Home Insurance Melbourne: 7 Powerful Reasons For Trust

Home insurance Melbourne is not just a policy—it’s protection for your greatest asset. In a city where the weather is as unpredictable as it is in Melbourne, and the housing stock is as diverse, having good home insurance is crucial. Homeowner, landlord, or renter, getting to know the ins and outs of Home insurance Melbourne can assist you in making wise decisions to secure your property and assets.

Melbourne’s distinct challenges, ranging from bush fires on the fringes to city theft hazards, require specific insurance solutions. With increasing premiums and differing coverage, it’s important to navigate the home insurance scene judiciously. This in-depth guide explores the home insurance options, cost-influencing factors, and how to maximize your coverage in Melbourne.

Table of Contents

Understanding Home insurance Melbourne

It takes a clear grasp of the different coverage options to navigate the terrain of Home insurance Melbourne. Melbourne’s housing market diversity and special environmental conditions necessitate that homeowners, landlords, and tenants select the appropriate insurance policies to cover their properties and possessions.

What is Home Insurance?

Home insurance offers financial cover against unexpected incidents that can harm your property or possessions. These incidents could be fire, theft, storms, or natural disasters. With Melbourne’s changeable weather conditions, having extensive home insurance provides assurance for property owners and renters alike.

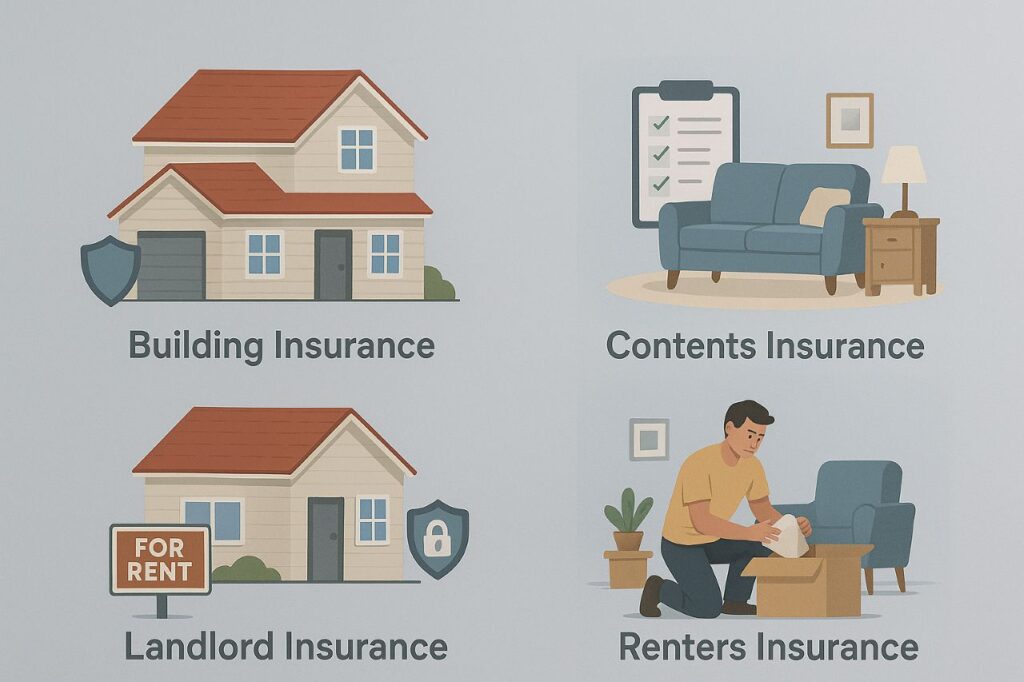

Types of Home Insurance

Knowing the various types of Home insurance Melbourne can assist you in choosing the policy that best meets your requirements: Types of Home Insurance:

- Building Insurance: This type of insurance covers the physical structure of your home, including walls, roof, and fixtures. It protects against damages caused by events like fire, storms, or vandalism. For instance, Allianz’s Building Insurance covers the cost of loss or damage to the physical structures that make up your home buildings, such as your house itself, garage, fences, sheds, and more.

