King Insurance Mobile Homes: Best Complete Guide

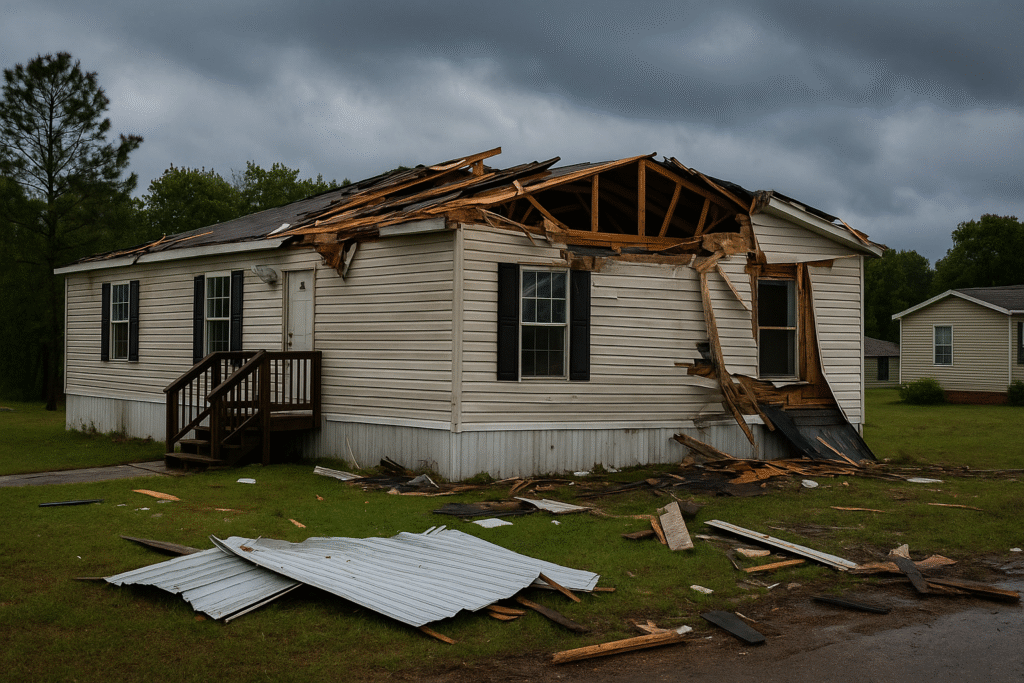

King Insurance mobile homes policies have become an essential resource for safeguarding homeowners who reside in manufactured or modular homes. Since mobile homes continue to remain a sensible and cost-effective housing option throughout the United States, getting them adequately covered has never been more crucial. Unlike a conventional home, mobile homes possess inherent exposures — from intense weather exposure to transport risks — that necessitate specialized insurance.

Learning how King Insurance mobile homes insurance operates can save you from expensive errors. Whether you’re purchasing a new mobile home, already have one, or plan on moving it to another state, selecting the right insurance policy can mean the difference between knowing you’re covered and going broke. This post delves into astonishing facts and realities about mobile home insurance through King Insurance, allowing you to make the right decision supported by professional advice and practical examples.

Table of Contents

Understanding King Insurance Mobile Homes Policies

What Makes Mobile Home Insurance Different?

Mobile homes, or manufactured homes, are constructed in a factory and shipped to where they will be placed. Due to their construction, they are more susceptible to environmental hazards than site-built houses. Mobile homes, as defined by the U.S. Department of Housing and Urban Development (HUD), come with certain construction and safety regulations, but even with guidelines in place, there are risks.

When it comes to insurance, mobile homes have special issues:

- Lightweight design makes them more susceptible to heavy damage from storms or high winds, particularly in tornado-susceptible zones such as the Midwest and Southeast.

- Prone to water and fire damage because of tight construction and more exposed utility lines.

- Not always securely anchored to a permanent base, so they are more likely to tip over or slide during floods or earthquakes.

- Regular homeowners insurance does not typically cover these perils well. That’s when King Insurance mobile homes policies step in. They are designed specifically to meet the exposed needs of manufactured housing.

