United Home Life Insurance Company Ripoff – Complete Guide

United Home Life Insurance Company ripoff complaints have been popping up with greater frequency online, giving pause to policyholders and potential buyers alike. As one of the more obscure life insurance companies operating in the U.S., United Home Life Insurance Company guarantees simplified issue policies, competitive pricing, and low underwriting. Some customers, however, are experiencing a different story altogether—one of delayed claims, confusing policies, and consumer dissatisfaction.

Here, in this article, we will reveal the reality behind the “ripoff” complaints associated with United Home Life. We’ll review genuine user feedback, scan policy details, assess customer support, and compare it to the competition. Whether you’re shopping for a policy or already have one, you must be in-the-know before trusting—and committing—your money to this insurer.

Table of Contents

What is United Home Life Insurance Company?

Background and History:

Founded in 1948 and based in Indianapolis, Indiana, United Home Life Insurance Company is a subsidiary of United Farm Family Life Insurance Company. With more than 70 years of experience in the industry, the company markets itself as a family-first, customer-first insurer that offers straightforward and easy-to-understand life insurance products to the typical American.

Nonetheless, even with its long history, increased consumer worries branded as a “United Home Life Insurance Company scam” have started to emerge. These tend not to be caused by outright scams, but rather by insufficiency of explanation, communication breakdown, or convoluting policy terms that are not well explained during purchase.

Based on the National Association of Insurance Commissioners (NAIC), the corporation has a humble portion of the U.S. life insurance industry and holds a relatively low complaint rate. Nevertheless, it’s vital to regard such information with discernment since customer complaint websites and unbiased review sites tend to depict a dissimilar snapshot compared to regulatory databases.

Key Note: The firm does not have online account access or mobile app functionality, something that is typically viewed as a negative in the present-day digital-first world.

Types of Policies Offered:

United Home Life Insurance Company focuses on easy issue life insurance, whereby it provides coverage without undergoing medical tests in the majority of instances. Its product offerings include:

- Whole Life Insurance – Permanent policies that have fixed premiums and cash value accumulation

- Term Life Insurance – Insurance for a certain number of years (10, 15, 20, or 30), usually less expensive

- Final Expense Insurance – Plans that are used to pay for funeral and burial expenses, normally sold to older adults

- No Medical Exam Policies – Suitable for someone who might not be eligible for regular underwritten policies.

These policies are packaged as readily accessible solutions for individuals with typical health histories or hectic lifestyles. But here is where the controversy erupts: numerous policyholders who subsequently faced problems with coverage or claims started posting negative experiences under the name “united home life insurance company ripoff.” The source of discontent is usually attributed to restricted benefits, ambiguous exclusions, or premium charges that exceed the final payouts.

You can navigate a synopsis of these types of policies on United Home Life’s official website (Note: always check links as URLs can shift over time).

Key Takeaways:

- The firm mainly markets to low- to middle-class families, retirees, and those looking for minimal underwriting.

- Its main selling features—no exams and easy approval—can sound good to many, but these advantages tend to be paid for with increased premiums or delayed benefits.

- Consumer complaints relating to policy misunderstandings or claims issues are increasingly contributing to the “united home life insurance company ripoff” narrative online.

Before committing to any plan, always request the full policy document. Even “simplified” policies may include exclusions, contestability clauses, or graded benefit structures that limit payouts during the first few years.

Also, compare policies on third-party aggregators or seek the advice of a licensed independent agent to ensure you don’t end up with a policy that might end up being a rip-off.

United Home Life Insurance Company Ripoff Complaints: What Are People Saying?

Common Customer Complaints:

Over the last few years, more and more policyholders have been sounding the alarm on their experiences, with many calling their experience a “United Home Life Insurance Company ripoff.” Although the company sells on convenience and ease of use, reports from customers indicate that these benefits are sometimes achieved at the cost of dependability and honesty.

The following are the top complaints reported:

- Payout delays for death claims — Beneficiaries typically complain of waiting more than the usual 30 days processing time, and this can be a very distressing wait during a bad emotional time.

- Inability to access customer service — Customers online refer to hours spent holding on, getting unclear answers, or being passed around without being helped.