- Contents Insurance: Contents insurance protects your own belongings within the home, including furniture, electronics, and clothing. The coverage is essential for protecting goods against theft, fire, or other insured events. QBE’s Contents Insurance, for instance, pays for the replacement or repair of your belongings, but not the building.

- Combined Home and Contents Insurance:A combined policy provides complete cover for the building and its contents. This is the best choice for homeowners who want complete protection. Westpac provides combined Building and Contents Insurance to protect your home’s physical structures, as well as the household and personal belongings you store within.

- Landlord Insurance: Created for homeowners who are renting out their properties, landlord insurance protects against possible tenant-caused damages and loss of rent. For instance, Allianz’s Landlord Insurance protects the expense of loss or damage to your investment property and the contents you supply for your tenant.

- Renters Insurance: Renters insurance is designed for tenants to cover their personal items in a rented home. It insures possessions against loss, damage, or theft. Compare The Market points out that renters insurance can cover furnishings, clothing, electronics, and other items in your home against loss, theft, or damage.

Selecting the correct Home insurance Melbourne requires evaluating your own needs and the level of coverage provided by each policy. By choosing the right type of insurance, you can have your home and possessions thoroughly covered for unexpected occurrences.

Factors That Determine Home Insurance Prices in Melbourne

- Location and Natural Hazards: Melbourne’s varied geography entails different risks:

- Bush-fire Danger Zones: Suburbs adjacent to wooded areas could be subject to higher premiums due to a greater risk of fire.

- Flood Prone Zones: Houses situated close to rivers or flood zones could be charged extra for flood cover.

- Melbourne’s varied geography entails different risks:

- Bush-fire Danger Zones: Suburbs adjacent to wooded areas could be subject to higher premiums due to a greater risk of fire.

- Flood Prone Zones: Houses situated close to rivers or flood zones could be charged extra for flood cover.

- Property Attributes: Age and Construction: Houses that are old or made from certain materials might command higher premiums.

- Security Features: Residential houses with alarms, deadlocks, and security cameras can enjoy lowered premiums.

- Personal Factors:

- Claims History: Frequent claims history can translate to higher premiums.

- Coverage Amount: Greater coverage levels tend to mean larger premiums.

7 Powerful Reasons Locals Trust It Most

Reason 1: Tailored Coverage for Melbourne’s Unique Risks

Bushfires, Floods, and Storms

Melbourne’s varied weather poses special challenges in the form of bush-fires in the outlying suburbs, flash flooding in low-lying neighborhoods, and violent storms. These natural elements require customized house insurance policies that cater to special regional dangers.

Why Melbourne’s Climate Requires Localized Policies

The city’s diverse topography and climatic conditions imply that a single insurance policy might not be sufficient. Regional policies take into account regional risks, and thus homeowners in bushfire-risk zones like the Dandenong Ranges or flood-risk areas like Kensington get proper coverage.

Which Suburbs Require Special Coverages

- Bushfire-Prone Suburbs: Suburbs such as Eltham, Warrandyte, and Belgrave tend to need special bush-fire coverage.

- Flood-Prone Areas: The areas of Kensington, Maribyrnong, and the Yarra River basin are flood-prone.

- Example: QBE and IAG’s Tailored Risk Maps

- QBE and IAG both offer interactive risk maps where homeowners can gauge their property’s exposure to natural disasters. Such tools enable making smart decisions regarding coverage required and premiums paid.

Reason 2: Flexible Policy Options to Suit Every Homeowner

Knowing Your Coverage Types

Home insurance Melbourne has different policy types to suit different requirements:

- Building Insurance: Insures your house’s structure, i.e., walls, roof, and fixtures.

- Contents Insurance: Insures personal items within your residence, e.g., furniture, electronics, and clothing.