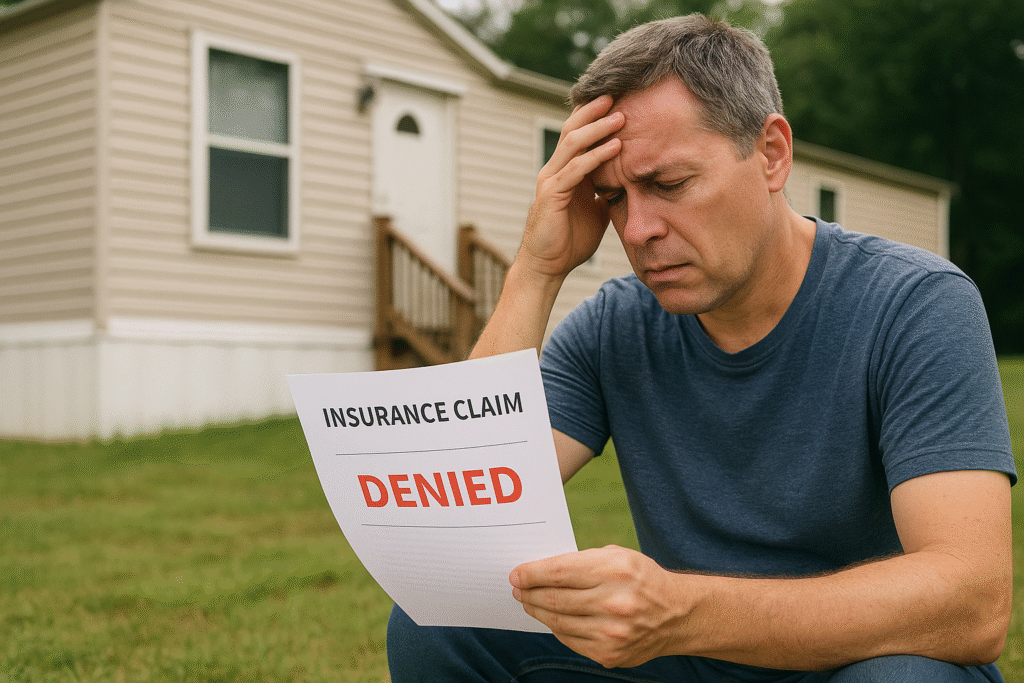

A homeowner in North Carolina witnessed their mobile home move as a result of Hurricane Florence. Their regular insurance denied the claim, but once they switched to King Insurance mobile homes, they enjoyed storm-specific dwelling coverage and temporary housing reimbursement.

Why Choose King Insurance?

King Insurance has established a reputation for grasping the complexities of mobile home ownership. Their specialized King Insurance mobile homes policies are designed with features that address the practical requirements of mobile homeowners.

Here’s how King Insurance is different:

- Flexible coverage: No matter whether you possess a single-wide, double-wide, or triple-wide home, King Insurance provides coverage tailored to your needs. This includes partial or complete replacement value options based on your budget.

- Liability protection: Their mobile home policies also cover liability in the event that a person gets injured on your property or you unintentionally damage another person’s property.

- Discounts for safety upgrades: You can reduce your premium with additional safety features such as smoke detectors, fire extinguishers, tie-down systems, and storm shutters.

This is reported by NAIC Consumer Reports: insurance firms that sell specialized products such as mobile home policies have higher claims satisfaction rates than generalist insurers. That’s why so many policyholders choose King Insurance mobile homes—they’re not selling a product; they know your lifestyle.

Tip: Always reveal if your mobile home is permanently attached to a foundation or not. This information greatly impacts your risk profile and can affect eligibility for some coverages under King Insurance mobile homes policies.

Being a first-time buyer or changing insurance companies, beginning with a specialized mobile home policy such as those offered by King Insurance mobile homes ensures your one-of-a-kind property is thoroughly and adequately covered.

Coverage Options and What They Mean

King Insurance mobile homes policies are tailored to the special needs of manufactured home owners. These policies feature basic protection and optional riders, so you can create the coverage best suited for your home type, lifestyle, and risk location.

Standard Coverage in King Insurance Mobile Homes:

All king insurance mobile homes policies have basic protections that cover the most frequent kinds of loss:

- Dwelling Coverage: Shields the physical structure of your mobile home from perils like fire, wind, vandalism, and falling objects.

- Personal Property: Protects your belongings inside the home, such as furniture, electronics, appliances, and clothing.

- Liability Protection: Covers medical expenses and legal costs if someone is injured on your property or you’re held responsible for damage to others.

Tip: Take a photo record of valuables and receipts. During a claim, this ensures losses can be quickly and easily verified.

As the National Association of Insurance Commissioners (NAIC) notes, personal property coverage is frequently underinsured — so check your limits and adjust them accordingly.