- Policy lapses with insufficient notice — Various clients claim policies were canceled or lapsed with very little notice, exposing them to being left unprotected.

- Premiums deducted post-cancellation — A number of consumers have complained that premiums were still being automatically debited even after cancelling their policy formally.

All these are not standalone cases. They are a trend that has led many to question online whether United Home Life Insurance Company Ripoff in simplicity.

A 2023 ConsumerAffairs study uncovered that more than 30% of the complaints included delays in claim payouts or dissatisfaction with customer services. For instance, on BBB.org, a number of users explained how the claims process turned into “a months-long ordeal” with poor communication or feedback.

Real Examples From Review Platforms:

- Better Business Bureau (BBB): A customer complained that despite providing all required documents, they waited more than 60 days for a life insurance claim, which led them to wonder if the provider was legitimate. The company replied with “processing delays” without compensation or redress.

- Trustpilot: Several reviewers provided 1-star ratings, stating that their policies had indefinite expiration dates, and that they received no active notification when coverage expired. This has given rise to charges of deceptive information—fueling the impression of a “United Home Life Insurance Company ripoff.”

- Reddit Threads: On sites such as Reddit, especially the personal finance and insurance subreddits, users have complained about not having an online cancellation option. Consequently, premiums were still being charged even months after customers believed their policies had been canceled.

Most Mentioned Grievances:

Following is a brief overview of the repeat complaints that have been adding to the rising dissatisfaction:

- Unavailability of online tools or account access — No customer portal to view or update policy information

- Ineffective communication from agents — Customers complain representatives are difficult to contact or give conflicting information

- Unclear fine print — Policies include graded benefit clauses or exclusions that are difficult to explain at the time of sale

- Surprise premium increases — Some users experience unexpected jumps in premiums without apparent justification

These complaints are echoed across multiple platforms, and many feel blindsided—hence the consistent association with the term “united home life insurance company ripoff.”

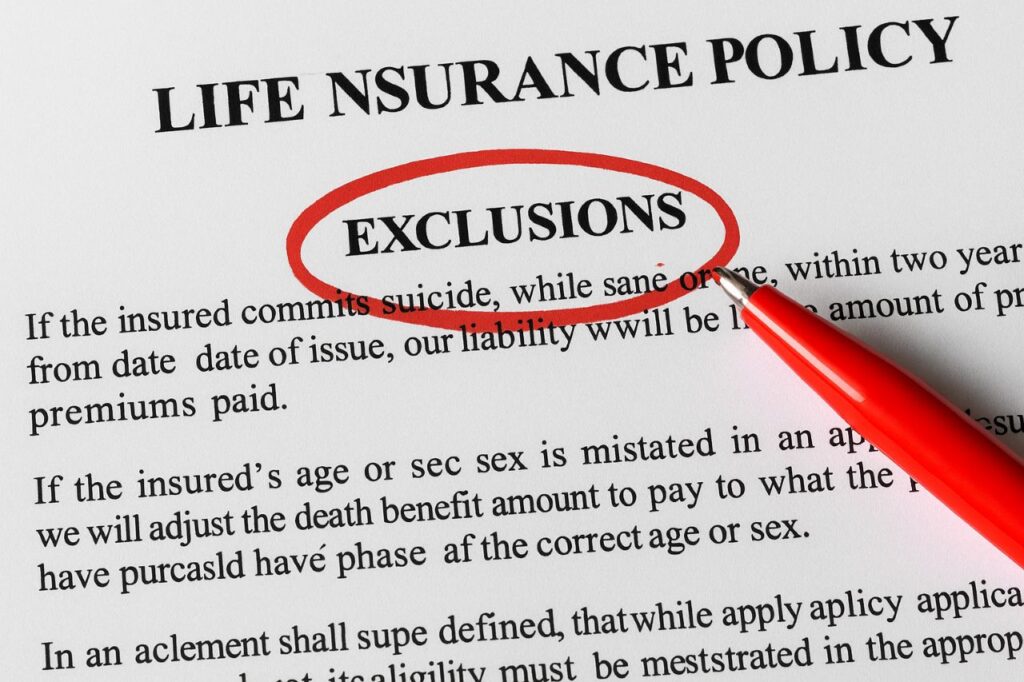

Policy Fine Print That Can Cost You – United Home Life Insurance Company Ripoff

Life insurance policies may look straightforward at first glance, but their fine print may have big financial implications—particularly if you’re not completely in the know about what you’re signing. Most complaints labeled as a “United Home Life Insurance Company ripoff” occur because policyholders or beneficiaries were surprised by exclusions, waiting periods, or confusing conditions hidden in policy documents.