- Combined Home and Contents Insurance: Provides overall coverage for both the building and contents.

- Landlord Insurance: For homeowners letting out their homes, insuring against damages caused by tenants and loss of rental income.

- Renters Insurance: For tenants to safeguard their personal property in a rented dwelling.

- Compare Policy Types:

- Use comparison sites such as Compare the Market to compare various policies and determine the most suitable for your requirements.

Reason 3: Competitive Premiums with Customizable Plans

How Locals Reduce Costs

Homeowners in Melbourne can use various methods to reduce their insurance premiums:

- Increasing Excess: Taking a higher excess can lower your premium, but make sure it’s something you can afford to pay if you need to make a claim.

- Paying Annually or Monthly: Paying your premium all at once, as opposed to monthly, can save you money.

- Bundling Policies: Having home insurance and other policies such as car insurance can mean discounts.

As per CHOICE, raising your excess to between $1,000 and $1,500 can lead to significant savings on your Home insurance Melbourne.

Reason 4: Reliable Brands with Local Knowledge

Top Insurers in Melbourne

Some well-known insurance companies provide Home insurance Melbourne:

Why They Are Reliable

These insurers have built a reputable presence in Melbourne, providing specialized policies, fast claims handling, and high standards of customer care. Their localized knowledge ensures policy is written to cover the local risks of Melbourne’s varied weather and geography.

Check Out Insurer Ratings

Prior to choosing a supplier, check independent ratings and reviews to gauge the satisfaction of customers and the quality of policies. Sites such as ProductReview.com.au provide interesting insights into what customers have said about different insurers.

Reason 5: Quick Claims Process and Assistance

How Insurers Respond to Emergencies

During a catastrophe, an effective and quick claims process is essential. Insurers such as AAMI have optimized their claims processes to provide rapid resolutions. For instance, AAMI provides policyholders with the ability to file claims online or through their app, offering instant updates and assistance during the process.

Real Customer Experiences

Most Melbourne locals have reported pleasing experiences with quick processing of claims, emphasizing that selecting an insurer with a responsive and reliable record is crucial.

Reason 6: Straightforward Comparison and Policy Management Facilities

Technologically Driven Ease

The processing of comparing and managing home insurance policies has become easier with advancements in technology:

- Comparison Websites: Sites such as iSelect and Compare the Market enable users to compare policies by different insurers speedily.

- Online Quote and Renewal Tools: Most companies have online facilities to acquire quotes, buy policies, and renew them, which gives convenience and expediency.

See How It Works

With the use of these online tools, homeowners can make intelligent choices, which means they will choose the most appropriate and affordable Home insurance Melbourne.

Reason 7: Better Security Means Lower Premiums

How Safety Affects Home Insurance in Melbourne

Putting security features in place can result in cheaper insurance premiums:

- Installing Alarms and Cameras: Discourages would-be burglars and minimizes the risk of theft.

- Smart Locks and Security Systems: Offers high-tech protection and can be eligible for discounts.

As per GIO, improving your home’s security not only safeguards your property but can also make your insurance premium lower.

Conclusion: Why Melbourne Homeowners Trust Local Insurance Solutions

To navigate Home insurance Melbourne arena, you need to have a clear understanding of your property needs and the risks involved where you are living. Stay informed and take initiative, and you can find an all-encompassing coverage that provides peace of mind at an affordable cost. Remember, the ideal policy is an investment in your home’s future.

Ready to safeguard your Melbourne home? Begin by comparing policies today and secure your peace of mind for tomorrow.

When and Why to Update Your Home Insurance in Melbourne

Life Events That Ought to Prompt a Policy Review

Keeping current with your home insurance Melbourne is important so that you’re always properly covered. Life situations change, and your insurance policy needs to change with them. If your policy isn’t updated to your current situation, you might be under-insured when you need it most.