Optional Add-Ons Worth Considering:

To add extra protection, king insurance mobile homes provides some very useful additions that can protect against hazards not included in the basic policy:

- Trip Collision Coverage: Insures your mobile home in transit — perfect for people moving or buying homes from another state.

- Equipment Breakdown: Insures major systems such as HVAC, electrical panels, and water heaters against sudden mechanical breakdown.

- Detached Structures: Provides coverage for outbuildings like workshops, detached garages, and sheds.

- Additional Living Expenses (ALE): Covers the cost of hotel stays, food, and transportation if your residence is rendered uninhabitable by a covered event.

Example: A Texas family had a kitchen fire that made their home temporarily unsafe. Their king insurance mobile homes’ ALE rider paid for their meals and hotel expense while the repair took two weeks.

ACV vs. RCV – Which is Better?

King Insurance mobile homes enables you to select between two reimbursement models:

- ACV (Actual Cash Value): Priced lower, but pays out according to the home’s depreciated value.

- RCV (Replacement Cost Value): Pays the full amount to replace your home or personal items with new equivalents minus depreciation.

Rule of Thumb: RCV is recommended for newer mobile homes or if you’ve made upgrades. ACV might suit older homes where full replacement isn’t necessary.

For a detailed comparison between ACV and RCV, refer to Policygenius.

Shocking Facts Every Owner Must Know

1. Not All Damages Are Insured:

Most first-time mobile homeowners make the expensive error of believing that insurance is a one-size-fits-all deal for any and every kind of damage. King Insurance mobile homes policies — as all other types of insurance products — have limited coverage and specific exclusions, though.

Here’s what’s generally not insured unless you pay extra for add-ons:

- Floods and earthquakes: Although these are not usually part of standard homeowners insurance, mobile homes are an even greater risk. For example, houses located in FEMA flood zones need supplemental flood insurance through the National Flood Insurance Program (NFIP).

- Mold damage: When mold is caused by prolonged lack of maintenance or neglect (such as a leaking roof gone unrepaired for months), it might not be covered.

- Relocation damage: Mobile homes are built to travel, but most policies won’t pay for damage in transit unless you purchase relocation or trip collision riders.

Real-Life Scenario: When Hurricane Ian came through, a mobile home in Fort Myers, Florida, was badly damaged when storm surge water reached its floor. Since the owner had not included flood insurance in their King Insurance mobile homes policy, the entire repair bill of almost $20,000 had to be covered out-of-pocket.

Pro Tip: If you reside in a high-risk zone, discuss combining your mobile home policy with flood or earthquake coverage with a King Insurance agent. Much cheaper than reconstruction after a disaster.

2. Depreciation Impacts Your Claim:

Depreciation is the most misinterpreted part of mobile home insurance. The majority of factory-built homes start depreciating when they roll off the assembly line, and it impacts the money you receive upon a claim.

In establishing a King Insurance mobile homes policy, you usually opt for:

Actual Cash Value (ACV):

- Pays out what your mobile home is currently worth, considering depreciation.

- Best suited for older homes or low-budget owners.

- Lower monthly premium but also lower reimbursement.

Replacement Cost Value (RCV):

- Pays for the cost of replacing your mobile home with a brand new one of the same quality.

- Higher premium but guarantees a full-value payout.

- Usually suggested for more recent models or permanent homes.

Example: A couple in Arizona with a 15-year-old double-wide opted for an ACV plan to save money. When a fire caused $30,000 in damage, they received only $14,000 due to depreciation — not enough to rebuild.

Pro Tip: If you’ve recently bought a new mobile home or made significant upgrades, ask King Insurance to reevaluate your policy and switch to RCV for better protection.

See more differences from the Insurance Information Institute.

3. Add-ons Can Save You Thousands:

Most homeowners don’t know how much value optional coverages can bring. Sure, base King Insurance mobile homes policies provide good protection, but it’s the endorsements that really make it strong.

Here are some worthwhile riders you should think about:

Trip Collision Coverage:

- Protects damages incurred while moving your mobile home.

- A necessity if you’re going to move states or move within your area.

- Covers expenses due to accidents, tip-overs, or incorrect towing.

Equipment Breakdown Insurance:

- Protects household systems such as HVAC, electrical panels, and major appliances.

- Less expensive than extended warranties or third-party repair services.

- Applies to unexpected and accidental breakdowns, not wear-and-tear.