It is essential to understand these hidden exclusions and clauses before selecting any life insurance policy.

Hidden Clauses and Exclusions – United Home Life Insurance Company Ripoff:

- Suicide Clause: The majority of life insurance companies, including United Home Life, have a two-year suicide clause. What this implies is that if the person who is insured commits suicide within two years of the initial policy start date, then the claim will be rejected. The insurance industry has this as a standard clause, but not all consumers know about it.

Find out more about suicide clauses through Investopedia.

- Contestability Period: An ordinary two-year contestability period permits the insurer to scrutinize the application for any inaccuracies. If United Home Life finds any misstatements (even subconscious), they have the right to reject the death claim. Most complainants about a “United Home Life Insurance Company ripoff” were astounded when their claims were declined on trivial reasons like an incorrect weight or smoking status.

- Late Premiums and Lapse Penalties: Policies can lapse when a premium payment is missed even by a day or two, particularly if grace periods are ambiguous. Reinstatement of a policy could necessitate extra medical information or charges. The absence of automated reminders or electronic billing systems at United Home Life exacerbates this situation and places many at the mercy of surprise cancellations.

Case in Point: On NerdWallet, experts suggest seeking out policies with good reinstatement terms and easy payment options—both of which are United Home Life’s weak points, according to customer reviews.

Final Expense vs. Term Life — What to Watch For:

One of the most common sources of “United Home Life Insurance Company Ripoff” complaints relates to final expense policies. They are touted as easy, low-barrier solutions for older Americans, but in many cases, they carry hidden trade-offs.

Final Expense Insurance Traps:

- More expensive premiums for low coverage – $40 a month for only $10,000 of coverage is typical.

- No accumulation of cash value – In contrast to some whole life contracts, few final expense plans build up value.

- Risk of falling behind – One late payment could invalidate years of premiums paid.

In contrast to term life insurance, which offers higher coverage for a limited time, final expense insurance targets funeral expenses and does not necessarily provide true long-term coverage. Consumers have complained about poor value and absence of growth, considering these policies to be deceptive or predatory, and this perpetuates the “united home life insurance company ripoff” image.

As per Policygenius, it is essential to compare final expense with term or whole life options prior to committing.

Questions to Ask Before Buying – United Home Life Insurance Company Ripoff:

Below are essential questions to assist you in avoiding the most common pitfalls that end up making customers feel cheated:

- How long do I have to wait to receive full death benefits?

- Will there be surrender penalties or fees if I miss a payment?

- Will this policy really pay for all final expenses, or only part?

- What if I skip a payment—is there a grace period?

- Can I monitor my policy or payments online, or will I only receive paper communication?

Claims Process and Customer Service: Hit or Miss?

Any life insurance company’s most important gauge is how effectively and dependably it processes claims. To our dismay, the majority of “United Home Life Insurance Company ripoff” complaints arise from claim delays and unsatisfactory customer service. For families who have lost a loved one and depend on a timely payment, any setback in this process is catastrophic—both emotionally and financially.

How the Claims Process Should Work:

In theory, the life insurance claim process should be fairly simple, particularly with natural causes of death or deaths outside of the contestability period. The industry standard is to pay valid claims within 30 days.

Here’s how the process must go, ideally:

- Notification: The family member or beneficiary calls the company to file the claim.

- Document Submission: The insurer asks for documents, which usually include:

- A filled-out claim form.

- A death certificate on record.

- A policy copy.

- Claim Review: The insurer reviews the information for accuracy and ensures the policy was active and in good standing.

- Payout Issued: After verification, the company issues the death benefit payment.