Some regular life events must make you upgrade your Home insurance Melbourne:

- Home Remodeling or Extensions: A kitchen renovation, a deck or a granny flat addition – each improvement adds the rebuild value to your property. If your Home insurance Melbourne isn’t adjusted in line with your property’s growing value, it may leave a gap in cover. (GIO)

- Buying Costly Items: Costly electronics, luxury furniture, or unique art should be covered under your contents. Not renewing your home insurance Melbourne could mean that these items are not covered in the event of loss or damage.

- Establishing a Home-Based Business: Once you start doing business from home, particularly involving equipment such as computers, printers, or stocks, it’s essential to make your insurer aware. Most common home insurance Melbourne policies don’t cover business gear without an extension.

- Renting Your House or Room: If you have your property or a room up for rent on AirBnB, it alters the risk profile of your house. AAMI and QBE have specifically designed home insurance Melbourne for landlords or rentals by the day. Not disclosing this will render your policy useless.

- Extended Absence from the Property: Leaving your home unoccupied for 60+ days might contravene policy terms and conditions. You should talk to your home insurance Melbourne provider to find out if you will need extra cover for that period.

How to Make Adjustments Without Losing Protection

When renewing home insurance Melbourne, you want to have your cover up to date without putting yourself at risk. Here’s what to do:

- Inform Your Insurance Provider Early: Notify your Home insurance Melbourne company immediately when any changes take place. Early notification keeps you covered while changing.

- Re-evaluate Your Sum Insured: Employ rebuild cost calculators online or expert appraisals to revise your sum insured. This keeps your home insurance Melbourne up to date with the amount it will cost to rebuild your home in case of a disaster.

- Revise Your Contents List: Maintaining an inventory of your belongings — especially new or expensive ones — helps ensure they’re included in your home insurance in Melbourne contents policy. Save receipts, photos, and serial numbers when possible.

- Understand Policy Conditions: Each home insurance Melbourne provider has unique exclusions. Check conditions around unoccupied properties, renovations, and commercial use of your home.

- Explore Additional Coverage Options: Some insurers provide voluntary extras such as portable contents protection, accidental damage, or flooding cover. Depending on how your life has evolved, these may become crucial aspects of your renewed home insurance in Melbourne.

Maintaining your home insurance Melbourne policy in sync with your present way of life and property value will safeguard your future finances and relieve you of unwanted stress when some unforeseen happenings occur. Periodic updates ensure your policy serves you — not you serving it.

Tips to Optimize Your Home Insurance in Melbourne

Acquiring top-notch Home insurance Melbourne necessitates planning and making the right choices. Given increasing premiums as well as numerous policy options available, homeowners may adopt various methods to attain satisfactory coverage without exorbitant payments.

- Compare Multiple Providers: Home insurance Melbourne market is competitive, with various policies available with different coverage and premiums. Using comparison sites such as Compare the Market and CHOICE enables you to compare several choices side by side. The sites inform you about policy details, exclusions, and customer feedback, enabling you to make an informed decision for your Home insurance Melbourne.

- Bundle Policies: Merging your Home insurance Melbourne with other policies, including car or contents insurance, can result in huge discounts. Multi-policy discounts are offered by most insurers, making it easier to manage and lower the cost overall. For example, GIO offers up to a 10% discount when you have three or more qualifying policies.

- Boost Your Excess: Choosing a higher excess—the amount you pay yourself when you make a claim—may reduce your premium. But make sure the excess is a sum you’re happy to pay in the unlikely event of a claim. CHOICE recommends that raising your excess to between $1,000 and $1,500 can achieve significant savings on your Home insurance Melbourne.

- Review Your Policy Regularly: Changes in life, like renovations or purchasing valuable assets, may impact your insurance requirements. Reviewing and renewing your policy on a regular basis ensures that your Home insurance Melbourne is in line with your current situation. Westpac recommends reviewing your sum insured and policy information every year to prevent under-insurance or overpaying for excess coverage.

