Bankwest permits policyholders to raise coverage limits for precious items—enabling easy customization of the policy to fit your personal stock.

As CHOICE points out, securing valuable items is sometimes overlooked by homeowners until it’s too late. It’s simple with Bankwest to declare and insure these valuables up front, cutting down on the risk of being under-insured.

Conversely, General Electric Home Insurance usually insists on a rider or personal articles policy for such protection. That is not always the case, but it makes things more complicated and possibly more expensive, something that Bankwest saves homeowners from with this amount of protection included in the standard policy framework.

Value types you can protect with Bankwest:

- Engagement rings and wedding bands.

- Fine art, such as paintings and sculptures.

- Luxury electronics and collectibles.

- Designer handbags and musical instruments.

With considerate perks such as emergency accommodation and flexible protection of valuables, Bankwest Home Insurance is more than simply adequate. In comparison with more conventional companies like General Electric Home Insurance, which tend to break down such offerings into ancillary coverage or extra charges, Bankwest’s one-stop solution provides both ease and savings—making it an attractive option for Australian homeowners in 2025.

6. Transparent Policy Details

Transparency is at the forefront of selecting an insurance company. Homeowners desire a clear understanding of what’s covered, what isn’t, and who to turn to for assistance when they need it. Bankwest Home Insurance satisfies that with easy-to-understand documentation and easy-to-reach support, allowing policyholders to make sound choices.

Clear Product Disclosure Statements (PDS):

A standout aspect of Bankwest Home Insurance is that it has well-presented and easy-to-follow Product Disclosure Statements (PDS). These statements set out important information such as:

- What is covered (e.g., building, contents, valuables).

- What is not covered (e.g., wear and tear, existing damage).

- Claim limits and sub-limits.

- Optional features such as flood and accidental damage cover.

Accessible directly online at the Bankwest site, these PDS documents enable prospective buyers to fully consider a policy prior to purchase. This sort of transparency assists in avoiding misunderstandings and guarantees honesty—something that’s not always assured with more universal providers such as General Electric Home Insurance.

Alternatively, American firms like GEICO (providing General Electric Home Insurance) might provide information in the form of general summaries or necessitate policyholders to get in touch with agents for the specific terms, slowing down the decision-making process.

Accessible Support:

Customer service is also an area in which Bankwest Home Insurance stands out. Whether you require assistance with understanding your policy, changing your coverage, or making a claim, there is support available through:

- 24/7 online portal.

- Phone helplines with local staff.

- In-branch advice.

- Live chat on the Bankwest home page.

- Detailed FAQ section and downloadable brochures.

This multichannel support ensures you’re never left in the dark—especially in emergencies. It’s also one of the reasons Bankwest consistently receives high marks on platforms like Finder and CHOICE.

In contrast, General Electric Home Insurance providers like GEICO often rely heavily on online self-service, which may not be ideal for all customers—particularly during high-stress claims situations or natural disasters.

Due to its straightforward documentation and helpful customer support, Bankwest Home Insurance allows homeowners to be informed and in charge with ease. This transparency is a far cry from the more secretive operations employed by some international insurers such as General Electric Home Insurance, setting Bankwest apart through greater customer trust and satisfaction.

7. Trusted Financial Institution

When choosing a home insurance company, trustworthiness and financial strength rank equally with coverage benefits. Bankwest Home Insurance brings customers more than a policy—they get to trust an insurer supported by one of Australia’s biggest and most stable banking entities.

Backed by Commonwealth Bank:

Bankwest Home Insurance is owned by the Commonwealth Bank of Australia (CBA)—a blue-chip financial institution which boasts a solid balance sheet, national coverage, and commitment to customer service. With this ownership, policyholders are assured of assistance from a financially stable and heavily regulated organization.

As Bankwest’s corporate website states, the CBA tie-up provides greater stability, security, and exposure to a larger financial service set, from mortgages through insurance packages. This institutional support is in contrast with global players like General Electric Home Insurance, which may be under wider corporate brands (e.g., GEICO under Berkshire Hathaway), but that tend not to have region-based benefits or direct banking integration in Australia.

Long-Standing Reputation:

Bankwest has been in business for over a century since it was founded in 1895. Bankwest has served Australians with sound financial products such as home loans, business banking, and insurance. Bankwest Home Insurance has adapted to the evolving needs of homeowners over the years with the incorporation of new features while still keeping its roots in trust and reliability.

As described on Wikipedia, the firm’s long history speaks to its resilience in adapting, innovating, and remaining relevant as financial conditions change. This is a stark opposite to companies such as General Electric Home Insurance, which, although reliable in America, are perhaps not equally established with such long-term reputations or deep-seated presences within Australian markets.

Bankwest’s track record is most critical during a crisis—natural disasters or economic instability—when customers desire assurance that their provider will be able to make good on claims without delay or with budget constraints.

By partnering with a reputable and established institution such as the Commonwealth Bank, Bankwest Home Insurance offers not only policy protection—it offers financial peace of mind. Compared to companies such as General Electric Home Insurance, which might not enjoy localized presence or customized options for Australian homeowners, Bankwest’s branded confidence and long-term trustworthiness offer a huge plus factor in 2025 and beyond.

Conclusion

Selecting the appropriate home insurance is key to safeguarding your assets and serenity of mind. Bankwest Home Insurance provides extensive coverage, adaptable arrangements, and outstanding customer support, making it the top option for homeowners in 2025. With competitive rates, clear policies, and the support of a reputable financial organization, Bankwest is an ideal ally in the protection of your residence.

Ready to make your home secure with Bankwest? Check their official website to learn more about policy choices and obtain a quote today.

Also Read: General Electric Home Insurance: 5 Shocking Facts You Must Know

Frequently Asked Questions (FAQs)

What does Bankwest Home Insurance cover?

Bankwest Home Insurance typically covers both your home building and its contents against risks like fire, theft, storm, water damage, and vandalism. It also includes up to $20 million in legal liability coverage. Optional extras like accidental damage and portable contents cover can be added to tailor your policy.

How is Bankwest Home Insurance different from General Electric Home Insurance?

While both offer solid protection, Bankwest Home Insurance provides more localized options for Australian homeowners, including no monthly payment fees, under-insurance safety nets, and customizable coverage for valuables. In contrast, General Electric Home Insurance (GEICO) caters mainly to U.S. homeowners and may not offer region-specific benefits or free monthly installment options.

Does Bankwest Home Insurance offer flood cover?

Yes, flood cover is available as an optional add-on with Bankwest Home Insurance. This is especially useful if you live in flood-prone areas across Australia. Always check your PDS to confirm if flood events are included in your specific policy.

Can I insure my rental property with Bankwest?

Absolutely. Bankwest Home Insurance offers investment property coverage with landlord-specific features like protection against malicious tenant damage and loss of rent. You can choose policies tailored to either owner-occupied or rental properties.

What is the underinsurance safety net?

Bankwest includes a 25% under-insurance safety net, which means that if your insured amount doesn’t fully cover the cost of rebuilding or replacing your home, they’ll pay an extra 25% to bridge the gap—something many insurers, including General Electric Home Insurance, don’t offer by default.

How do I file a claim with Bankwest Home Insurance?

You can lodge a claim 24/7 via the Bankwest claims portal or by calling their customer service team. Be ready to provide details about the incident, supporting documents (photos, receipts), and your policy number.

One Comment