You can also locate a standard claims guide from reputable websites such as AARP Life Insurance Help, which provides the anticipated timelines and steps. Yet numerous United Home Life policyholders describe an entirely different experience.

Where the System Breaks Down-United Home Life Insurance Company Ripoff:

Many consumer complaints reflect that the process with United Home Life is far from smooth. This has resulted in a flood of posts throughout online forums and reviews that describe their experience as a “United Home Life Insurance Company Ripoff.”

Major concerns are:

- Too much paperwork: Even after the submission of required documents, customers are being requested for more forms or being asked to resubmit information several times.

- Inactive communication: Beneficiaries complain about excessive wait times, calls not being answered, and emails going unresponded to. Others indicate that they had to follow up for weeks simply to hear an update.

- Beyond 30–90 days extended delays: Most claims are held up during the contestability period (usually the first couple of years of the policy) when insurers investigate for possible fraud or misrepresentation. However, consumers complain these investigations tend to drag on with little explanation or even just cause.

It is based on ConsumerAffairs that more than 20% of the firm’s poor reviews concern delayed payments or unpaid claims. This unreliability forms a primary reason why several term it United Home Life Insurance Company Ripoff—and yet, perhaps the policy was cheap or simple to obtain.

Claims Best Practices:

Avoid getting trapped in delays or being denied benefits by following these key best practices:

- Make duplicate copies of all documents filed, such as forms, ID, and certificates.

- Document phone calls when permitted by law, or document notes in detail with dates, times, and names of agents.

- Send documents with certified mail or read receipts through email. This guarantees there is a record that documents were sent.

- Read the entire policy in advance to know what’s expected throughout the claims process.

- Refer unresolved complaints to your state’s Department of Insurance after 30 days. Most state regulators can look into it and even prod the company into answering.

You can look up your state regulator through the NAIC Consumer Tool.

All these steps not only demand closure—they also assist fellow consumers in making wise choices and preventing a possible “united home life insurance company scam” experience.

Is United Home Life Insurance Company Ripoff Really a Fact or Just Poor Expectations?

The Fine Line Between Miscommunication and Deception:

In some cases, the “ripoff” label may be tied more to poor communication than outright fraud. For example:

- Agents may oversimplify benefits.

- Customers may not fully understand graded death benefits.

- Confusion around policy types (e.g., guaranteed issue vs. underwritten).

| Feature | United Home Life | Mutual of Omaha | AIG |

|---|---|---|---|

| Online account access | No | Yes | Yes |

| Guaranteed issue options | Yes | Yes | Yes |

| Claim turnaround time | 30–60 days | 7–14 days | 14–30 days |

| Customer satisfaction rating | Low | High | Medium |

How to Protect Yourself from United Home Life Insurance Company Ripoff

As more and more complaints are filed about miscommunication, claim denials, and inadequate customer service, it is not surprising that phrases like “united home life insurance company ripoff” are building momentum on the internet. Although not all bad experiences amount to outright fraud, the majority are the result of questionable transparency and high-pressure sales strategies that exploit less-educated consumers.

Knowing how to guard yourself prior to purchasing any life insurance policy—particularly from firms with varying reviews—is essential for financial peace of mind.

Red Flags in Life Insurance Sales:

Being aware of warning signs during the selling process can prevent you from future aggravation and loss of money. Numerous buyers who now equate their experience as a “United Home Life Insurance Company scam” had previously overlooked warning signs along the way.

Some of these warning signs include:

- Pushy or aggressive agents — If an agent rushes you to sign right away or refuses to answer your questions directly, be suspicious.

- Complicated benefit payment conditions — Policies that fail to outline timelines, claim requirements, or beneficiary procedures should raise an eyebrow.

- No written report — Proper agents will always give you clear, detailed written information for your inspection.

- No customer service line or lack of support — A reputable insurance firm must have several communication options: phone, email, and, preferably, an online portal.

Customers should be cautious of unsolicited contact, inflated claims of benefits, and any firm that refuses to talk about exclusions or waiting periods, states the Federal Trade Commission (FTC).