Additional Living Expenses (ALE):

- Covers the cost of hotel accommodations, meals, and transportation if your home is rendered uninhabitable.

- Most useful following hurricanes, flames, or substantial water damage.

- Covers pets in some policies.

Example: A Tennessee couple retired had their water heater burst, destroying flooring and insulation. Their King Insurance mobile homes rider for equipment breakdown covered both appliance repair and replacement of damaged interiors.

Clever Strategy: Have your agent run a total-loss scenario on your mobile home and give you a coverage gap analysis. This will assist you in determining which riders to purchase in order to have full coverage.

Additional information regarding policy add-ons may be found in NAIC’s Homeowners Insurance Guide.

Real Costs: What Will You Pay?

Knowing the price of King Insurance mobile homes protection is vital to planning your finances and making the best coverage decision. Although prices are fairly different, some basic considerations include determining how much you’ll pay each year.

Premium Pricing Factors:

A king insurance mobile homes policy price isn’t one size that fits all. There are a number of factors involved, which can raise or reduce your premium.

- Location: Regions more susceptible to natural disasters such as hurricanes, tornadoes, or wildfires usually receive more premiums. For instance, Florida, Louisiana, and Texas might receive higher rates because they have greater weather risks. The Insurance Information Institute (III) states that location is among the most important price factors of mobile home insurance.

- Home Age: Older homes have higher chances of having structural flaws or outdated systems. This poses a higher risk to the insurer, which can result in higher premiums.

- Safety Features: Properties that are fitted with safety add-ons — including burglar alarms, smoke detectors, deadbolts, and hurricane straps — commonly receive discounts. They reduce the possibility of claims and show active risk management to King Insurance mobile homes underwriters.

Example Cost Breakdown:

Let’s see what a policy could cost for a single-wide mobile home in a mid-risk state like Texas:

- Base Premium: $600/year – Basic coverage of dwelling, personal property, and liability.

- Flood Coverage Add-On: $150/year – Optional in areas with seasonal flooding or storm surges.

- Equipment Breakdown Rider: $50/year – Protects HVAC systems, water heaters, and major appliances.

Estimated Total: $800/year

Remember that these figures are representative. Your real quote can differ based on your home’s size, location, age, and coverage choices you make under your king insurance mobile homes policy.

Discounts Available:

One of the largest benefits of selecting King Insurance mobile homes is the availability of several discount options that can dramatically reduce the price of your policy.

- Bundling Discount: Get a discounted overall premium when you bundle your mobile home policy with auto, RV, or boat coverage.

- No-Claims History: If you’ve had no claims in recent years, you can qualify for a discounted rate.

- Senior Discount: Policyholders over 55 often qualify for specialized savings plans.

- New Home Discount: If your mobile home is newly constructed or installed, King Insurance can provide a discount for newer, safer construction.

For additional money-saving tips, visit Consumer Reports, which explains how safety features and smart shopping lower premiums.

Tip: Always ask for a customized quote. Share your senior status, veteran history, security upgrades, or clean claims record. These can unlock more savings with King Insurance mobile homes policies.

Common Mistakes to Avoid

Even with the best policy in place, many homeowners still face claim denials or insufficient coverage due to avoidable mistakes. Being proactive with your King Insurance mobile homes plan ensures that you’re always protected when it matters most.

Not Updating Your Policy:

It’s natural for mobile homeowners to make modifications over time — such as remodels, new appliances, or even relocating the home to another lot. But if you fail to report them, your king insurance mobile homes policy could become out of date and no longer accurately measure the actual risk or value.

- Remodels such as room additions or kitchen remodels boost your home’s value — which could mean you’re underinsured.

- Appliance updates (e.g., new water heater or HVAC) might not be within old thresholds.

- Moving to a new location could significantly alter your risk exposure.

Risk Alert: Not renewing your policy could lead to partial payments, or even in some instances, denial of a claim owing to out-of-date records.

Tip: Whenever you make structural changes, contact your King Insurance mobile homes agent and ask for a fast policy review. It’s free and may save you thousands.

Assuming Coverage is the Same Everywhere:

One of the big mistakes is assuming that your mobile home insurance is the same everywhere in the U.S. In fact, King Insurance mobile homes policies are different by state because of varying laws, weather exposures, and insurance rules.

- Florida and California, for example, mandate stronger wind or fire-resistance standards because they are more susceptible to hurricane and wildfire damages.