- Install Security Features: Improving the security of your home can result in reduced premiums for your home insurance in Melbourne. The installation of alarms, deadlocks, and CCTV cameras decreases the chances of theft and vandalism, which are rewarded by insurers with discounts. GIO states that maintaining your home secure with such devices not only discourages burglars but can also render your insurance premium more affordable.

- Pay Annually Instead of Monthly: Paying your premium annually, rather than in monthly installments, can result in savings. Some insurers charge additional fees for monthly payments. CHOICE recommends considering annual payments to avoid these extra costs and potentially secure a lower overall premium for your home insurance in Melbourne.

Through these tactics, you can maximize your home insurance in Melbourne so that it provides you with full coverage according to your budget and requirements. By checking your policy at regular intervals and being aware of the discounts and offers available, you can have efficient and affordable insurance coverage.

Conclusion

Moving around the home insurance Melbourne market necessitates a clean comprehension of what your property demands and the danger present in your area. Stay knowledgeable and keep pace, and you can lock in full protection at a fair price that keeps your wallet at peace. Always recall that an effective insurance policy is an investment in the future of your house.

Ready to cover your Melbourne residence? Begin today by comparing policies and get your peace of mind tomorrow.

Read: United Homes Insurance: 5 Powerful Reasons Homeowners Trust This Coverage

Frequently Asked Questions About Home Insurance in Melbourne

What does home insurance in Melbourne typically cover?

Home insurance in Melbourne generally covers damage to your home’s structure, personal belongings, and liability for accidents on your property. Coverage usually includes events like fire, theft, vandalism, and natural disasters such as storms or hail. Optional add-ons like flood or accidental damage cover may be available depending on the provider.

Is home insurance mandatory in Melbourne?

No, home insurance in Melbourne is not legally required. However, if you have a mortgage, your lender will likely require at least building insurance. Even without a loan, having insurance is highly recommended to protect your financial investment and assets.

How much does home insurance cost in Melbourne?

The cost of home insurance in Melbourne depends on various factors, including the location of your home, property size, building materials, contents value, claim history, and coverage limits. On average, it can range from AUD $800 to $2,000 annually for combined building and contents insurance.

What’s the difference between building and contents insurance?

Building insurance covers the physical structure of your home (walls, roof, fixtures), while contents insurance protects your personal belongings like furniture, appliances, clothing, and electronics. Many homeowners opt for a combined home insurance in Melbourne policy that includes both.

Can renters get home insurance in Melbourne?

Yes, renters can purchase contents-only home insurance in Melbourne. This policy covers your personal belongings inside a rental property but doesn’t include the building itself, which is typically the landlord’s responsibility.

How can I lower my home insurance premium in Melbourne?

To reduce your home insurance in Melbourne premium:

Compare quotes from different providers.

Bundle policies (e.g., car and home).

Increase your policy excess.

Install security systems like alarms or cameras.

Avoid frequent small claims.

Which companies offer reliable home insurance in Melbourne?

Trusted providers of home insurance in Melbourne include:

Allianz

QBE

AAMI

NRMA

Compare The Market

Always read the PDS (Product Disclosure Statement) before purchasing.

Does home insurance in Melbourne cover flood and bush-fire damage?

Standard home insurance Melbourne policies often cover bush-fire damage, but flood coverage may require an optional add-on. It’s essential to check your insurer’s Product Disclosure Statement (PDS) and consider additional coverage if you live in a high-risk area.

What is accidental damage cover in home insurance in Melbourne?

Accidental damage cover is an optional extra that protects your property and contents from unintentional incidents—like spilling paint on carpet or breaking a TV. It adds an extra layer of security to your home insurance in Melbourne, especially useful for families.

Is my solar panel system covered under home insurance in Melbourne?

Yes, most home insurance Melbourne policies include solar panels under building insurance. However, coverage may depend on whether the panels are permanently fixed and declared in your policy. Always confirm with your insurer.

One Comment