Smart Shopping for Policies:

If you’re shopping around for life insurance—United Home Life or another company—these tactics can assist you in avoiding a ripoff situation:

- Deal with licensed and rated agents — Always request the state license number of the agent and check it through your state’s database or the National Association of Insurance Commissioners (NAIC).

- Utilize third-party review websites — Sites like NerdWallet, Policygenius, and Trustpilot provide real-life feedback and comparisons side by side.

- Request “free look” periods — These enable you to cancel within 10–30 days of policy approval and you get a full refund. If a company refuses to uphold this privilege or does not clearly indicate it, it may result in another “united home life insurance company ripoff” episode.

Steps to Verify Before You Buy:

Before you sign on the dotted line, do the following in advance to be sure you’re dealing with a reputable insurer:

- Check the agent’s license with NAIC’s Consumer Information Source or your state’s insurance department website.

- Ask for full written policy documents prior to payment or authorization of drafts from your bank account. Never take brochures or verbal guarantees at face value.

- Put claim procedures in writing, such as the duration of time claims usually take and under what conditions claims will be delayed or denied.

- Request that all communications by email, particularly anything with terms, rates, or cancellation policies. It is worth its weight in gold if you ever need to contest something down the line.

Conclusion: United Home Life Insurance Company Ripoff?

It would be unjust to deem United Home Life Insurance Company Ripoff for all policyholders. But repeated grievances against inferior customer service, delayed claims, and ambiguous policy language are too substantial to overlook. Although most policyholders are content with their coverage, some are left feeling deceived or underserved.

If you’re thinking about a policy, shop around. Research. Ask tough questions. Read the fine print. And most of all, compare providers before you buy. Life insurance is a significant financial decision, and you’re owed clarity, reliability, and peace of mind.

If you’ve experienced something—good or bad—with United Home Life, post your story on reputable forums such as BBB or ConsumerAffairs. And if you’re looking for improved alternatives, approach a licensed independent broker who can assist you in finding an open, customer-centric plan.

Also Read: King Insurance Mobile Homes: The Complete 2025 Guide to Protect Your Future

Frequently Asked Questions (FAQs)- United Home Life Insurance Company Ripoff

Is it true about United Home Life Insurance Company Ripoff?

No, United Home Life Insurance Company is a legitimate business founded in 1948. However, many consumers have labeled their experiences as a “United Home Life Insurance Company ripoff” due to delayed claims, confusing policy terms, and poor customer support. These issues stem more from administrative problems than outright fraud.

Why do people say United Home Life Insurance Company is a ripoff?

Many customers use the phrase United Home Life Insurance Company ripoff after facing claim delays, difficulty canceling policies, unexpected premium deductions, and limited online account access. These issues create dissatisfaction, especially when buyers weren’t informed about the fine print during the sales process.

How long does United Home Life take to process a claim?

While the industry standard is around 30 days, numerous users have reported waiting 60 to 90 days or more with United Home Life. These delays have been a major reason why people label their experience as a United Home Life Insurance Company ripoff, particularly when there’s no clear communication from the company.

Can I cancel my United Home Life policy online?

No, United Home Life Insurance does not provide an online portal for cancellations. Several users complain that their premiums were still being deducted after cancellation requests—an issue that has contributed to the United Home Life Insurance Company ripoff perception.

Are there better alternatives to United Home Life Insurance Company?

Yes, alternatives like AIG, Mutual of Omaha, and State Farm often receive higher ratings for digital access and claim service. Comparing these options can help you avoid ending up in a situation that feels like a United Home Life Insurance Company ripoff.

What can I do if my claim is delayed or denied?

If you believe you’re experiencing a United Home Life Insurance Company ripoff, first contact their customer service and document all communication. If the issue isn’t resolved in 30 days, file a complaint with your state’s Department of Insurance and share your review on platforms like BBB or ConsumerAffairs.

How can I protect myself from United Home Life Insurance Company Ripoff?

To avoid a United Home Life Insurance Company ripoff or similar issue:

1. Only work with licensed agents (check via NAIC).

2. Request full policy details in writing.

3. Use your state’s free-look period to cancel if needed.

4. Keep copies of all documents and communications.

Taking these steps can save you from unexpected complications and financial loss.

One Comment