- Agents in some states (e.g., Louisiana, South Carolina) are mandated to carry state-specific licenses to lawfully sell mobile home insurance.

Real Example: A homeowner relocated from Georgia to beachside Florida without informing King Insurance. Their storm insurance did not provide the stronger Florida standards required, and they were denied a wind damage claim.

Discover more about state-specific laws through the National Association of Insurance Commissioners (NAIC).

Pro Tip: Never forget to notify your insurer when relocating state-side. King Insurance can modify your mobile homes policy to suit local regulations and guarantee continuous protection.

Claims Process and Customer Satisfaction

Filing a claim with King Insurance mobile homes is usually easy — but preparing ahead of time can save you a lot of time in getting paid.

How to File a Claim with King Insurance:

To initiate your claim, just follow these important steps:

- Document the Damage: Get clear pictures or videos of the damage immediately. The more details you include, the quicker the process.

- Contact King Insurance Immediately: Use their 24/7 customer service line or claims portal. Early notification allows quicker claim assignment and resolution.

- Submit Receipts and Ownership Proof: Upload receipts for valuable items, appliance warranties, or installation records. These validate your claim and speed up payout.

Tip: Keep a digital backup of important documents in cloud storage for easy access during emergencies.

What to Expect During the Claim:

Once your claim is filed, here’s what typically happens:

- A licensed adjuster will be sent to evaluate your home and confirm your losses.

- You will get an estimated payment according to your policy (ACV or RCV formula).

- Claims typically take 5-10 business days.

- Payment is sent by direct deposit or mailed check, according to your choice.

Customer Reviews and Ratings:

Similar to most national providers, King Insurance mobile homes gets a variety of reviews on sites such as:

- Trustpilot: Commended for quick handling and responsive claims agents.

- Better Business Bureau (BBB): Negative comments mention higher premiums following claims and poor communication.

Example: A North Carolina policyholder was grateful for prompt service in a burst pipe situation but pointed out that their renewal premium went up by 20%.

Tip: Carefully read your entire policy (fine print too) prior to making a claim. If you’re unsure, have your King Insurance agent take you through your coverages and limits.

Conclusion

With King Insurance mobile homes, the specifics count. From the kind of policy you buy to the add-ons you pay for, every choice can have a big bearing on your financial security and your peace of mind. Affordable living is what mobile homes provide, but affordable protection is what mobile homeowners need — and specialized insurance is part of that equation.

By understanding what’s covered, what’s not, and how to tailor your plan to your unique needs, you’re protecting more than just a structure — you’re safeguarding your lifestyle. Whether you’re new to mobile home ownership or looking to switch insurance providers, King Insurance offers customizable solutions worth considering.

Obtain a personalized quote from King Insurance and get your mobile home fully covered against the unexpected turns of life.

Also Read: Beachfront Home Insurance: 7 Shocking Pitfalls to Avoid Now

Frequently Asked Questions (FAQs)

What does a King Insurance mobile homes policy typically cover?

A standard policy covers the structure of your mobile home, personal belongings, and liability protection. Optional riders can add coverage for floods, equipment breakdowns, and relocation.

How much does King Insurance mobile homes coverage cost per year?

The average annual premium ranges from $500 to $1,200, depending on your location, the age of your home, and selected add-ons. Discounts and bundling options can reduce this cost.

Can I get flood coverage with King Insurance mobile homes?

Yes, but it’s not included by default. Flood coverage must be purchased separately, especially if you live in a FEMA-designated flood zone.

What’s the difference between ACV and RCV in King Insurance mobile homes policies?

ACV (Actual Cash Value): Pays the current market value minus depreciation.

RCV (Replacement Cost Value): Pays the full cost to replace the home or items with new ones, without deducting depreciation.

Does King Insurance cover damage during mobile home relocation?

Only if you’ve added trip collision coverage. Standard policies don’t cover transport-related damage unless this rider is included.

Are older mobile homes eligible for King Insurance coverage?

Yes, but rates may be higher due to increased risk. Homes built before HUD regulations (pre-1976) may require inspection or limited coverage.

Can I bundle King Insurance mobile homes with other policies?

Absolutely. Bundling with auto or RV insurance can qualify you for multi-policy discounts, reducing your overall premium.

How do I file a claim with King Insurance for my mobile home?

Contact their 24/7 claims line or online portal. Provide photos, receipts, and a description of the damage. An adjuster will assess your claim, usually within 5–10 business days.

One Comment